Question: Is it fair to have a policy that can kill the entire industry and benefit only a handful of companies in their valuation related to

Is it fair to have a policy that can kill the entire industry and benefit only a handful of companies in their valuation related to zomato case study? Is this any recipe for growth?

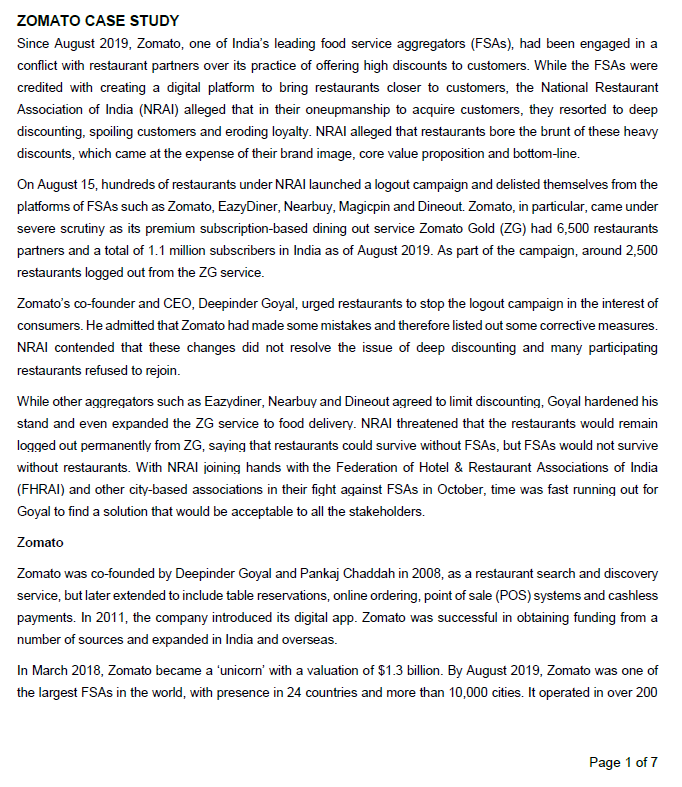

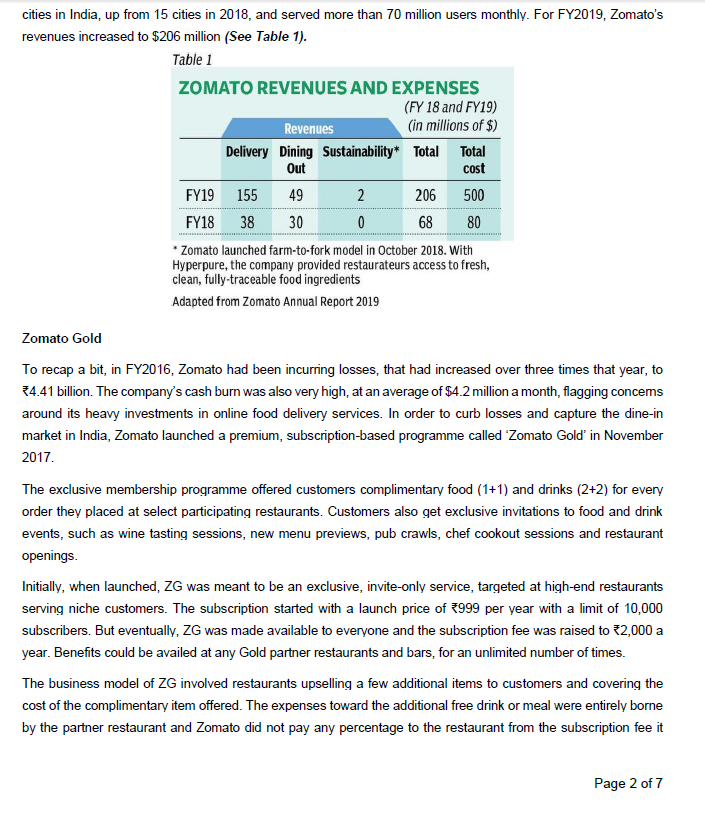

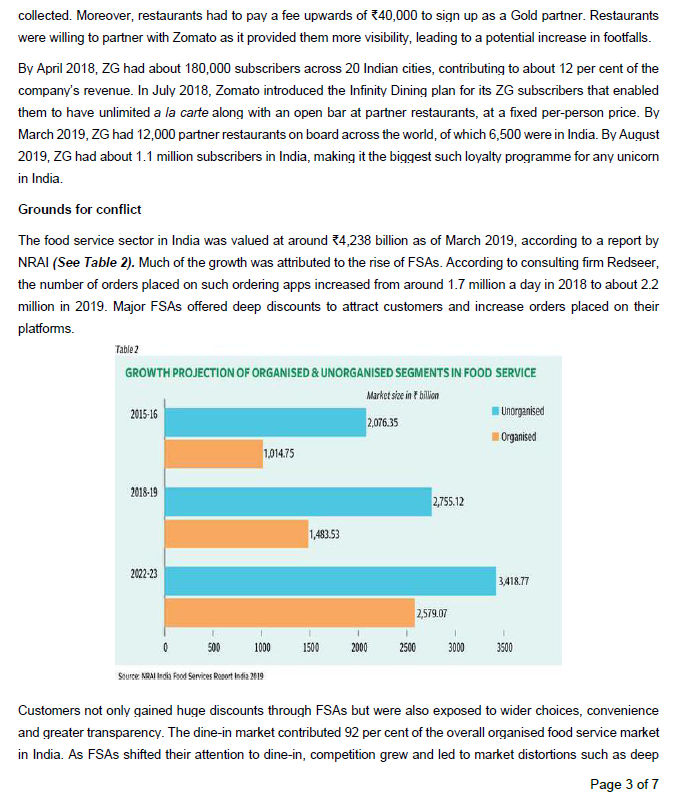

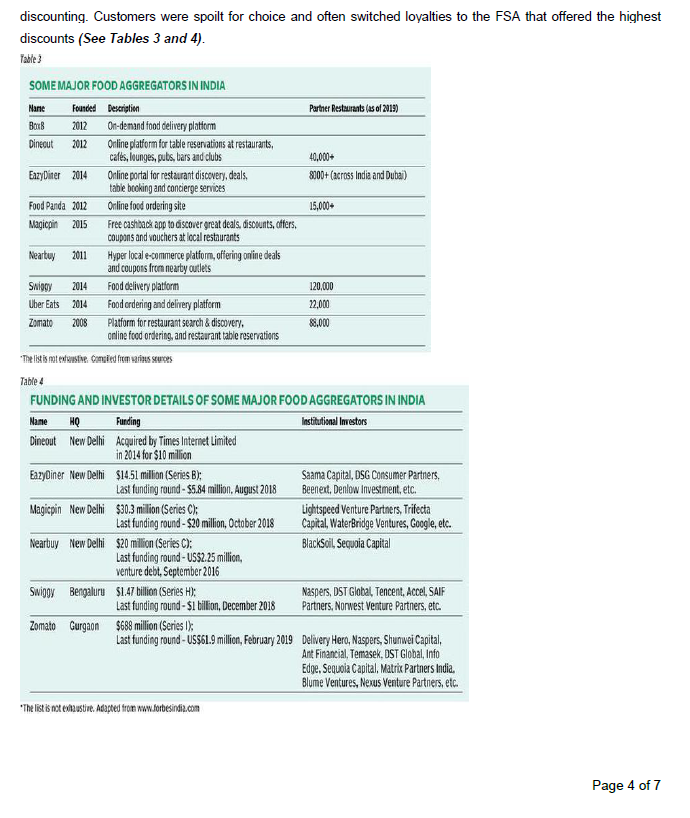

ZOMATO CASE STUDY Since August 2019, Zomato, one of India's leading food service aggregators (FSAs), had been engaged in a conflict with restaurant partners over its practice of offering high discounts to customers. While the FSAs were credited with creating a digital platform to bring restaurants closer to customers, the National Restaurant Association of India (NRAI) alleged that in their oneupmanship to acquire customers, they resorted to deep discounting, spoiling customers and eroding loyalty. NRAI alleged that restaurants bore the brunt of these heavy discounts, which came at the expense of their brand image, core value proposition and bottom-line. On August 15, hundreds of restaurants under NRAI launched a logout campaign and delisted themselves from the platforms of FSAs such as Zomato, EazyDiner, Nearbuy, Magicpin and Dineout. Zomato, in particular, came under severe scrutiny as its premium subscription-based dining out service Zomato Gold (ZG) had 6,500 restaurants partners and a total of 1.1 million subscribers in India as of August 2019. As part of the campaign, around 2,500 restaurants logged out from the ZG service. Zomato's co-founder and CEO, Deepinder Goyal, urged restaurants to stop the logout campaign in the interest of consumers. He admitted that Zomato had made some mistakes and therefore listed out some corrective measures. NRAI contended that these changes did not resolve the issue of deep discounting and many participating restaurants refused to rejoin. While other aggregators such as Eazydiner, Nearbuy and Dineout agreed to limit discounting, Goyal hardened his stand and even expanded the ZG service to food delivery. NRAI threatened that the restaurants would remain logged out permanently from ZG, saying that restaurants could survive without FSAs, but FSAs would not survive without restaurants. With NRAI joining hands with the Federation of Hotel & Restaurant Associations of India (FHRAI) and other city-based associations in their fight against FSAs in October, time was fast running out for Goyal to find a solution that would be acceptable to all the stakeholders. Zomato Zomato was co-founded by Deepinder Goyal and Pankaj Chaddah in 2008, as a restaurant search and discovery service, but later extended to include table reservations, online ordering, point of sale (POS) systems and cashless payments. In 2011, the company introduced its digital app. Zomato was successful in obtaining funding from a number of sources and expanded in India and overseas. In March 2018, Zomato became a 'unicorn' with a valuation of $1.3 billion. By August 2019, Zomato was one of the largest FSAs in the world, with presence in 24 countries and more than 10,000 cities. It operated in over 200 Page 1 of 7cities in India, up from 15 cities in 2018, and served more than 70 million users monthly. For FY2019, Zomato's revenues increased to $206 million (See Table 1). Table 1 ZOMATO REVENUES AND EXPENSES (FY 18 and FY19) Revenues (in millions of $) Delivery Dining Sustainability* Total Total Out cost FY19 155 49 2 206 500 FY18 38 30 0 68 80 *Zomato launched farm-to-fork model in October 2018. With Hyperpure, the company provided restaurateurs access to fresh, clean, fully-traceable food ingredients Adapted from Zomato Annual Report 2019 Zomato Gold To recap a bit, in FY2016, Zomato had been incurring losses, that had increased over three times that year, to *4.41 billion. The company's cash burn was also very high, at an average of $4.2 million a month, flagging concems around its heavy investments in online food delivery services. In order to curb losses and capture the dine-in market in India, Zomato launched a premium, subscription-based programme called "Zomato Gold' in November 2017. The exclusive membership programme offered customers complimentary food (1+1) and drinks (2+2) for every order they placed at select participating restaurants. Customers also get exclusive invitations to food and drink events, such as wine tasting sessions, new menu previews, pub crawls, chef cookout sessions and restaurant openings. Initially, when launched, ZG was meant to be an exclusive, invite-only service, targeted at high-end restaurants serving niche customers. The subscription started with a launch price of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts