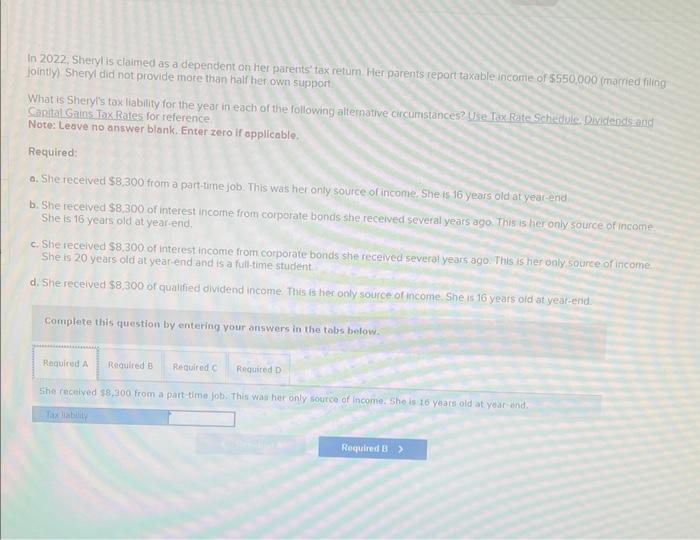

Question: it asks for her tax liability at A, B, C and D In 2022: Sheryl is ciaimed as a dependent on her parents tax retum.

In 2022: Sheryl is ciaimed as a dependent on her parents tax retum. Her parenis report taxable incomie of $550,000 (ma mied filing Jointy) Sheryl did not provide more than half her own support What is Sheryis tax liability for the year in each of the following altemative curcumstances? Use Tax Rate Schectule, Diviclendsand. Capital Gains Tax Rates for reference Note: Leave no answer blank. Enter zero if opplicoble. Required: a. She received $8,300 from a part-time job. This was her only source of income, She is 16 years old at year-end b. She recelved $8.300 of interest incorne from corporate bonds she received several years ago. This is her only source of income She is 16 years old at year end. c. She feceived $8,300 of interest income from corporate bonds she received severat years ago. This is her only source of income. She is 20 years old at year-end and is a full-time student d. She received $8,300 of qualifed dividend income. This is her only source of income, She is 16 years old at year-end Complete this question by entering your answers in the tobs below. She recilved $8,300 from a part-time job. This was her only source of Income. She is 16 years old at yoar-end

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts