Question: is there Anyone done this question before need help Question 1 (65) SHU Co. is a retail shop selling cameras. It commenced its operations in

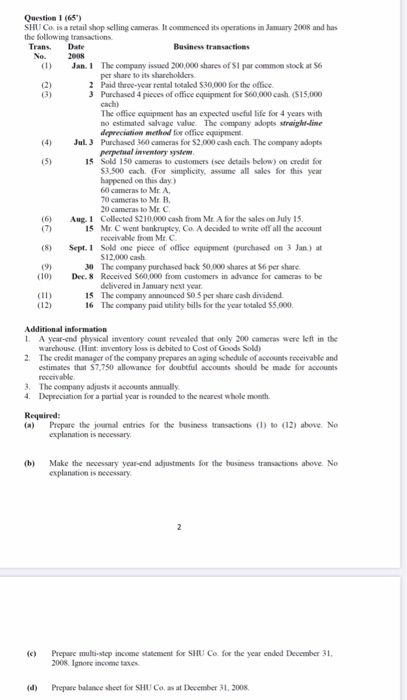

Question 1 (65) SHU Co. is a retail shop selling cameras. It commenced its operations in January 2008 and has the following transactions Trans Date Business transactions No. 2008 (1) Jan. The company issued 200,000 shares of S1 par common stock at 56 per share to its sharcholders (2) 2 Paid three-year rental totaled $30,000 for the office (3) 3 Purchased 4 pieces of office equipment for $60,000 cash. (S15,000 cash) The office equipment has an expected useful life for 4 years with no estimated salvage value. The company adopts straight-line depreciation method for office equipment (4) Jul. 3 Purchased 360 cameras for $2,000 cash cach. The company adopts perpetual inventory system (5) 15 Sold 150 cameras to customers (see details below) on credit for $3.500 each. (For simplicity, asume all sales for this year happened on this day.) 60 cameras to Mr. A 70 cameras to Mr. B 20 cameras to Mr C (6) Aug. 1 Collected S210,000 cash from Mr. A for the sales on July 15. (2) 15 Mr. C went bankruptey, Co. A decided to write off all the account receivable from Mr. (8) Sept. I sold one piece of office equipment (purchased on 3 Jan.) at $12,000 cash (9) 30 The company purchased back 50,000 shares at S6 per share. (10) Dec. 8 Received $60,000 from customers in advance for cameras to be delivered in January next year. (11) 15 The company announced 50.5 per share cash dividend. (12) 16 The company paid utility bills for the year totaled 55.000 Additional information 1. A year-end physical inventory count revealed that only 200 cameras were left in the warehouse. (Hint: inventory loss is debited to Cost of Goods Sold) 2. The credit manager of the company prepares an aging schedule of accounts receivable and estimates that $7.750 allowance for doubtful accounts should be made for accounts receivable 3. The company adjusts it accounts annually 4. Depreciation for a partial year is rounded to the nearest whole month Required: Prepare the joumal entries for the business transactions (1) to (12) above. No explanation is necessary (b) Make the necessary year-end adjustments for the business transactions above. No explanation is necessary 2 (c) Prepare multi-step income statement for SHU Co. for the year ended December 31. 2008. Ignore income taxes (d) Prepare balance sheet for SHU Co. as at December 31, 2008

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts