Question: Irelated to the Solved Problem] Use a demand and supply graph for the federal funds market to analyze the following situation. Be sure that your

![Irelated to the Solved Problem] Use a demand and supply graph](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f808e6509f4_23766f808e5dc9d5.jpg)

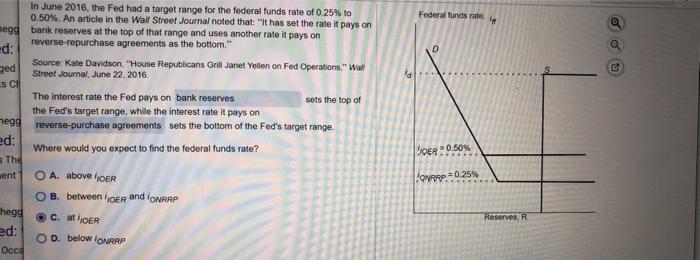

Irelated to the Solved Problem] Use a demand and supply graph for the federal funds market to analyze the following situation. Be sure that your graph clearly shows changes in the equilibrium federal funds rate, changes in the equilibrium level of reserves, and any shifts in the demand and supply curves Suppose that the Fed decides to increase the required reserve ratio, but does not want the increase to affect its target for the federal funds rate. Show how the Fed can use open market operations to accomplish this policy Federal funds rate - -- To offset the effect of an increase in the required reserve ratio, which would increase the demand for reserves, the Fed could buy securities Using the multipoint curve drawing tool, illustrate your answer assuming that the discount rate does not change. Property label your curve. Carefully follow the instructions above, and only draw the required object PI R Reserves After plotting the final point of your multipoint curve. press the Esc key on your keyboard to end the line Federal funds rate id In June 2016, the Fed had a target range for the federal funds rate of 0.25% to 0.50%. An article in the Wall Street Journal noted that it has set the rate it pays on segg bank reserves at the top of that range and uses another rate it pays on reverse-repurchase agreements as the bottom." ed: Source: Kate Davidson, "House Republicans Grill Janet Yellen on Fed Operations." Wall ged Street Journal, June 22, 2016 SCH The interest rate the Fed pays on bank reserves sets the top of the Fed's target range, while the interest rate it pays on hegg reverse-purchase agreements sets the bottom of the Fed's target range. ed: Where would you expect to find the federal funds rate? 3 The O A. above HOER OB. between HOER and 'ONRRP c. at HOER ed: D. below IONRAP Occi 'OER 0.50% ent opper0.25% hegg Reserves, R O Irelated to the Solved Problem] Use a demand and supply graph for the federal funds market to analyze the following situation. Be sure that your graph clearly shows changes in the equilibrium federal funds rate, changes in the equilibrium level of reserves, and any shifts in the demand and supply curves Suppose that the Fed decides to increase the required reserve ratio, but does not want the increase to affect its target for the federal funds rate. Show how the Fed can use open market operations to accomplish this policy Federal funds rate - -- To offset the effect of an increase in the required reserve ratio, which would increase the demand for reserves, the Fed could buy securities Using the multipoint curve drawing tool, illustrate your answer assuming that the discount rate does not change. Property label your curve. Carefully follow the instructions above, and only draw the required object PI R Reserves After plotting the final point of your multipoint curve. press the Esc key on your keyboard to end the line Federal funds rate id In June 2016, the Fed had a target range for the federal funds rate of 0.25% to 0.50%. An article in the Wall Street Journal noted that it has set the rate it pays on segg bank reserves at the top of that range and uses another rate it pays on reverse-repurchase agreements as the bottom." ed: Source: Kate Davidson, "House Republicans Grill Janet Yellen on Fed Operations." Wall ged Street Journal, June 22, 2016 SCH The interest rate the Fed pays on bank reserves sets the top of the Fed's target range, while the interest rate it pays on hegg reverse-purchase agreements sets the bottom of the Fed's target range. ed: Where would you expect to find the federal funds rate? 3 The O A. above HOER OB. between HOER and 'ONRRP c. at HOER ed: D. below IONRAP Occi 'OER 0.50% ent opper0.25% hegg Reserves, R O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts