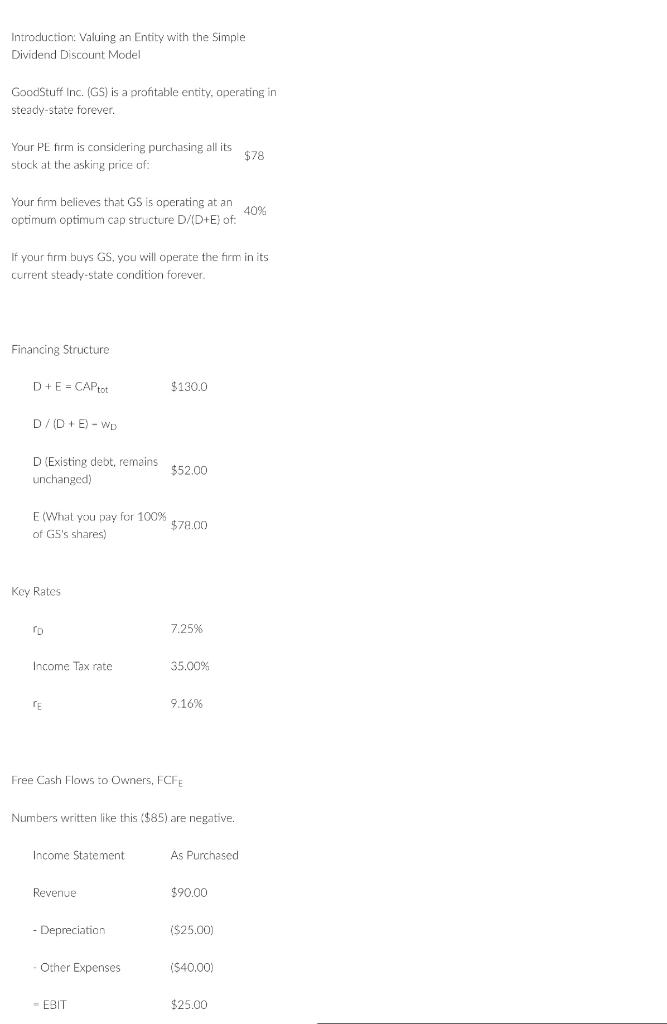

Question: Introduction: Valuing an Entity with the Simple Dividend Discount Model GoodStuff Inc. (GS) is a profitable entity, operating in steady-state forever. Your PE firm is

