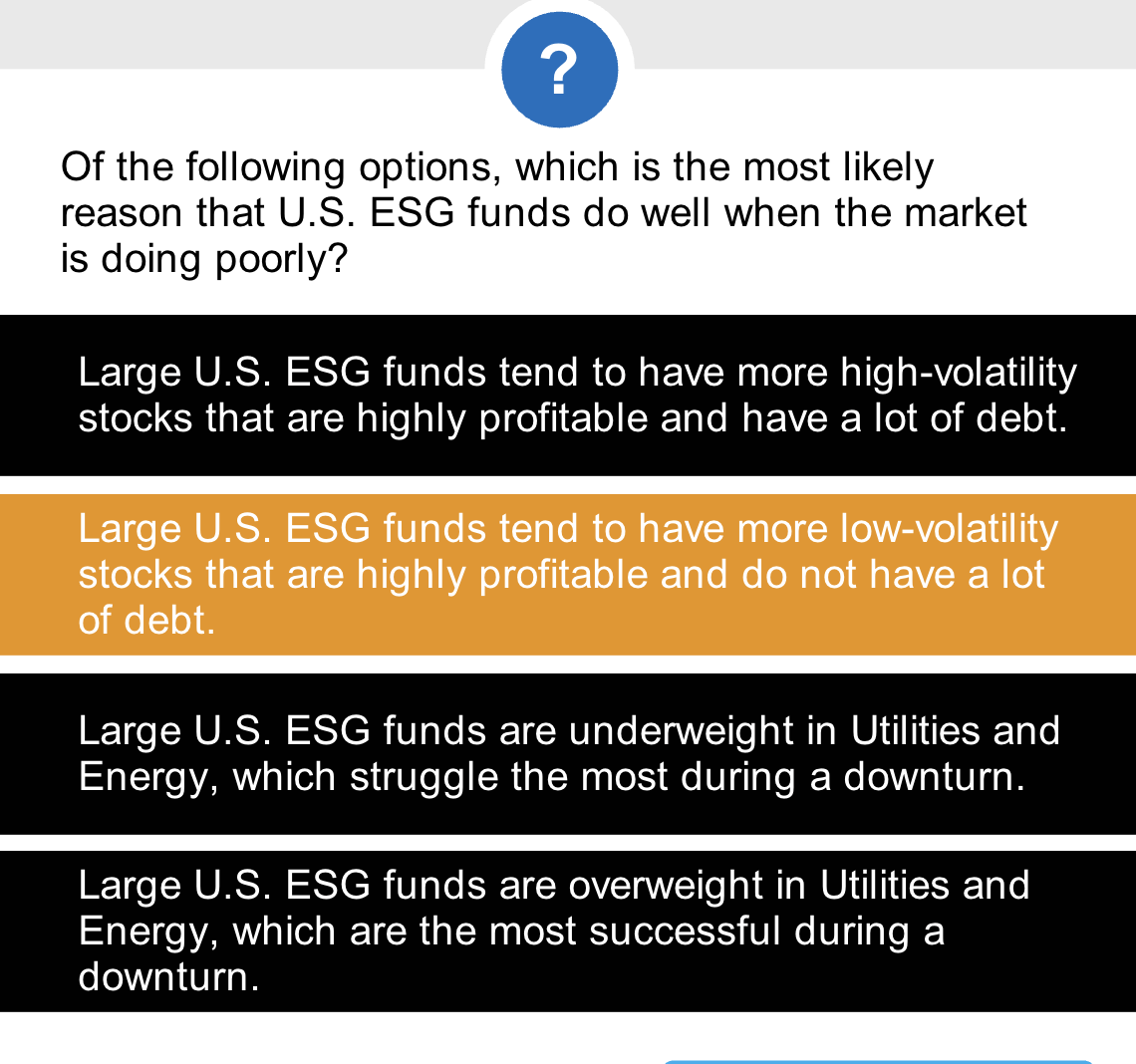

Question: is doing poorly? Large U . S . ESG funds tend to have more high - volatility stocks that are highly profitable and have a

is doing poorly?

Large US ESG funds tend to have more highvolatility stocks that are highly profitable and have a lot of debt.

Large US ESG funds tend to have more lowvolatility stocks that are highly profitable and do not have a lot of debt.

Large US ESG funds are underweight in Utilities and Energy, which struggle the most during a downturn.

Large US ESG funds are overweight in Utilities and Energy, which are the most successful during a downturn.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock