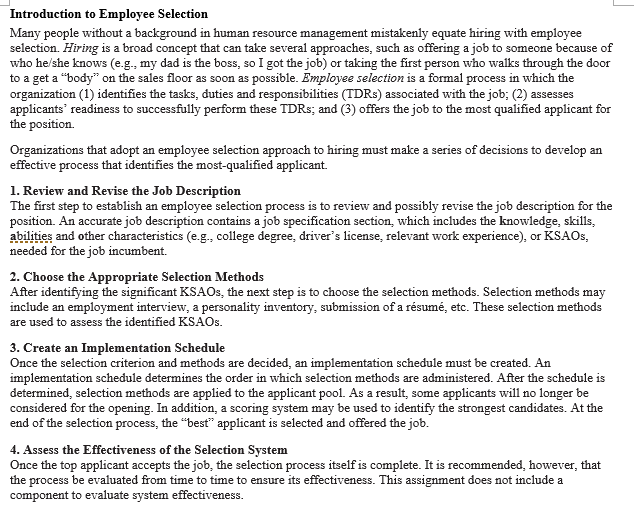

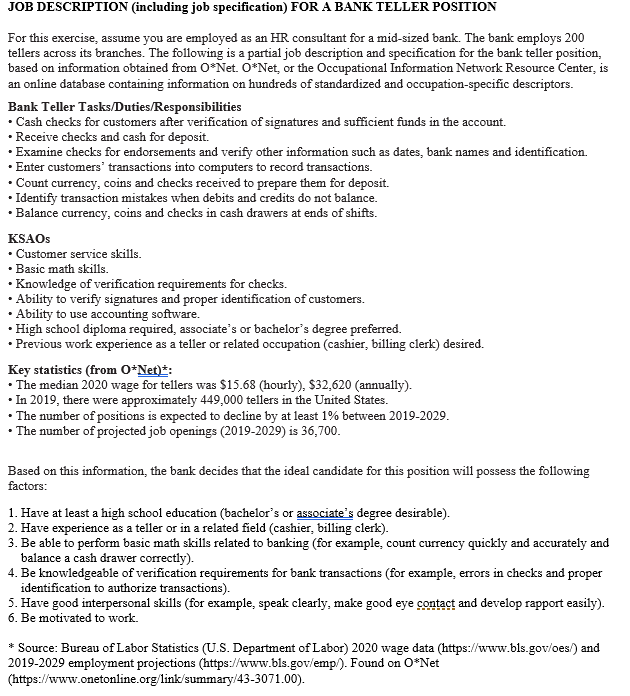

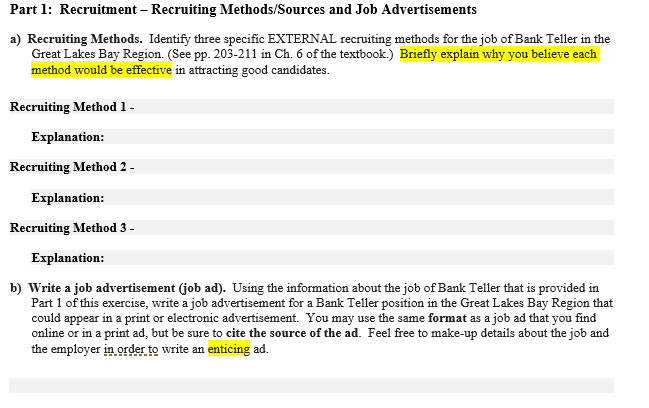

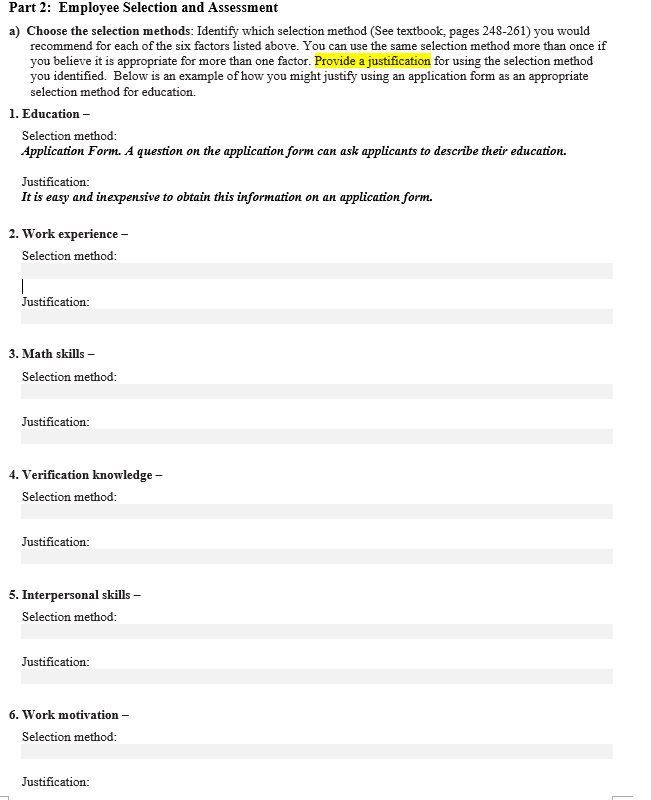

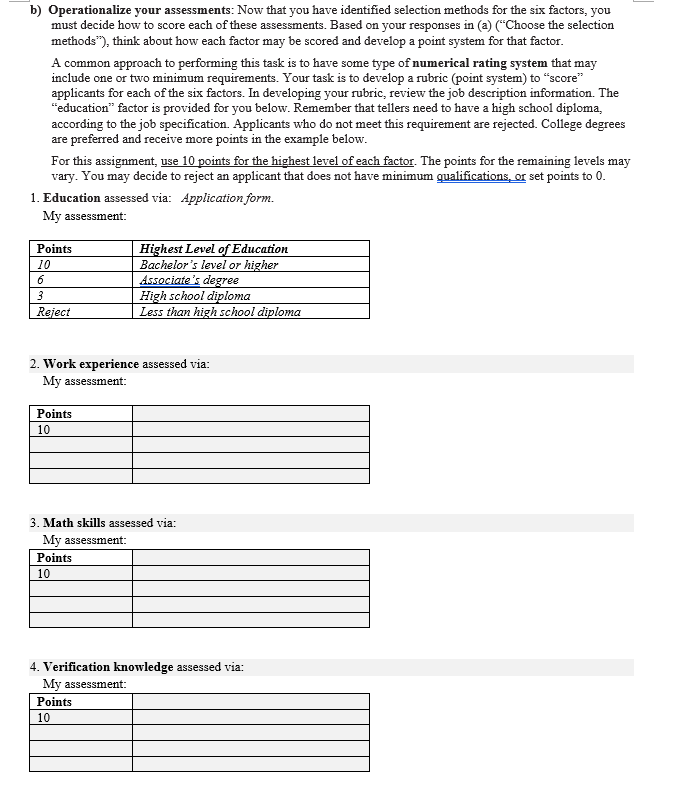

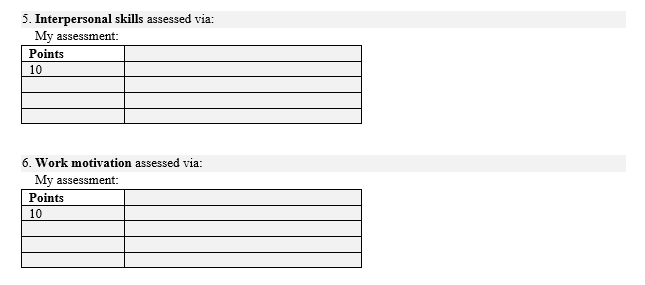

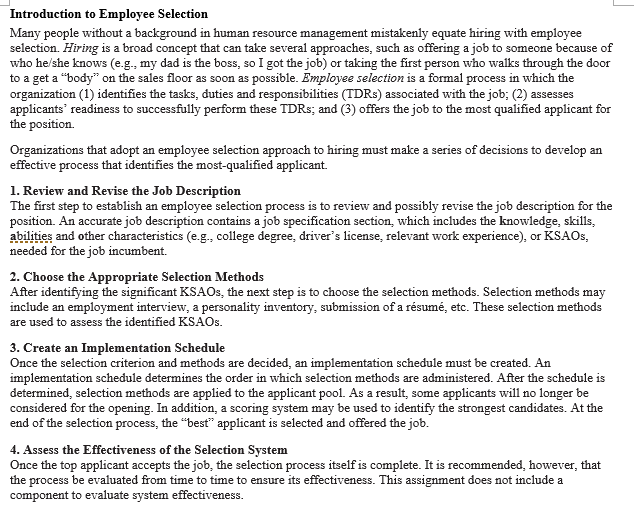

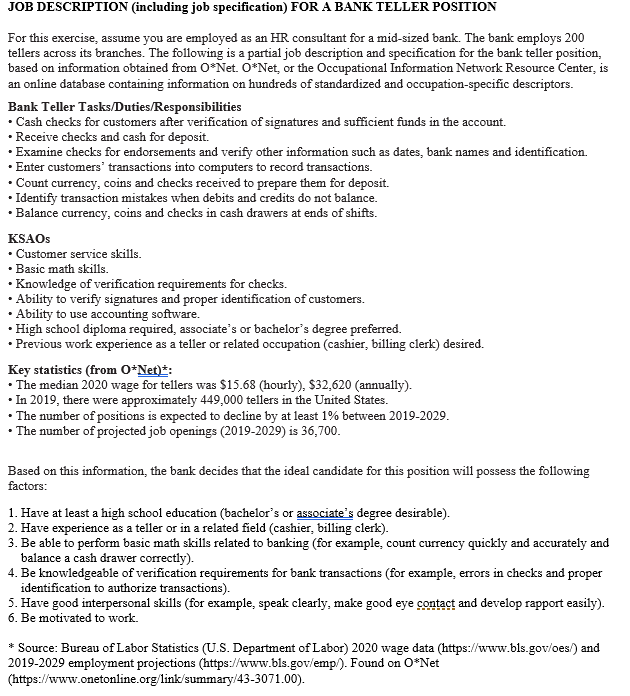

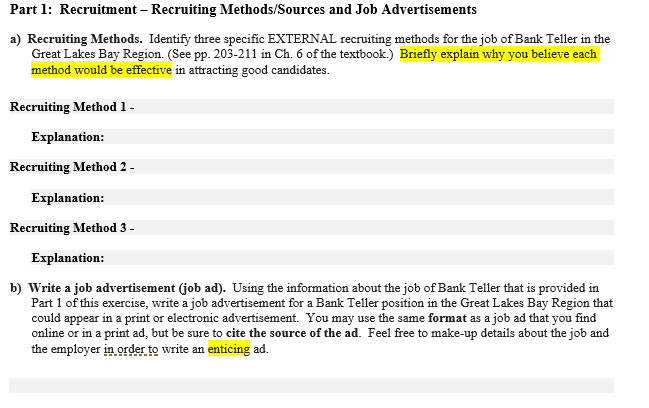

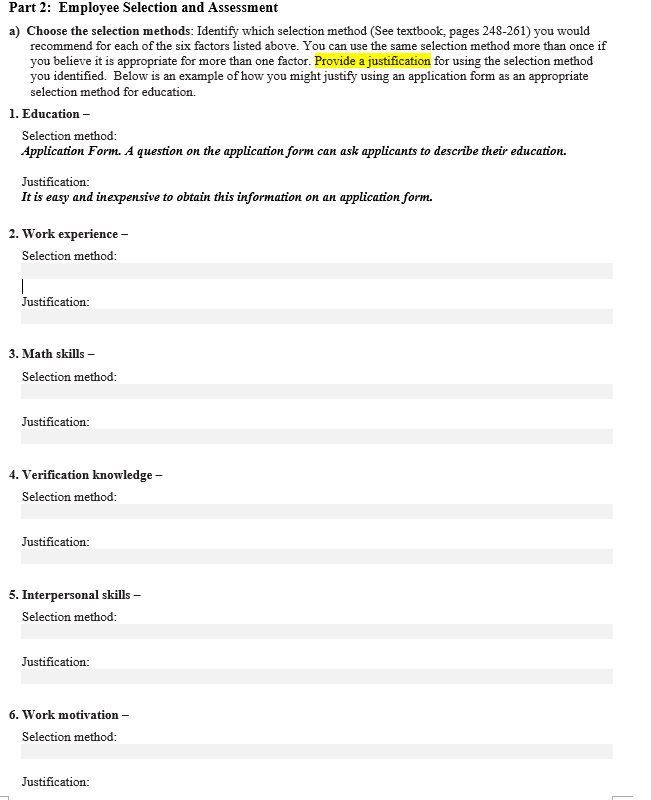

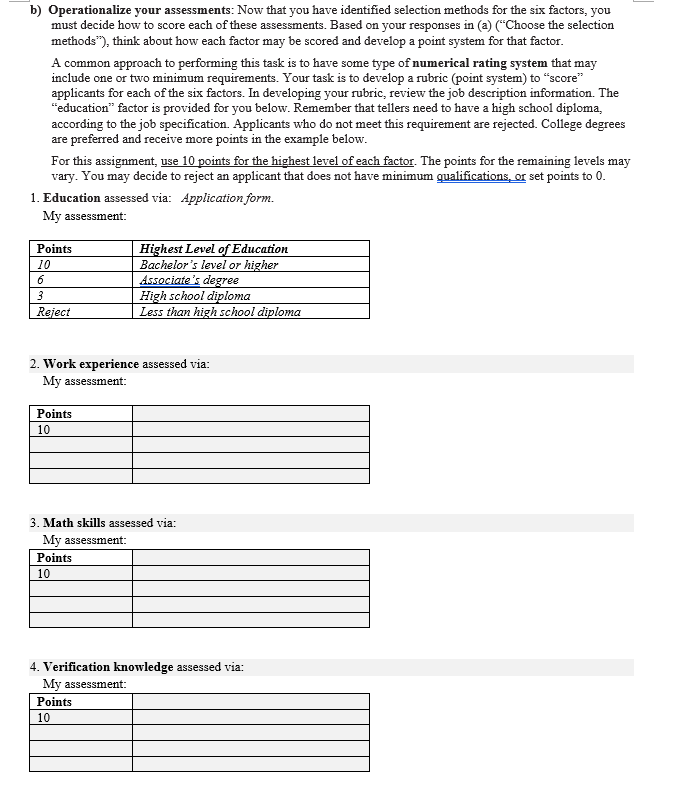

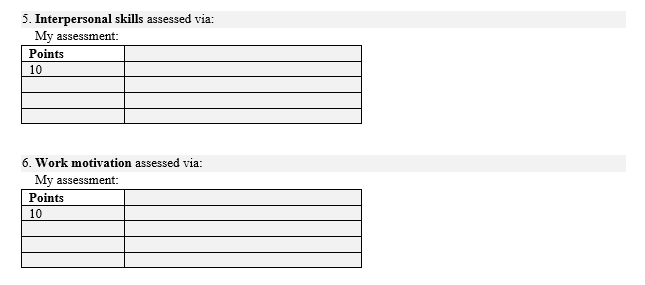

Introduction to Employee Selection Many people without a background in human resource management mistakenly equate hiring with employee selection. Hiring is a broad concept that can take several approaches, such as offering a job to someone because of who he/she knows (eg., my dad is the boss, so I got the job) or taking the first person who walks through the door to a get a "body" on the sales floor as soon as possible. Employee selection is a formal process in which the organization (1) identifies the tasks, duties and responsibilities (TDRs) associated with the job; (2) assesses applicants' readiness to successfully perform these TDRs; and (3) offers the job to the most qualified applicant for the position Organizations that adopt an employee selection approach to hiring must make a series of decisions to develop an effective process that identifies the most-qualified applicant. 1. Review and Revise the Job Description The first step to establish an employee selection process is to review and possibly revise the job description for the position. An accurate job description contains a job specification section, which includes the knowledge, skills, abilities and other characteristics (e.g., college degree, driver's license, relevant work experience), or KSAOS, needed for the job incumbent. 2. Choose the Appropriate Selection Methods After identifying the significant KSAOs, the next step is to choose the selection methods. Selection methods may include an employment interview, a personality inventory, submission of a rsum, etc. These selection methods are used to assess the identified KSAOS. 3. Create an Implementation Schedule Once the selection criterion and methods are decided, an implementation schedule must be created. An implementation schedule determines the order in which selection methods are administered. After the schedule is determined, selection methods are applied to the applicant pool. As a result, some applicants will no longer be considered for the opening. In addition, a scoring system may be used to identify the strongest candidates. At the end of the selection process, the "best" applicant is selected and offered the job. 4. Assess the Effectiveness of the Selection System Once the top applicant accepts the job, the selection process itself is complete. It is recommended, however, that the process be evaluated from time to time to ensure its effectiveness. This assignment does not include a component to evaluate system effectiveness. JOB DESCRIPTION (including job specification) FOR A BANK TELLER POSITION For this exercise, assume you are employed as an HR consultant for a mid-sized bank. The bank employs 200 tellers across its branches. The following is a partial job description and specification for the bank teller position, based on information obtained from O'Net. O*Net, or the Occupational Information Network Resource Center, is an online database containing information on hundreds of standardized and occupation-specific descriptors. Bank Teller Tasks/Duties/Responsibilities Cash checks for customers after verification of signatures and sufficient funds in the account. Receive checks and cash for deposit. Examine checks for endorsements and verify other information such as dates, bank names and identification. Enter customers' transactions into computers to record transactions. Count currency, coins and checks received to prepare them for deposit. Identify transaction mistakes when debits and credits do not balance. Balance currency, coins and checks in cash drawers at ends of shifts. KSAOs Customer service skills. Basic math skills. Knowledge of verification requirements for checks. Ability to verify signatures and proper identification of customers. Ability to use accounting software. High school diploma required, associate's or bachelor's degree preferred. Previous work experience as a teller or related occupation (cashier, billing clerk) desired. Key statistics (from O*Net): The median 2020 wage for tellers was $15.68 (hourly), $32,620 (annually). In 2019, there were approximately 449,000 tellers in the United States. The number of positions is expected to decline by at least 1% between 2019-2029. The number of projected job openings (2019-2029) is 36,700. Based on this information, the bank decides that the ideal candidate for this position will possess the following factors: 1. Have at least a high school education (bachelor's or associate's degree desirable). 2. Have experience as a teller or in a related field (cashier, billing clerk). 3. Be able to perform basic math skills related to banking (for example, count currency quickly and accurately and balance a cash drawer correctly). 4. Be knowledgeable of verification requirements for bank transactions (for example, errors in checks and proper identification to authorize transactions). 5. Have good interpersonal skills (for example, speak clearly, make good eye contact and develop rapport easily). 6. Be motivated to work. * Source: Bureau of Labor Statistics (U.S. Department of Labor) 2020 wage data (https://www.bls.gov/oes/) and 2019-2029 employment projections (https://www.bls.gov/emp/). Found on O*Net (https://www.onetonline.org/link/summary/43-3071.00). Part 1: Recruitment - Recruiting Methods/Sources and Job Advertisements a) Recruiting Methods. Identify three specific EXTERNAL recruiting methods for the job of Bank Teller in the Great Lakes Bay Region. (See pp. 203-211 in Ch. 6 of the textbook.) Briefly explain why you believe each method would be effective in attracting good candidates. Recruiting Method 1 - Explanation: Recruiting Method 2 - Explanation: Recruiting Method 3 - Explanation: b) Write a job advertisement (job ad). Using the information about the job of Bank Teller that is provided in Part 1 of this exercise, write a job advertisement for a Bank Teller position in the Great Lakes Bay Region that could appear in a print or electronic advertisement. You may use the same format as a job ad that you find online or in a print ad, but be sure to cite the source of the ad. Feel free to make-up details about the job and the employer in order to write an enticing ad. Part 2: Employee Selection and Assessment a) Choose the selection methods: Identify which selection method (See textbook, pages 248-261) you would recommend for each of the six factors listed above. You can use the same selection method more than once if you believe it is appropriate for more than one factor. Provide a justification for using the selection method you identified. Below is an example of how you might justify using an application form as an appropriate selection method for education. 1. Education - Selection method: Application Form. A question on the application form can ask applicants to describe their education. Justification: It is easy and inexpensive to obtain this information on an application form. 2. Work experience - Selection method: | Justification: 3. Math skills - Selection method: Justification: 4. Verification knowledge - Selection method: Justification: 5. Interpersonal skills - Selection method: Justification: 6. Work motivation - Selection method: Justification: b) Operationalize your assessments: Now that you have identified selection methods for the six factors, you must decide how to score each of these assessments. Based on your responses in (a) ("Choose the selection methods"), think about how each factor may be scored and develop a point system for that factor. A common approach to performing this task is to have some type of numerical rating system that may include one or two minimum requirements. Your task is to develop a rubric (point system) to "score applicants for each of the six factors. In developing your rubric, review the job description information. The "education factor is provided for you below. Remember that tellers need to have a high school diploma, according to the job specification Applicants who do not meet this requirement are rejected. College degrees are preferred and receive more points in the example below. For this assignment, use 10 points for the highest level of each factor. The points for the remaining levels may vary. You may decide to reject an applicant that does not have minimum qualifications, or set points to 0. 1. Education assessed via: Application form. My assessment: Points 10 6 3 Reject Highest Level of Education Bachelor's level or higher Associate's degree High school diploma Less than high school diploma 2. Work experience assessed via: My assessment: Points 10 3. Math skills assessed via: My assessment: Points 10 4. Verification knowledge assessed via: My assessment: Points 10 5. Interpersonal skills assessed via: My assessment: Points 10 6. Work motivation assessed via: My assessment: Points 10