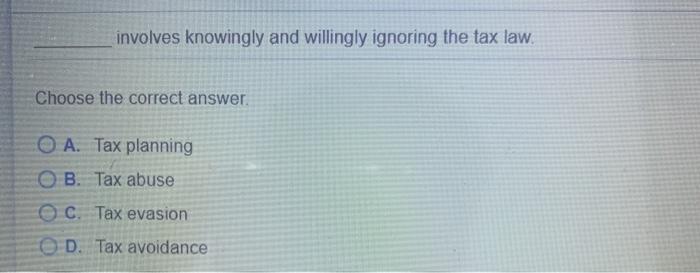

Question: involves knowingly and willingly ignoring the tax law. Choose the correct answer. O A. Tax planning OB. Tax abuse C. Tax evasion e D. Tax

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock