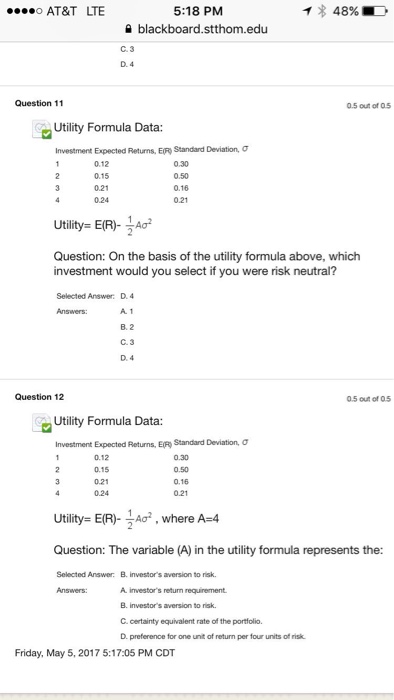

Question: Investment Expected Returns, E(R) Standard Deviation, sigma Utility = E(R) - 1/2 A sigma^2 On the basis of the utility formula above, which investment would

Investment Expected Returns, E(R) Standard Deviation, sigma Utility = E(R) - 1/2 A sigma^2 On the basis of the utility formula above, which investment would you select if you were risk neutral? Investment Expected Returns, E(R) Standard Deviation, sigma Utility = E(R) - 1/2 A sigma^2, where A = 4 The variable (A) in the utility formula represents the: Select Answer B: investor's aversion to risk. Answers: A. investor's return requirement B. investor s aversion to risk. C. certainty equivalent rate of the portfolio. D. preference for one unit of return per four units of risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts