Question: ise A Saved Help Save & Exit Check Required information Use the following information for the Exercises below. [The following information applies to the questions

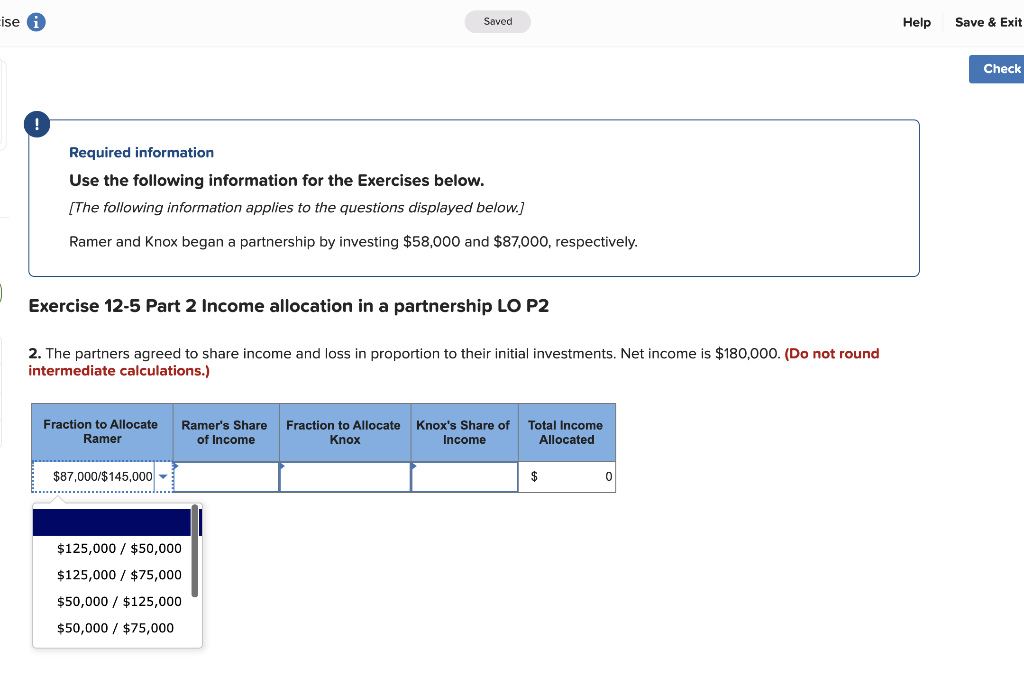

ise A Saved Help Save & Exit Check Required information Use the following information for the Exercises below. [The following information applies to the questions displayed below.) Ramer and Knox began a partnership by investing $58,000 and $87,000, respectively. Exercise 12-5 Part 2 Income allocation in a partnership LO P2 2. The partners agreed to share income and loss in proportion to their initial investments. Net income is $180,000. (Do not round intermediate calculations.) Fraction to Allocate Ramer Ramer's Share of Income Fraction to Allocate Knox Knox's Share of Income Total Income Allocated $87,000/$145,000 $ 0 $125,000 / $50,000 $125,000 / $75,000 $50,000 / $125,000 $50,000 / $75,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts