Question: Project 3 - Revised Debt Equity investments 1. Explain the importance of intent when a company holds debt securities in another company. 2. If a

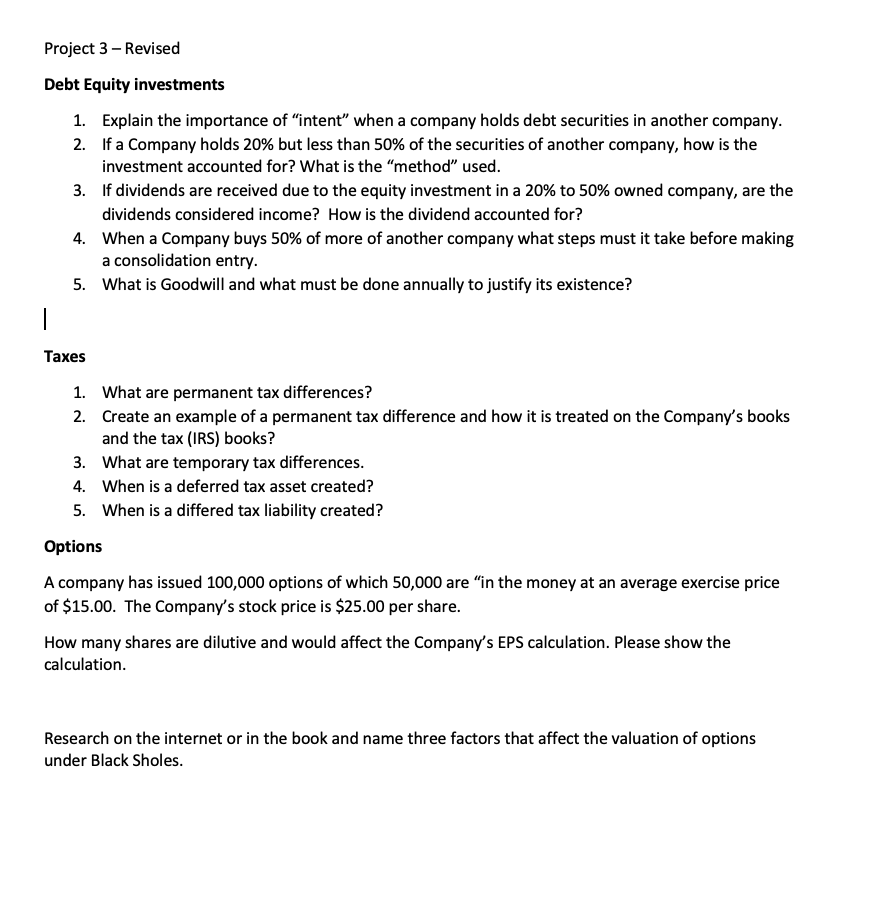

Project 3 - Revised Debt Equity investments 1. Explain the importance of "intent" when a company holds debt securities in another company. 2. If a Company holds 20% but less than 50% of the securities of another company, how is the investment accounted for? What is the "method" used. 3. If dividends are received due to the equity investment in a 20% to 50% owned company, are the dividends considered income? How is the dividend accounted for? 4. When a Company buys 50% of more of another company what steps must it take before making a consolidation entry. 5. What is Goodwill and what must be done annually to justify its existence? Taxes 1. What are permanent tax differences? 2. Create an example of a permanent tax difference and how it is treated on the Company's books and the tax (IRS) books? 3. What are temporary tax differences. 4. When is a deferred tax asset created? 5. When is a differed tax liability created? Options A company has issued 100,000 options of which 50,000 are "in the money at an average exercise price of $15.00. The Company's stock price is $25.00 per share. How many shares are dilutive and would affect the Company's EPS calculation. Please show the calculation. Research on the internet or in the book and name three factors that affect the valuation of options under Black Sholes. Project 3 - Revised Debt Equity investments 1. Explain the importance of "intent" when a company holds debt securities in another company. 2. If a Company holds 20% but less than 50% of the securities of another company, how is the investment accounted for? What is the "method" used. 3. If dividends are received due to the equity investment in a 20% to 50% owned company, are the dividends considered income? How is the dividend accounted for? 4. When a Company buys 50% of more of another company what steps must it take before making a consolidation entry. 5. What is Goodwill and what must be done annually to justify its existence? Taxes 1. What are permanent tax differences? 2. Create an example of a permanent tax difference and how it is treated on the Company's books and the tax (IRS) books? 3. What are temporary tax differences. 4. When is a deferred tax asset created? 5. When is a differed tax liability created? Options A company has issued 100,000 options of which 50,000 are "in the money at an average exercise price of $15.00. The Company's stock price is $25.00 per share. How many shares are dilutive and would affect the Company's EPS calculation. Please show the calculation. Research on the internet or in the book and name three factors that affect the valuation of options under Black Sholes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts