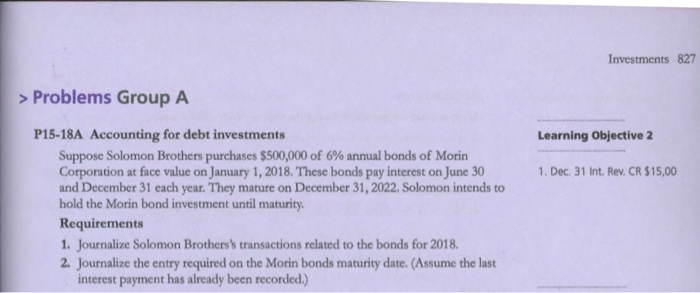

Question: Investments 827 > Problems Group A Learning Objective 2 1. Dec. 31 Int. Rev. CR $15,00 P15-18A Accounting for debt investments Suppose Solomon Brothers purchases

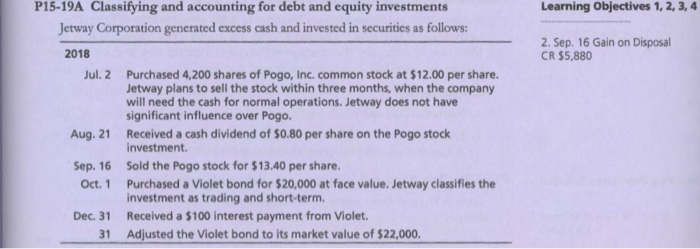

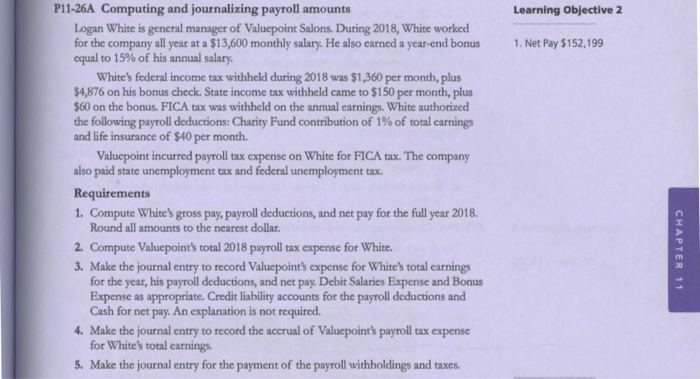

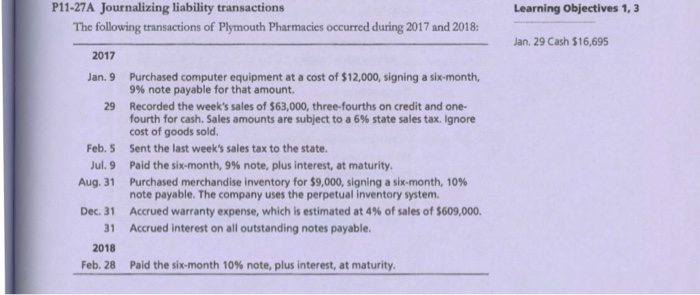

Investments 827 > Problems Group A Learning Objective 2 1. Dec. 31 Int. Rev. CR $15,00 P15-18A Accounting for debt investments Suppose Solomon Brothers purchases $500,000 of 6% annual bonds of Morin Corporation at face value on January 1, 2018. These bonds pay interest on June 30 and December 31 each year. They mature on December 31, 2022. Solomon intends to hold the Morin bond investment until maturity. Requirements 1. Journalize Solomon Brothers's transactions related to the bonds for 2018. 2. Journalize the entry required on the Morin bonds maturity date. (Assume the last interest payment has already been recorded.) Learning Objectives 1, 2, 3, 4 2. Sep. 16 Gain on Disposal CR $5,880 P15-19A Classifying and accounting for debt and equity investments Jetway Corporation generated excess cash and invested in securities as follows: 2018 Jul. 2 Purchased 4,200 shares of Pogo, Inc. common stock at $12.00 per share. Jetway plans to sell the stock within three months, when the company will need the cash for normal operations. Jetway does not have significant influence over Pogo. Aug. 21 Received a cash dividend of $0.80 per share on the Pogo stock investment. Sep. 16 Sold the Pogo stock for $13.40 per share. Oct. 1 Purchased a Violet bond for $20,000 at face value. Jetway classifies the Investment as trading and short-term. Dec. 31 Received a 5100 interest payment from Violet. 31 Adjusted the Violet bond to its market value of $22,000. Learning Objective 2 1. Net Pay 5152,199 P11-26A Computing and journalizing payroll amounts Logan White is general manager of Valuepoint Salons. During 2018, White worked for the company all year at a $13,600 monthly salary. He also earned a year-end bonus equal to 15% of his annual salary. White's federal income tax withheld during 2018 was $1,360 per month, plus $4,876 on his bonus check. State income tax withheld came to $150 per month, plus $60 on the bonus. FICA tax was withheld on the annual earnings. White authorized the following payroll deductions: Charity Fund contribution of 1% of total carnings and life insurance of $40 per month. Valuepoint incurred payroll tax expense on White for FICA tax. The company also paid state unemployment tax and federal unemployment tax. Requirements 1. Compute White's gross pay, payroll deductions, and net pay for the full year 2018. Round all amounts to the nearest dollar. 2. Compute Valuepoint's total 2018 payroll tax expense for White 3. Make the journal entry to record Valuepoint's expense for White's total earnings for the year, his payroll deductions, and net pay. Debit Salaries Expense and Bonus Expense as appropriate. Credit liability accounts for the payroll deductions and Cash for net pay. An explanation is not required. 4. Make the journal entry to record the accrual of Valuepoint's payroll tax expense for White's total earnings 5. Make the journal entry for the payment of the payroll withholdings and taxes. CHAPTER 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts