Question: is my answer right? how do you know It is December 2020 and you are examining the financial statements of Stark Industries (see below). You

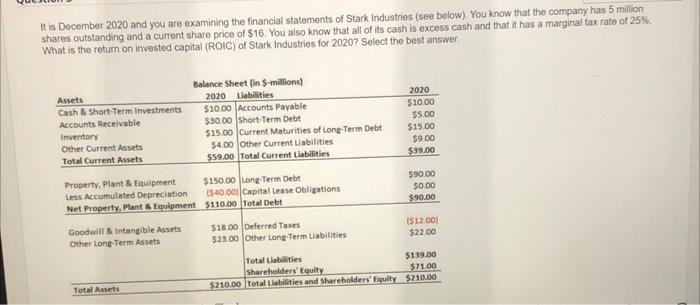

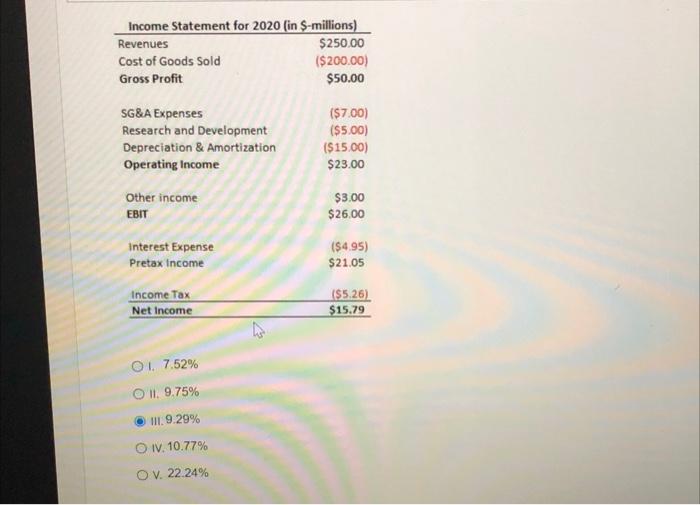

It is December 2020 and you are examining the financial statements of Stark Industries (see below). You know that the company has 5 milion shares outstanding and a current share price of $16. You also know that all of its cash is excess cash and that it has a marginal tax rate of 25% What is the return on invested capital (ROIC) of Stark Industries for 2020? Select the best answer Assets Cash & Short-Term Investments Accounts Receivable Inventory Other Current Assets Total Current Assets Balance Sheet (in S-millions) 2020 Liabilities $10.00 Accounts Payable $30 00 Short-Term Debt $15.00 Current Maturities of Long-Term Debt $400 Other Current Liabilities $59.00 Total Current Liabilities 2020 $10.00 $5.00 $15.00 $9.00 $39.00 Property. Plant & Equipment $150.00 Long-Term Debt Less Accumulated Depreciation 1540.00 Capital Lease Obligations Net Property. Plant & Equipment $110.00 Total Debt 590.00 50.00 $90.00 1512.00) $22.00 Goodwill & Intangible Assets Other tong-Term Assets $18.00 Deferred Taxes $23.00 Other Long-Term Liabilities Total Liabilities $139.00 Shareholders' Equity $71.00 $210.00 Total Liabilities and Shareholders' Equity $210.00 Total Assets Income Statement for 2020 (in S-millions) Revenues $250,00 Cost of Goods Sold ($200.00) Gross Profit $50.00 SG&A Expenses Research and Development Depreciation & Amortization Operating Income ($7.00) ($5.00) ($15.00) $23.00 Other income EBIT $3.00 $26.00 Interest Expense Pretax income ($4.95) $21.05 Income Tax Net Income $5.26) $15.79 OI 7.52% O II. 9.75% III. 9.29% O IV. 10.77% O v. 22.24%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts