Question: Is there anybody who help me to write the problem model and solve this problem in excel? It is very urgent. TABLE 17 (Refer to

Is there anybody who help me to write the problem model and solve this problem in excel? It is very urgent.

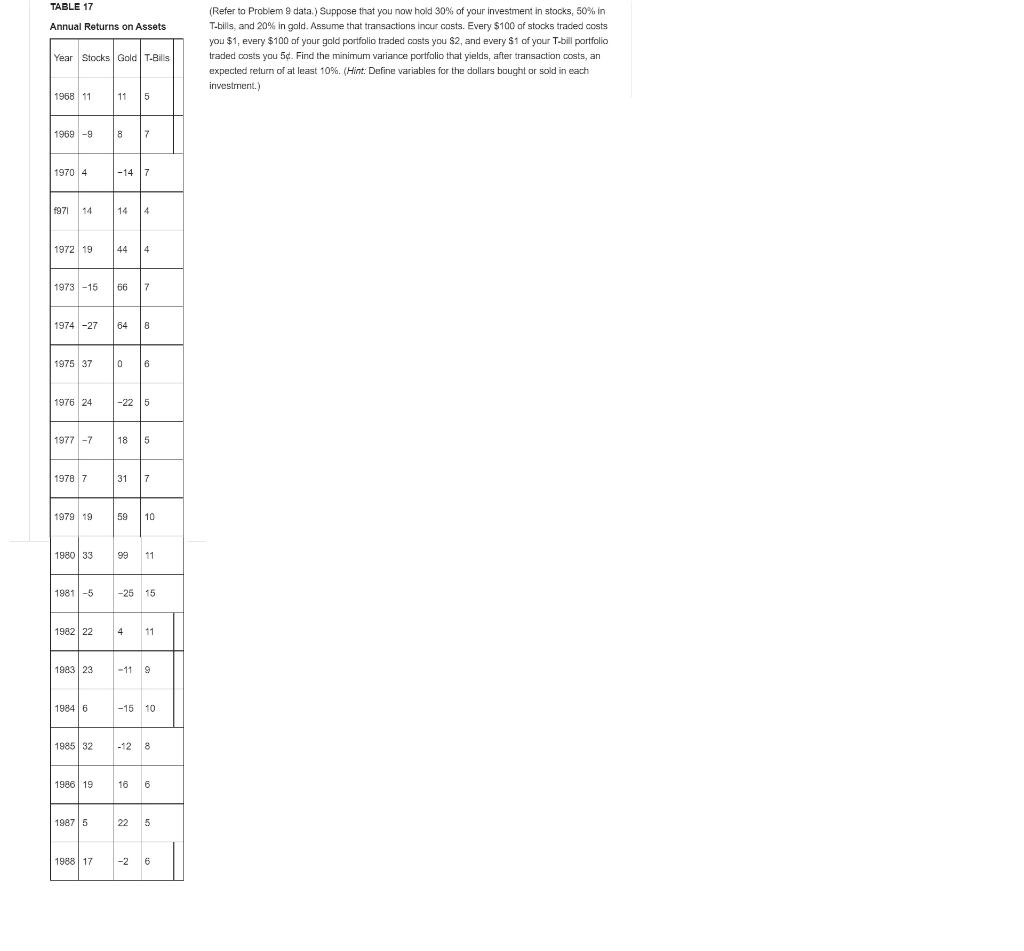

TABLE 17 (Refer to Problem 8 data.) Suppose that you now hold 30% of your investment in stocks, 50% in Annual Returns on Assets T-bills, and 20% in gold. Assume that transactions incur costs. Every $100 of stocks traded costs \begin{tabular}{|l|l|l|l|} \hline Year & Stocks & Gold & T-Bills \\ \hline 1968 & 11 & 11 & 5 \\ \hline \end{tabular} you $1, every $100 of your gold portfolio traded costs you $2, and every $1 of your T-bill portfolio traded costs you 5%. Find the minimum variance portfolio that yields, after transaction costs, an expected relurn of at least 10%. (Hint: Define variables for the dollars bought or sold in each investment.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts