Question: PLEASE SHOW ALL FORMULAS, NO RAW NUMBERS. A B C D E F G H I 1 12/8/12 2 Chapter: 15 3 Problem: 12 4

PLEASE SHOW ALL FORMULAS, NO RAW NUMBERS.

PLEASE SHOW ALL FORMULAS, NO RAW NUMBERS.

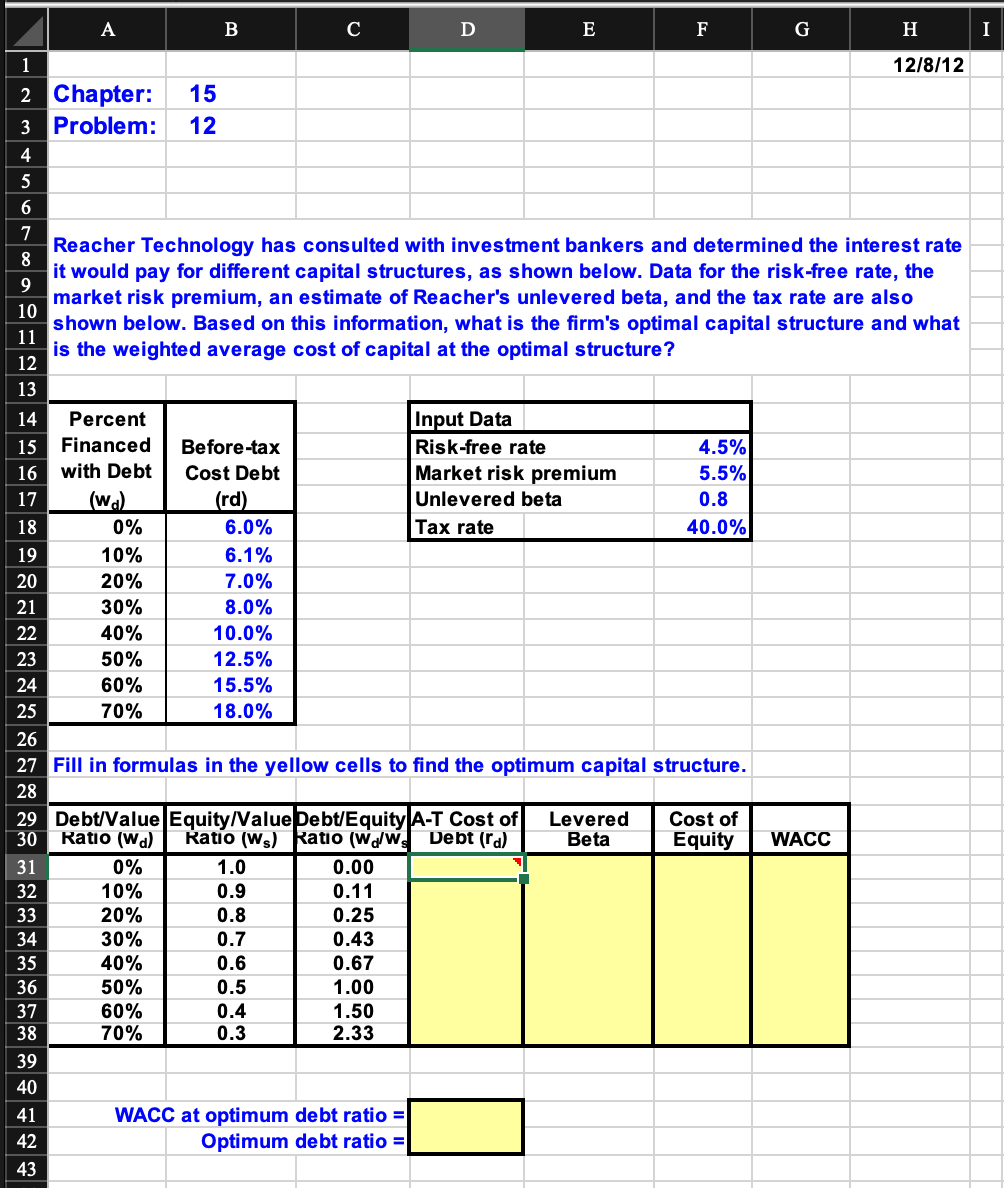

A B C D E F G H I 1 12/8/12 2 Chapter: 15 3 Problem: 12 4 5 6 7 Reacher Technology has consulted with investment bankers and determined the interest rate 8 it would pay for different capital structures, as shown below. Data for the risk-free rate, the 9 market risk premium, an estimate of Reacher's unlevered beta, and the tax rate are also 10 shown below. Based on this information, what is the firm's optimal capital structure and what 11 is the weighted average cost of capital at the optimal structure? 12 13 14 Percent Input Data 15 Financed Before-tax Risk-free rate 4.5% 16 with Debt Cost Debt Market risk premium 5.5% 17 (w.) (rd) Unlevered beta 0.8 18 0% 6.0% Tax rate 40.0% 19 10% 6.1% 20 20% 7.0% 21 30% 8.0% 22 40% 10.0% 23 50% 12.5% 24 60% 15.5% 25 70% 18.0% 26 27 Fill in formulas in the yellow cells to find the optimum capital structure. 28 29 Debt/Value Equity/Value Debt/Equity A-T Cost of Levered Cost of 30 Ratio (wa) Ratio (ws) Katio (w/w Debt (ra) Beta Equity WACC 31 0% 1.0 0.00 32 10% 0.9 0.11 33 20% 0.8 0.25 34 30% 0.7 0.43 35 40% 0.6 0.67 36 50% 0.5 1.00 37 60% 0.4 1.50 38 70% 0.3 2.33 39 40 41 WACC at optimum debt ratio = 42 Optimum debt ratio = 43 A B C D E F G H I 1 12/8/12 2 Chapter: 15 3 Problem: 12 4 5 6 7 Reacher Technology has consulted with investment bankers and determined the interest rate 8 it would pay for different capital structures, as shown below. Data for the risk-free rate, the 9 market risk premium, an estimate of Reacher's unlevered beta, and the tax rate are also 10 shown below. Based on this information, what is the firm's optimal capital structure and what 11 is the weighted average cost of capital at the optimal structure? 12 13 14 Percent Input Data 15 Financed Before-tax Risk-free rate 4.5% 16 with Debt Cost Debt Market risk premium 5.5% 17 (w.) (rd) Unlevered beta 0.8 18 0% 6.0% Tax rate 40.0% 19 10% 6.1% 20 20% 7.0% 21 30% 8.0% 22 40% 10.0% 23 50% 12.5% 24 60% 15.5% 25 70% 18.0% 26 27 Fill in formulas in the yellow cells to find the optimum capital structure. 28 29 Debt/Value Equity/Value Debt/Equity A-T Cost of Levered Cost of 30 Ratio (wa) Ratio (ws) Katio (w/w Debt (ra) Beta Equity WACC 31 0% 1.0 0.00 32 10% 0.9 0.11 33 20% 0.8 0.25 34 30% 0.7 0.43 35 40% 0.6 0.67 36 50% 0.5 1.00 37 60% 0.4 1.50 38 70% 0.3 2.33 39 40 41 WACC at optimum debt ratio = 42 Optimum debt ratio = 43

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts