Question: is the solution correct for this wu is -6,825.64 the equivalent annual annuity of project A? please explain. Cash flow Initial Investment $21 million Project

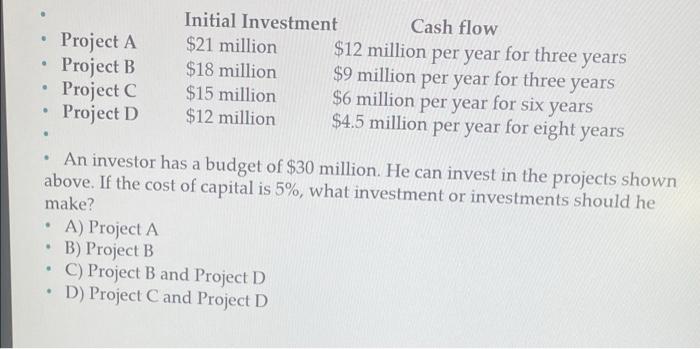

Cash flow Initial Investment $21 million Project A Project B $18 million $12 million per year for three years $9 million per year for three years $6 million per year for six years $4.5 million per year for eight years . Project C $15 million $12 million . Project D . An investor has a budget of $30 million. He can invest in the projects shown above. If the cost of capital is 5%, what investment or investments should he make? A) Project A B) Project B . C) Project B and Project D D) Project C and Project D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts