Question: Inx 1. Find the absolute maximum or minimum (if any) for h(x) x over [1, 2]. [10 marks] 2. A company makes hand-made designer chairs

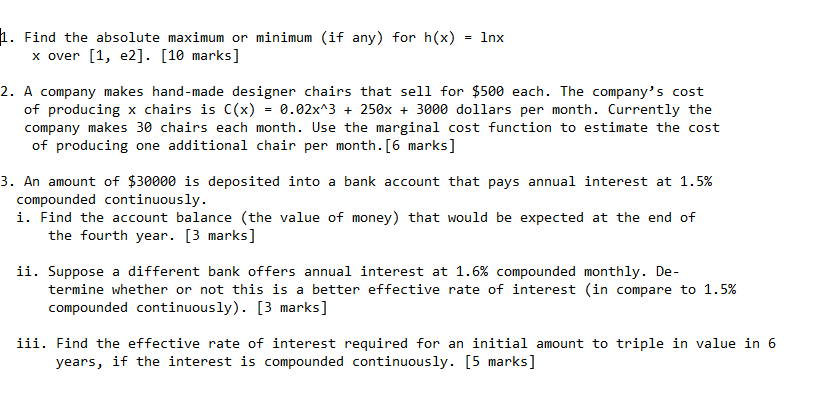

Inx 1. Find the absolute maximum or minimum (if any) for h(x) x over [1, 2]. [10 marks] 2. A company makes hand-made designer chairs that sell for $500 each. The company's cost of producing x chairs is C(x) = 0.02x^3 + 250x + 3000 dollars per month. Currently the company makes 30 chairs each month. Use the marginal cost function to estimate the cost of producing one additional chair per month.[6 marks] 3. An amount of $30000 is deposited into a bank account that pays annual interest at 1.5% compounded continuously. i. Find the account balance (the value of money) that would be expected at the end of the fourth year. [3 marks] ii. Suppose a different bank offers annual interest at 1.6% compounded monthly. De- termine whether or not this is a better effective rate of interest (in compare to 1.5% compounded continuously). [3 marks] iii. Find the effective rate of interest required for an initial amount to triple in value in 6 years, if the interest is compounded continuously. [5 marks] Inx 1. Find the absolute maximum or minimum (if any) for h(x) x over [1, 2]. [10 marks] 2. A company makes hand-made designer chairs that sell for $500 each. The company's cost of producing x chairs is C(x) = 0.02x^3 + 250x + 3000 dollars per month. Currently the company makes 30 chairs each month. Use the marginal cost function to estimate the cost of producing one additional chair per month.[6 marks] 3. An amount of $30000 is deposited into a bank account that pays annual interest at 1.5% compounded continuously. i. Find the account balance (the value of money) that would be expected at the end of the fourth year. [3 marks] ii. Suppose a different bank offers annual interest at 1.6% compounded monthly. De- termine whether or not this is a better effective rate of interest (in compare to 1.5% compounded continuously). [3 marks] iii. Find the effective rate of interest required for an initial amount to triple in value in 6 years, if the interest is compounded continuously. [5 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts