Question: Is this correct? if not please explain why and what it should be. Discussion Question 18-9 (LO. 1) At a point when Robin Corporation has

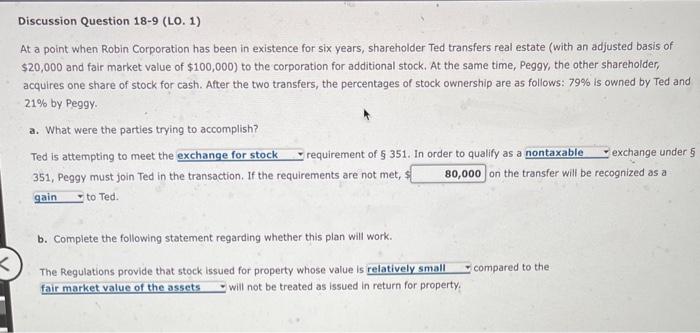

Discussion Question 18-9 (LO. 1) At a point when Robin Corporation has been in existence for six years, shareholder Ted transfers real estate (with an adjusted basis of $20,000 and fair market value of $100,000 ) to the corporation for additional stock. At the same time, Peggy, the other shareholder, acquires one share of stock for cash. After the two transfers, the percentages of stock ownership are as follows: 79% is owned by Ted and 21% by Peggy. a. What were the parties trying to accomplish? Ted is attempting to meet the requirement of 5351 . in order to qualify as a exchange under 351, Peggy must join Ted in the transaction. If the requirements are not met, 5 on the transfer will be recognized as a to Ted. b. Complete the following statement regarding whether this plan will work. The Regulations provide that stock issued for property whose value is compared to the E will not be treated as issued in return for property

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts