Question: Question 16 1 pts Consider a portfolio manager whose mission is to maximize annual returns through debt investments in utilities that generate electricity using wind

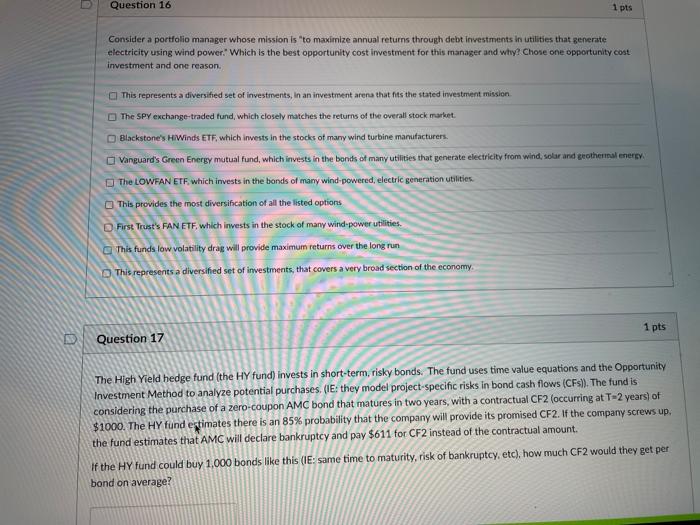

Question 16 1 pts Consider a portfolio manager whose mission is to maximize annual returns through debt investments in utilities that generate electricity using wind power. Which is the best opportunity cost investment for this manager and why? Chose one opportunity cost investment and one reason. This represents a diversified set of investments, in an investment arena that fits the stated investment mission The SPY exchange-traded fund, which closely matches the returns of the overall stock market. Blackstone's HiWinds ETF, which invests in the stocks of many wind turbine manufacturers. Vanguard's Green Energy mutual fund, which invests in the bonds of many utilities that generate electricity from wind, solar and geothermal enery The LOWFAN ETF, which invests in the bonds of many wind powered, electric generation utilities This provides the most diversification of all the listed options First Trust's FAN ETF, which invests in the stock of many wind power utilities This funds low volatility drag will provide maximum returns over the long run This represents a diversified set of investments, that covers a very broad section of the economy 1 pts IND Question 17 The High Yield hedge fund (the HY fund) invests in short-term, risky bonds. The fund uses time value equations and the Opportunity Investment Method to analyze potential purchases. (IE: they model project-specific risks in bond cash flows (CF)). The fund is considering the purchase of a zero-coupon AMC bond that matures in two years, with a contractual CF2 (occurring at T-2 years) of $1000. The HY fund estimates there is an 85% probability that the company will provide its promised CF2. If the company screws up. the fund estimates that AMC will declare bankruptcy and pay $611 for CF2 instead of the contractual amount. If the HY fund could buy 1.000 bonds like this (IE: same time to maturity, risk of bankruptcy, etc), how much CF2 would they get per bond on average

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts