Question: Is this statement correct regarding lump - sum back payments for Social Security benefits? Is this a correct cotion ? Taxpayer received 2 1 2

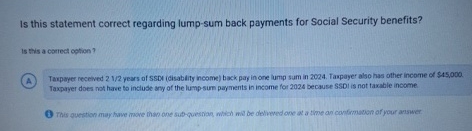

Is this statement correct regarding lumpsum back payments for Social Security benefits?

Is this a correct cotion

Taxpayer received years of SSDI disablity income back pay in one lump sum in Taxpayer also has other income of $ Taxpayer does not have to include any of the lumpsum payments in income for because SSDI is not taxable income.

This question may have move than one subquesnan, mich mil be delivered one at a the an confinmation of your answer:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock