Question: Is my cash flow statement correct 1 . 1 . . 1 . 1 . 1 .2 . 1 .3 . 1 . 4 .

Is my cash flow statement correct

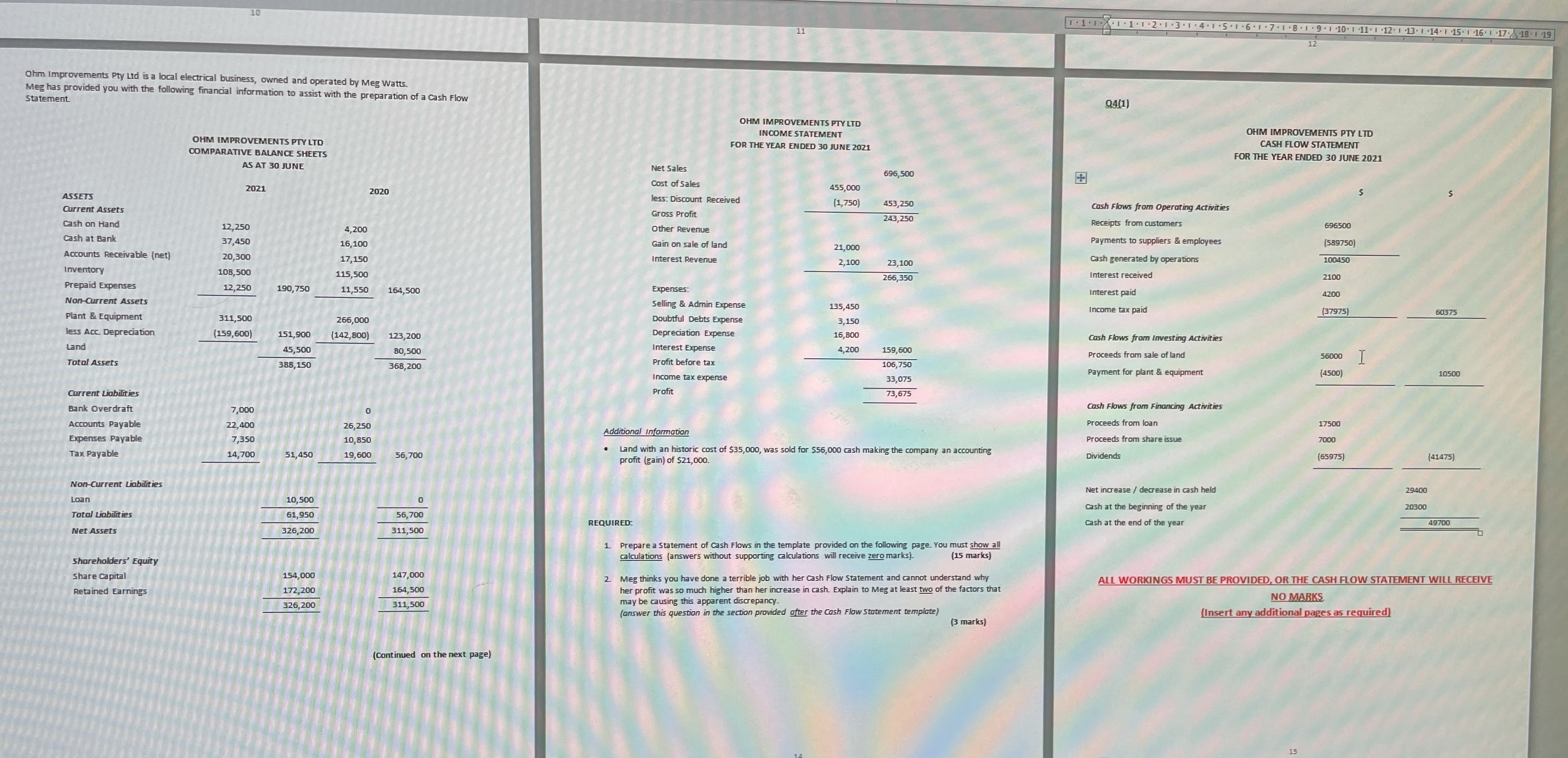

1 . 1 . . 1 . 1 . 1 .2 . 1 .3 . 1 . 4 . 1 .5 . 1 6 . 1 7 . 1 8 . 1 . 9 . 1 10. 1 41 1 12 1 13 . 1 -14 . 1 15. 1 16 .1 17 18 1 19 Ohm Improvements Pty Ltd is a local electrical business, owned and operated by Meg Watts. Meg has provided you with the following financial information to assist with the preparation of a Cash Flow 04(1) Statement OHM IMPROVEMENTS PTY LTD OHM IMPROVEMENTS PTY LTD INCOME STATEMENT CASH FLOW STATEMENT OHM IMPROVEMENTS PTY LTD FOR THE YEAR ENDED 30 JUNE 2021 FOR THE YEAR ENDED 30 JUNE 2021 COMPARATIVE BALANCE SHEETS AS AT 30 JUNE Net Sales 696,500 Cost of Sales 455,000 2021 2020 ASSETS less: Discount Received (1,750) 453,250 Cash Flows from Operating Activities Current Assets Gross Profit 243,250 Receipts from customers 696500 Cash on Hand 12,250 4,200 Other Revenue Payments to suppliers & employees (589750) Cash at Bank 37,450 16,100 Gain on sale of land 21,000 100450 Accounts Receivable (net) 20,300 17,150 Interest Revenue Cash generated by operations 2,100 23,100 Interest received 2100 Inventory 108,500 115,500 266,350 4200 Prepaid Expenses 12,250 190,750 11,550 Expenses: Interest paid 164,500 Non-Current Assets Selling & Admin Expense 135,450 Income tax paid (37975) 60375 Plant & Equipment 311,500 265,000 Doubtful Debts Expense 3,150 16, 800 less Acc. Depreciation (159,600) 151,900 Depreciation Expense Cash Flows from Investing Activities (142,800) 123,200 Interest Expense 4,200 159,600 56000 Land 45,500 80,500 Proceeds from sale of land Profit before tax 106,750 10500 Total Assets 388,150 368,200 Payment for plant & equipment [4500) Income tax expense 33,075 Profit 73,675 Current Liabilities Cash Flows from Financing Activities Bank Overdraft 7,000 Proceeds from loan 17500 Accounts Payable 22,400 26,250 Additional Information Proceeds from share issue 7000 Expenses Payable 7,350 10,850 Land with an historic cost of $35,000, was sold for $56,000 cash making the company an accounting Dividends (65975) (41475) Tax Payable 14,700 51,450 19,600 56,700 profit (gain) of $21,000. Net increase / decrease in cash held 2940 Non-Current Liabilities 20300 Loan 10,500 Cash at the beginning of the year 49700 Total Liabilities 61,950 56,700 Cash at the end of the year REQUIRED: Net Assets 326,200 311,500 1 Prepare a Statement of Cash Flows in the template provided on the following page. You must show all calculations (answers without supporting calculations will receive zero marks)- (15 marks) Shareholders' Equity ALL WORKINGS MUST BE PROVIDED, OR THE CASH FLOW STATEMENT WILL RECEIVE Share Capital 154,000 147,000 2 Meg thinks you have done a terrible job with her Cash Flow Statement and cannot understand why 172,200 164,500 her profit was so much higher than her increase in cash. Explain to Meg at least two of the factors that NO MARKS Retained Earnings may be causing this apparent discrepancy. 326,200 311,500 (Insert any additional pages as required) (answer this question in the section provided after the Cash Flow Statement template) (3 marks) Continued on the next page)