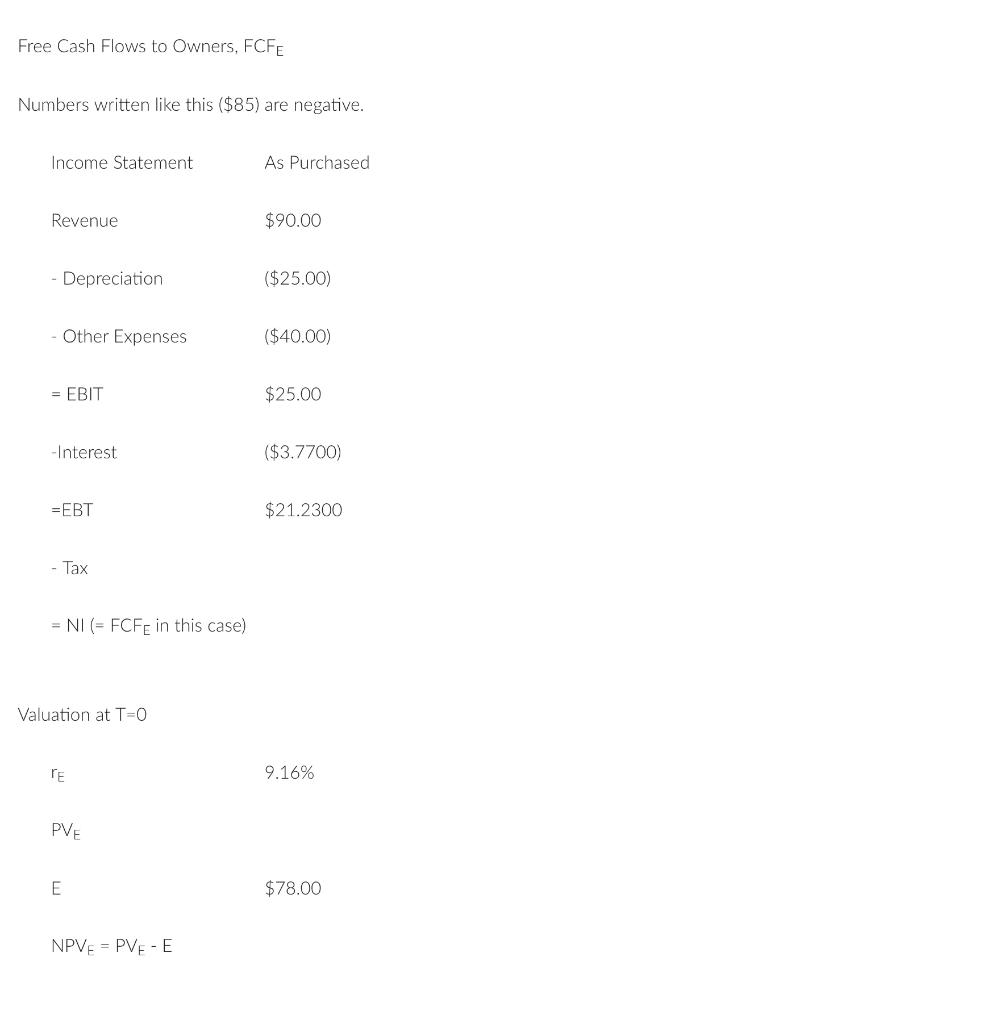

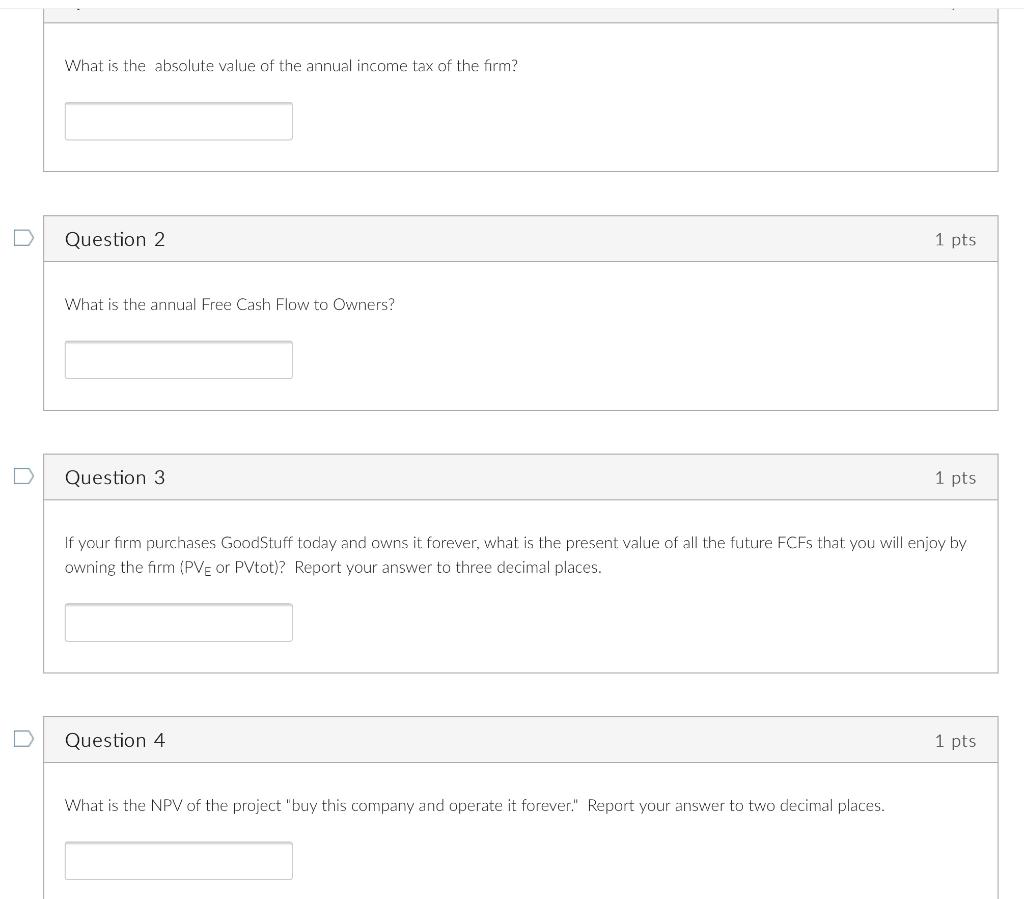

Introduction: Valuing an Entity with the Simple Dividend Discount Model GoodStuff Inc. (GS) is a profitable entity, operating in steady-state forever. Your PE firm is considering purchasing all its stock at the asking price of: Free Cash Flows to Owners, FCF E Numbers written like this ($85) are negative. Tax =NI(=FCFE in this case) Valuation at T=O rE9.16% PV E $78.00 NPVE=PVEE What is the absolute value of the annual income tax of the firm? Question 2 1 pts What is the annual Free Cash Flow to Owners? Question 3 1 pts If your firm purchases GoodStuff today and owns it forever, what is the present value of all the future FCFs that you will enjoy by owning the firm (PV E or PVtot)? Report your answer to three decimal places. Question 4 1 pts What is the NPV of the project "buy this company and operate it forever." Report your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts