Question: Inventory cost flow methods; perpetual system [ LO 8 - 1 , 8 - 4 ] [ The following information applies to the questions

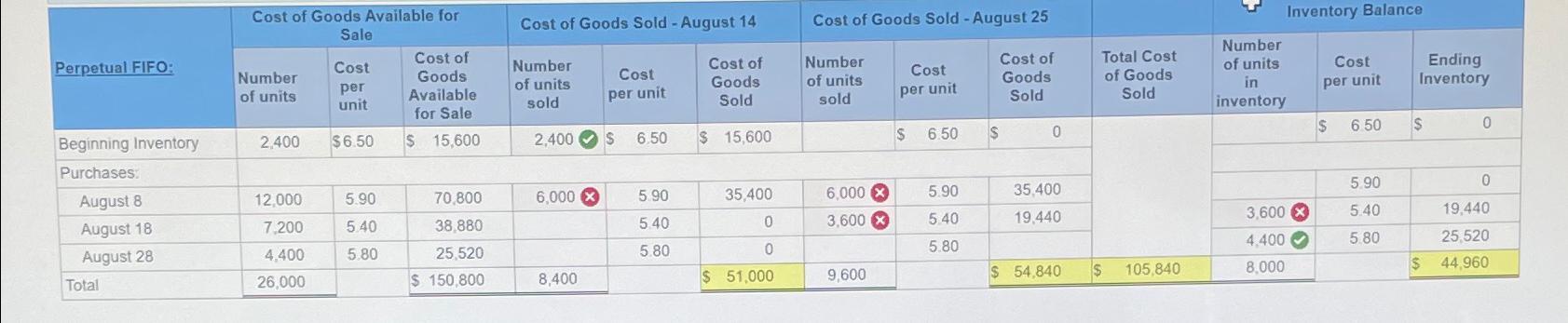

Perpetual FIFO: Beginning Inventory Purchases: August 8 August 18 August 28 Total Cost of Goods Available for Sale Number of units 2,400 12,000 7,200 4,400 26,000 Cost per unit $6.50 5.90 5.40 5.80 Cost of Goods Available for Sale $ 15,600 70,800 38,880 25,520 $ 150,800 Cost of Goods Sold - August 14 Number of units sold 2,400 S Cost of Goods Sold $ 15,600 6,000 X 8,400 Cost per unit 6.50 5.90 5.40 5.80 35,400 0 0 $ 51,000 Cost of Goods Sold - August 25 Number of units sold Cost of Goods Sold 6,000 x 3,600 x 9,600 Cost per unit S 6.50 5.90 5.40 5.80 $ 0 35,400 19,440 $ 54,840 Total Cost of Goods Sold $ 105,840 Number of units in inventory Inventory Balance 3,600 x 4.400 8,000 Cost per unit $ 6.50 5.90 5.40 5.80 Ending Inventory $ 0 0 19,440 25,520 $ 44,960

Step by Step Solution

There are 3 Steps involved in it

To determine the inventory balance Altira would report in its August 31 2024 balance sheet and the c... View full answer

Get step-by-step solutions from verified subject matter experts