Question: Introduction: Valuing an Entity with the Simple Dividend Discount Model GoodStuff Inc. (GS) is a profitable entity, operating in steady-state forever. Your PE firm is

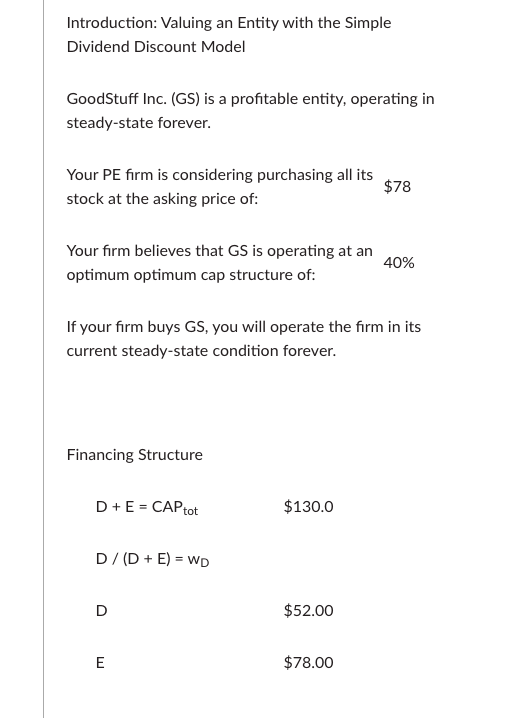

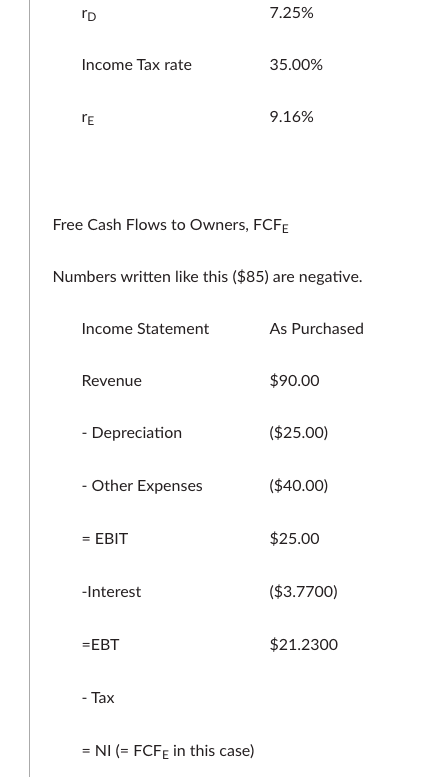

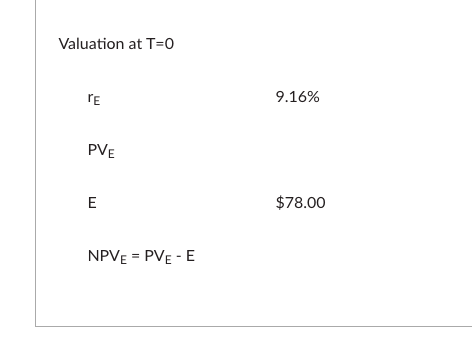

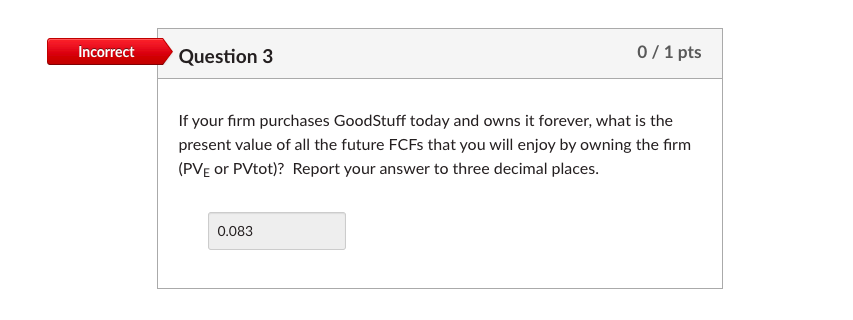

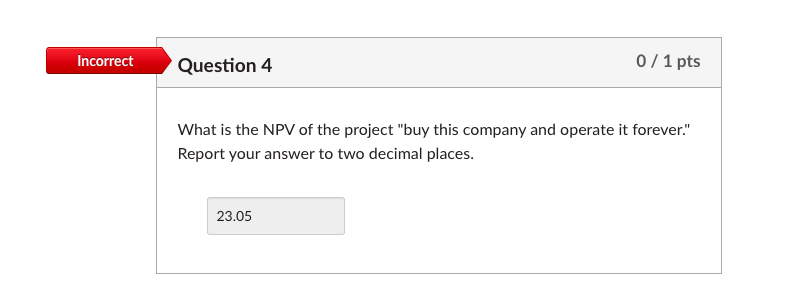

Introduction: Valuing an Entity with the Simple Dividend Discount Model GoodStuff Inc. (GS) is a profitable entity, operating in steady-state forever. Your PE firm is considering purchasing all its stock at the asking price of: $78 Your firm believes that GS is operating at an optimum optimum cap structure of: 40% If your firm buys GS, you will operate the firm in its current steady-state condition forever. Financing Structure D+E = CAP tot $130.0 D/(D+E) = WD D $52.00 E $78.00 ro 7.25% Income Tax rate 35.00% PE 9.16% Free Cash Flows to Owners, FCFE Numbers written like this ($85) are negative. Income Statement As Purchased Revenue $90.00 - Depreciation ($25.00) - Other Expenses ($40.00) = EBIT $25.00 -Interest ($3.7700) =EBT $21.2300 - = NI (= FCF in this case) Valuation at T=0 PE 9.16% PVE E $78.00 NPVE = PVE-E Incorrect Question 3 0/ 1 pts If your firm purchases GoodStuff today and owns it forever, what is the present value of all the future FCFs that you will enjoy by owning the firm (PV or PVtot)? Report your answer to three decimal places. 0.083 Incorrect Question 4 0 / 1 pts What is the NPV of the project "buy this company and operate it forever." Report your answer to two decimal places. 23.05 Introduction: Valuing an Entity with the Simple Dividend Discount Model GoodStuff Inc. (GS) is a profitable entity, operating in steady-state forever. Your PE firm is considering purchasing all its stock at the asking price of: $78 Your firm believes that GS is operating at an optimum optimum cap structure of: 40% If your firm buys GS, you will operate the firm in its current steady-state condition forever. Financing Structure D+E = CAP tot $130.0 D/(D+E) = WD D $52.00 E $78.00 ro 7.25% Income Tax rate 35.00% PE 9.16% Free Cash Flows to Owners, FCFE Numbers written like this ($85) are negative. Income Statement As Purchased Revenue $90.00 - Depreciation ($25.00) - Other Expenses ($40.00) = EBIT $25.00 -Interest ($3.7700) =EBT $21.2300 - = NI (= FCF in this case) Valuation at T=0 PE 9.16% PVE E $78.00 NPVE = PVE-E Incorrect Question 3 0/ 1 pts If your firm purchases GoodStuff today and owns it forever, what is the present value of all the future FCFs that you will enjoy by owning the firm (PV or PVtot)? Report your answer to three decimal places. 0.083 Incorrect Question 4 0 / 1 pts What is the NPV of the project "buy this company and operate it forever." Report your answer to two decimal places. 23.05

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts