Question: is 940.75 correct or any other answer? I am not sure please provide accurate answer Question 17 1 pts The High Yield hedge fund (the

is 940.75 correct or any other answer? I am not sure please provide accurate answer

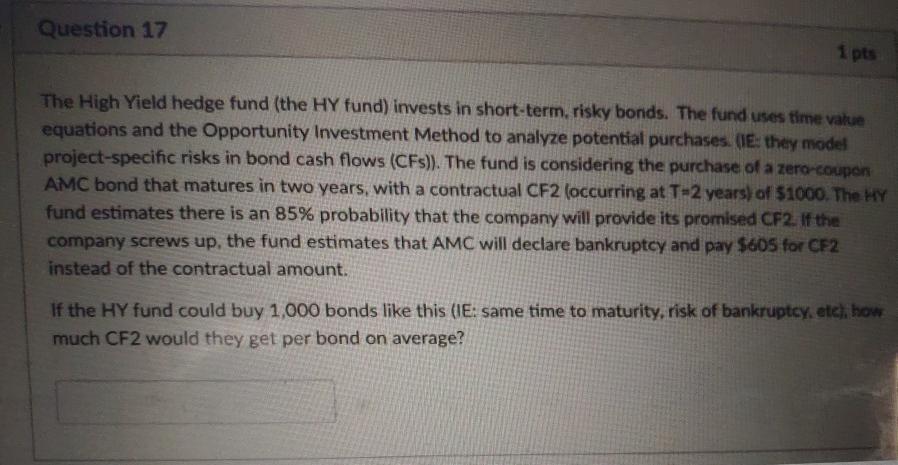

Question 17 1 pts The High Yield hedge fund (the HY fund) invests in short-term, risky bonds. The fund uses time value equations and the Opportunity Investment Method to analyze potential purchases. (IE: they model project-specific risks in bond cash flows (CFs)). The fund is considering the purchase of a zero-coupon AMC bond that matures in two years, with a contractual CF2 (occurring at T-2 years) of 51000. The HY fund estimates there is an 85% probability that the company will provide its promised CF2. If the company screws up, the fund estimates that AMC will declare bankruptcy and pay $605 for CF2 instead of the contractual amount. If the HY fund could buy 1,000 bonds like this (IE: same time to maturity, risk of bankruptcy, etc), how much CF2 would they get per bond on average

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts