Question: Investment subject Some formulae: [ begin{array}{l} Eleft(r_{i} ight)=sum_{s} p_{(s)} r_{(s)} quad S D_{i}=sigma_{i}=sqrt{sum_{s} p_{(s)}left[r_{(s)}-E(r) ight]^{2}} operatorname{Cov}(x, y)=sigma_{x y}=sum_{s} p_{(s)}left[left(r_{x}-Eleft(r_{x} ight) ight) timesleft(r_{y}-Eleft(r_{y} ight) ight)

Investment subject

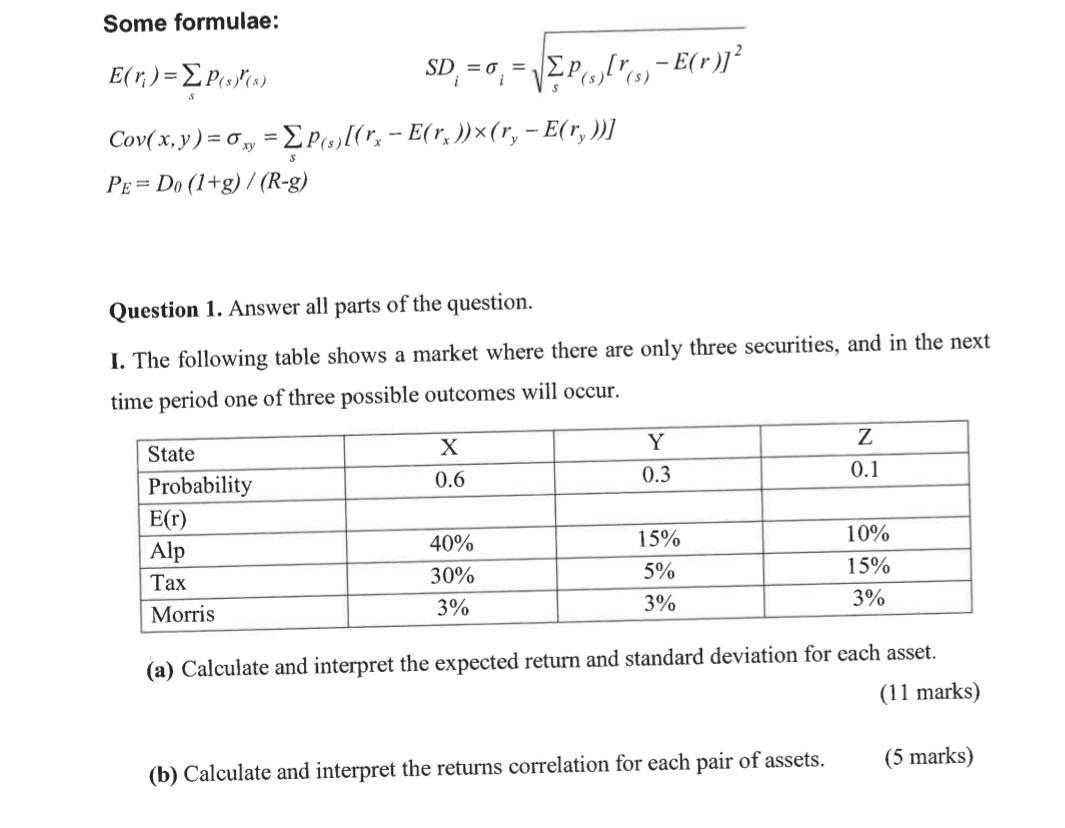

Some formulae: \\[ \\begin{array}{l} E\\left(r_{i}\ ight)=\\sum_{s} p_{(s)} r_{(s)} \\quad S D_{i}=\\sigma_{i}=\\sqrt{\\sum_{s} p_{(s)}\\left[r_{(s)}-E(r)\ ight]^{2}} \\\\ \\operatorname{Cov}(x, y)=\\sigma_{x y}=\\sum_{s} p_{(s)}\\left[\\left(r_{x}-E\\left(r_{x}\ ight)\ ight) \\times\\left(r_{y}-E\\left(r_{y}\ ight)\ ight)\ ight] \\\\ P_{E}=D_{0}(1+g) /(R-g) \\end{array} \\] Question 1. Answer all parts of the question. I. The following table shows a market where there are only three securities, and in the next time period one of three possible outcomes will occur. (a) Calculate and interpret the expected return and standard deviation for each asset. (11 marks) (b) Calculate and interpret the returns correlation for each pair of assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts