Question: invertmert will be recovered when the project is shut down. Finaly. astume that twe frmis magginal tate rade is 34 percene. 2. What is the

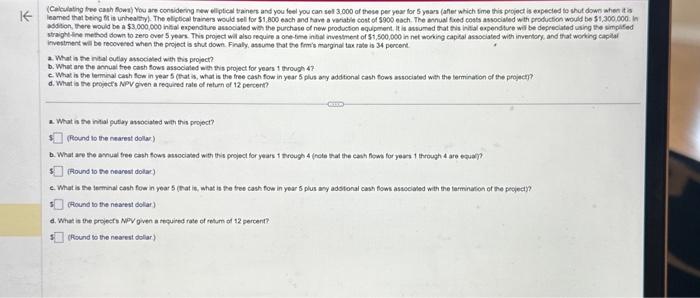

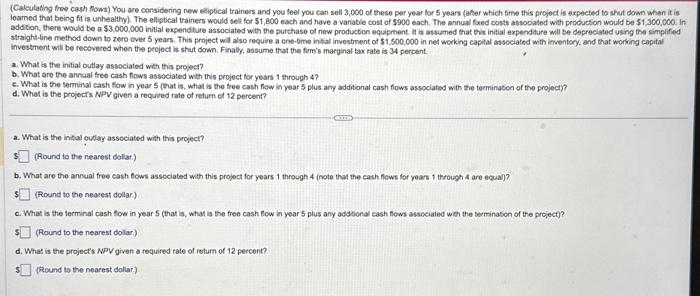

invertmert will be recovered when the project is shut down. Finaly. astume that twe frmis magginal tate rade is 34 percene. 2. What is the nital cutiay awocialed with tis projech b. What are the annuai fee cash fows associaled with tis project for yeans 1 through 4? c. What is the lempeal canh fow in year 5 (trat is, what is the free cash fow in yeag 5 plus ary addional cash fows associated with the termiraton of the projech? d. What is the fropect NPV given a requinted rate of feturn of 12 percont? 2. What a the inial putiry anociated with this propect? (Reund to the nearest dolly:) (Fhound to the cearest dolac) e. What is the temichal cash foe in yoar 5 (hat it, what in the tee cash fow in yoar 5 plus ary adstonal cosh fows associaled w th the tarminarion of he pegea)? (Hlound to the nearest delar) d. What it the proiests NpV oven a tequited rase of retum of 12 pertert? (Round oo the nearest dollar) (Calculating thee cash fows) You are considering new eliptical trainers and you feel you can sell 3,000 of these per year for 5 years (afer which ime this project is expected to shut down when it is loamed that being fit is unhealthy . The elliptical trainers would sel for $1,800 each and have a variable cost of $900 each. The annual fxed costs assooiated with production would be $1,300,000. In addition, there would be a $3,000,000 initial expendture assoclated with the purchase of new production equipment it is assumed that Eis initial expenditure will be depreciated using the simplifed straight-line method down to zero over 5 years. This project will also require a one-6ime intial investment of $1,500,000 in net working capital associated with imentory, and that working capital investment will be recovered when the peoject is shut down. Finaly, assume that the ferm's marginal tax rate is 34 percent. a. What is the initial outlay associated with this project? b. What are the annual free cash fows associated with this project for yesrs 1 through 4 ? c. What is the terminal cash fow in yoar 5 (that is, what is the tree cash fiow in year 5 plus any additional cash flows associated with the terminaton of the project)? d. What is the project's NPV given a required rate of return of 12 percent? a. What is the intal oulay associated with this project? (Round to the nearest dolar.) b. What are the annual tree cash fows associated wth this project for years 1 through 4 (note that the cash flows for years 1 through 4 are equag? (Round to the nearest dollar.) c. What is the lerminal cash fow in year 5 (that is, what is the free cash fow in yoar 5 plus any addional cash flows associated wath the terminason of the project? (Round to the nearest dolac.) d. What is the project's NPV given a required rate of return of 12 percent? (Round to the nearest dollar.) invertmert will be recovered when the project is shut down. Finaly. astume that twe frmis magginal tate rade is 34 percene. 2. What is the nital cutiay awocialed with tis projech b. What are the annuai fee cash fows associaled with tis project for yeans 1 through 4? c. What is the lempeal canh fow in year 5 (trat is, what is the free cash fow in yeag 5 plus ary addional cash fows associated with the termiraton of the projech? d. What is the fropect NPV given a requinted rate of feturn of 12 percont? 2. What a the inial putiry anociated with this propect? (Reund to the nearest dolly:) (Fhound to the cearest dolac) e. What is the temichal cash foe in yoar 5 (hat it, what in the tee cash fow in yoar 5 plus ary adstonal cosh fows associaled w th the tarminarion of he pegea)? (Hlound to the nearest delar) d. What it the proiests NpV oven a tequited rase of retum of 12 pertert? (Round oo the nearest dollar) (Calculating thee cash fows) You are considering new eliptical trainers and you feel you can sell 3,000 of these per year for 5 years (afer which ime this project is expected to shut down when it is loamed that being fit is unhealthy . The elliptical trainers would sel for $1,800 each and have a variable cost of $900 each. The annual fxed costs assooiated with production would be $1,300,000. In addition, there would be a $3,000,000 initial expendture assoclated with the purchase of new production equipment it is assumed that Eis initial expenditure will be depreciated using the simplifed straight-line method down to zero over 5 years. This project will also require a one-6ime intial investment of $1,500,000 in net working capital associated with imentory, and that working capital investment will be recovered when the peoject is shut down. Finaly, assume that the ferm's marginal tax rate is 34 percent. a. What is the initial outlay associated with this project? b. What are the annual free cash fows associated with this project for yesrs 1 through 4 ? c. What is the terminal cash fow in yoar 5 (that is, what is the tree cash fiow in year 5 plus any additional cash flows associated with the terminaton of the project)? d. What is the project's NPV given a required rate of return of 12 percent? a. What is the intal oulay associated with this project? (Round to the nearest dolar.) b. What are the annual tree cash fows associated wth this project for years 1 through 4 (note that the cash flows for years 1 through 4 are equag? (Round to the nearest dollar.) c. What is the lerminal cash fow in year 5 (that is, what is the free cash fow in yoar 5 plus any addional cash flows associated wath the terminason of the project? (Round to the nearest dolac.) d. What is the project's NPV given a required rate of return of 12 percent? (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts