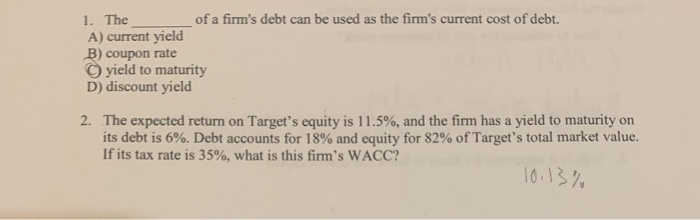

Question: is question 1 correct and how do you do question 2? 1. The of a firm's debt can be used as the firm's current cost

1. The of a firm's debt can be used as the firm's current cost of debt. A) current yield B) coupon rate yield to maturity D) discount yield 2. The expected return on Target's equity is 11.5%, and the firm has a yield to maturity on its debt is 6%. Debt accounts for 18% and equity for 82% of Target's total market value. If its tax rate is 35%, what is this firm's WACC? 10.13%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts