Question: is it clear.? like what you need ? Styles Paragraph 4- The real rate of interest has been estimated to be percent, and the expected

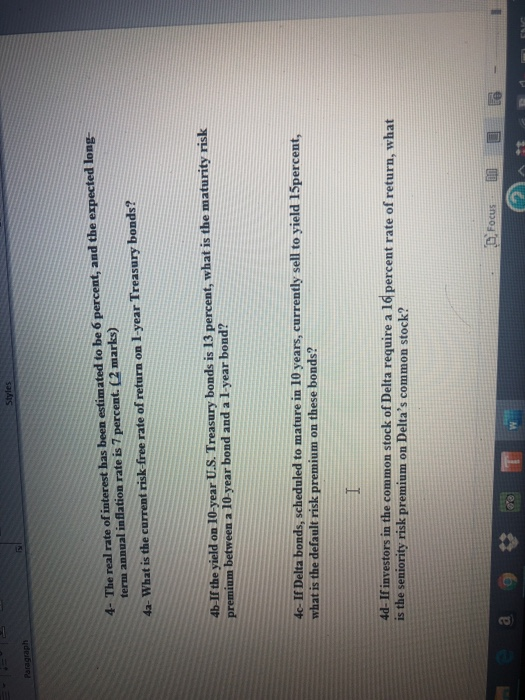

Styles Paragraph 4- The real rate of interest has been estimated to be percent, and the expected long term annual inflation rate is Y percent. (2 marks) 4a- What is the current risk-free rate of return on 1-year Treasury bonds? 4b-If the yield on 10-year U.S. Treasury bonds is 1 percent, what is the maturity risk premium between a 10-year bond and a l-year bond? 4c- If Delta bonds, scheduled to mature in 10 years, currently sell to yield 1 percent, what is the default risk premium on these bonds? 4d- If investors in the common stock of Delta require a l' percent rate of return, what is the seniority risk premium on Delta's common stock? Focus BD ( 9 BA ENG 2412 = = - Styles Paragraph 4. The real rate of interest has been estimated to be 6 percent, and the expected long- term annual inflation rate is 7 percent. (2 marks) 4a- What is the current risk-free rate of return on 1-year Treasury bonds? 4b-If the yield on 10-year U.S. Treasury bonds is 13 percent, what is the maturity risk premium between a 10-year bond and a 1-year bond? 4c- If Delta bonds, scheduled to mature in 10 years, currently sell to yield 15 percent, what is the default risk premium on these bonds? 4d- If investors in the common stock of Delta require a 16 percent rate of return, what is the seniority risk premium on Delta's common stock? Focus on

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts