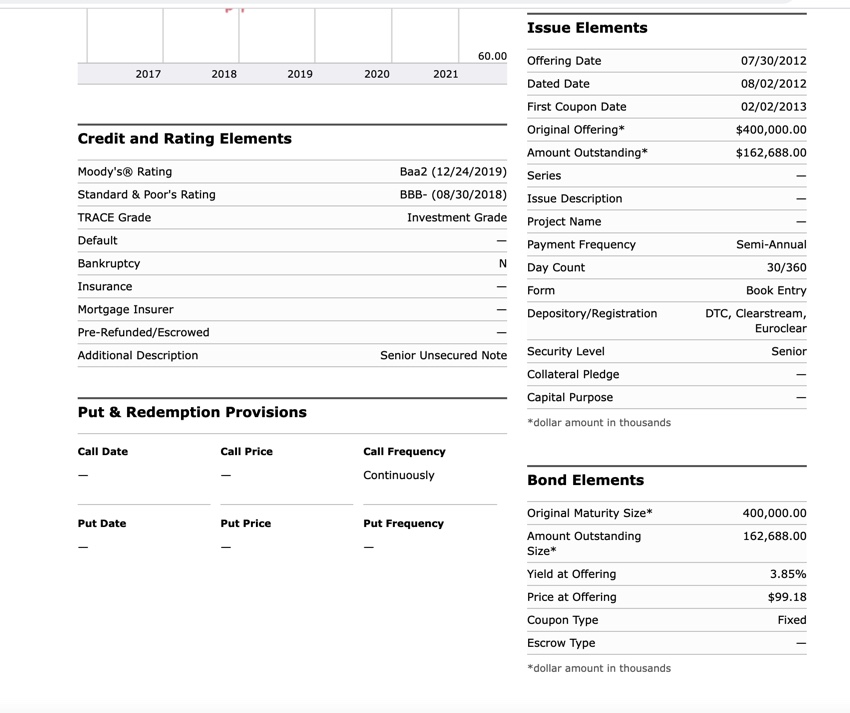

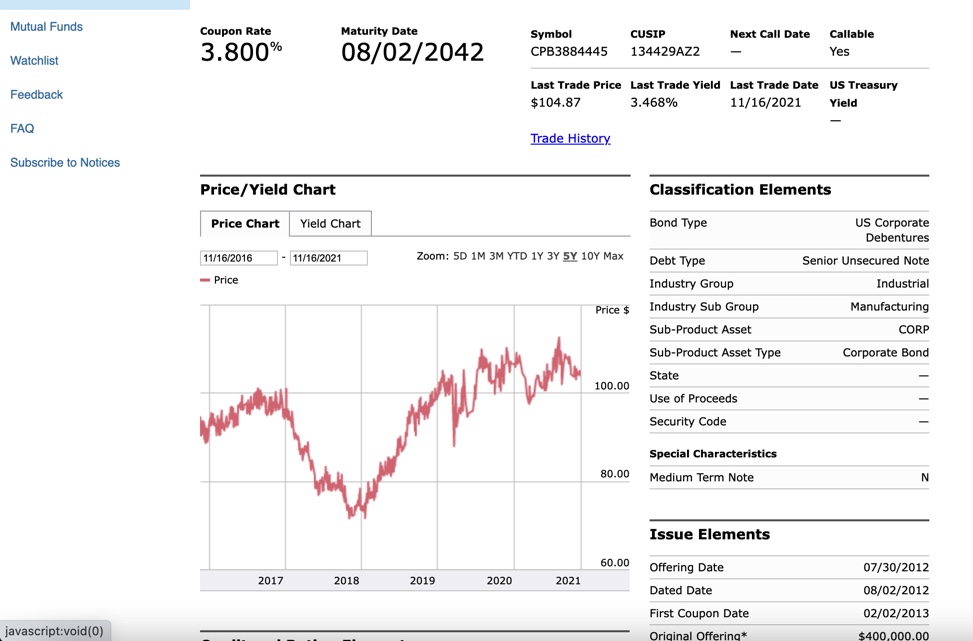

Question: Issue Elements 60.00 Offering Date 07/30/2012 2017 2018 2019 2020 2021 ted Date 08/02/2012 First Coupon Date 02/02/2013 Original Offering* $400,000.00 Credit and Rating Elements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts