Question: Involuntary Conversion A taxpayer's delivery van with an adjusted basis of $7,000 was stolen. Luckily, the taxpayer had comprehensive insurance on the van so the

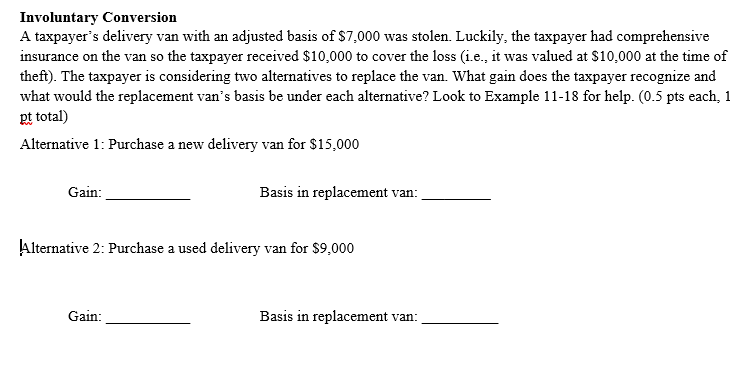

Involuntary Conversion A taxpayer's delivery van with an adjusted basis of $7,000 was stolen. Luckily, the taxpayer had comprehensive insurance on the van so the taxpayer received $10,000 to cover the loss (i.e., it was valued at $10.000 at the time of theft). The taxpayer is considering two alternatives to replace the van. What gain does the taxpayer recognize and what would the replacement van's basis be under each alternative? Look to Example 11-18 for help. (0.5 pts each, 1 pt total) Alternative 1: Purchase a new delivery van for $15,000 Gain: Basis in replacement van: Alternative 2: Purchase a used delivery van for $9,000 Gain: - Basis in replacement van

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts