Question: Is this correct? Problem 3: Reacher Solutions is considering 3 different capital structures. To help them make the optimal choice, they provided you with the

Is this correct?

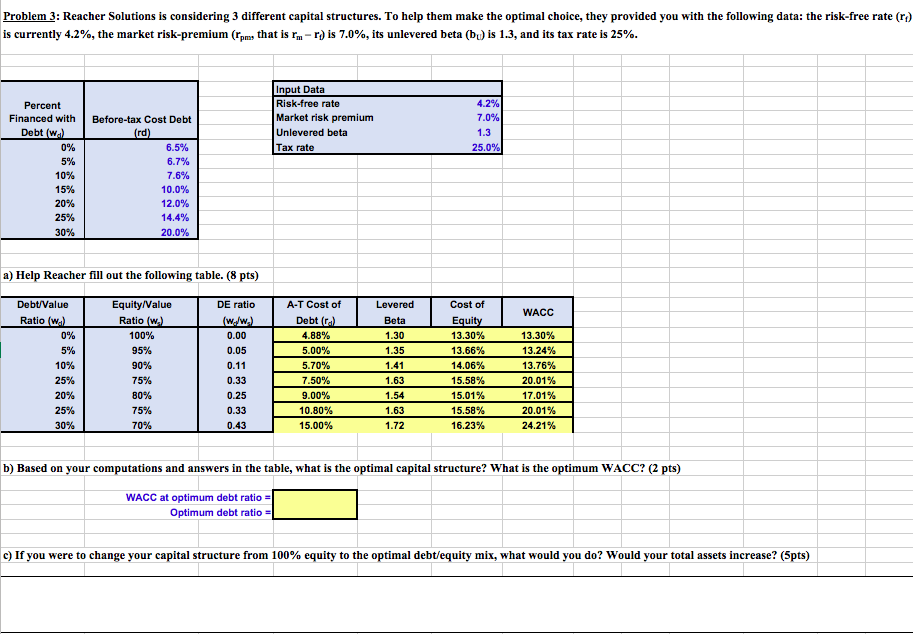

Problem 3: Reacher Solutions is considering 3 different capital structures. To help them make the optimal choice, they provided you with the following data: the risk-free rate (ri) is currently 4.2%, the market risk-premium (Tpms that is rm -r) is 7.0%, its unlevered beta (b) is 1.3, and its tax rate is 25%. Input Data Risk-free rate Market risk premium Unlevered beta Tax rate 4.2% 7.0% 1.3 25.0% Percent Financed with Debt (w.) 0% 5% 10% 15% 20% 25% 30% Before-tax Cost Debt (rd) 6.5% 6.7% 7.6% 10.0% 12.0% 14.4% 20.0% a) Help Reacher fill out the following table. (8 pts) WACC Debt/Value Ratio (w.) 0% 5% 10% 25% 20% 25% 30% Equity/Value Ratio (w.) 100% 95% 90% 75% 80% 75% 70% DE ratio (w./w) 0.00 0.05 0.11 0.33 0.25 0.33 0.43 A-T Cost of Debt (r.) 4.88% 5.00% 5.70% 7.50% 9.00% 10.80% 15.00% Levered Beta 1.30 1.35 1.41 1.63 1.54 1.63 1.72 Cost of Equity 13.30% 13.66% 14.06% 15.58% 15.01% 15.58% 16.23% 13.30% 13.24% 13.76% 20.01% 17.01% 20.01% 24.21% b) Based on your computations and answers in the table, what is the optimal capital structure? What is the optimum WACC? (2 pts) WACC at optimum debt ratio Optimum debt ratio c) If you were to change your capital structure from 100% equity to the optimal debt/equity mix, what would you do? Would your total assets increase? (5pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts