Question: it is a business systems and analysis design . I need a business case and calcation solution if anybody can help me Small Business Financial

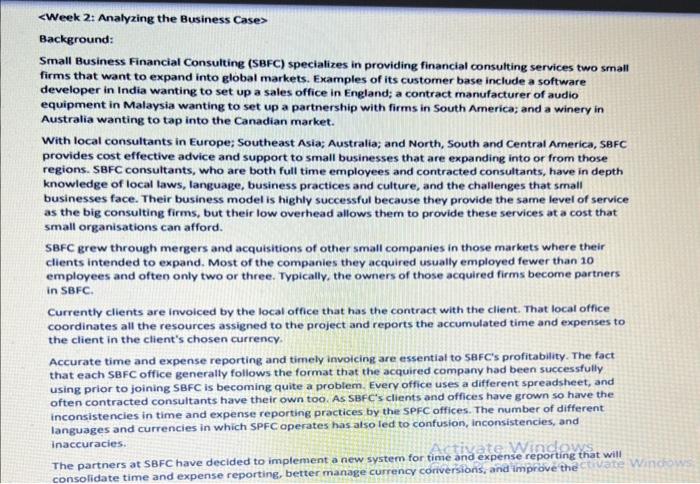

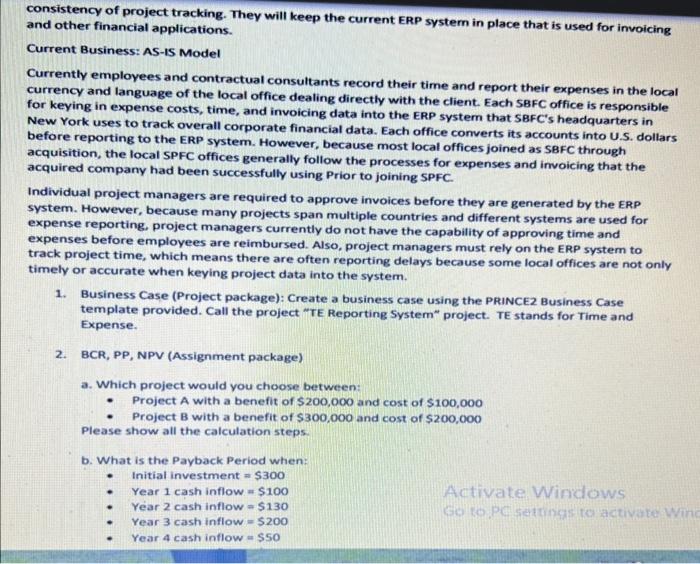

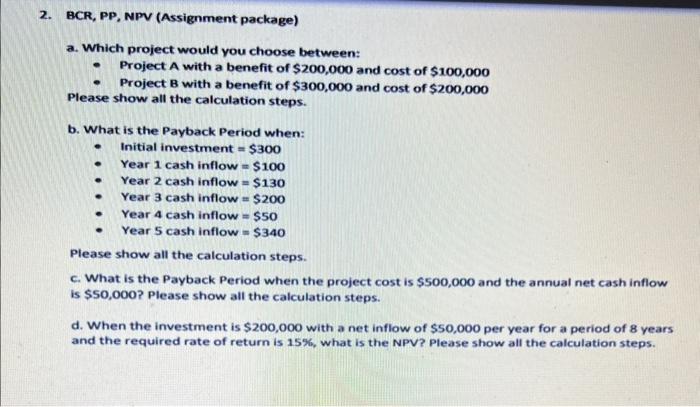

Small Business Financial Consulting (SBFC) specializes in providing financial consulting services two small firms that want to expand into global markets. Examples of its customer base include a software developer in India wanting to set up a sales office in England; a contract manufacturer of audio equipment in Malaysia wanting to set up a partnership with firms in South America; and a winery in Australia wanting to tap into the Canadian market. With local consultants in Europe; Southeast Asia; Australia; and North, South and Central America, SBFC provides cost effective advice and support to small businesses that are expanding into or from those regions. SBFC consultants, who are both full time employees and contracted consultants, have in depth knowledge of local laws, language, business practices and culture, and the challenges that small businesses face. Their business model is highly successful because they provide the same level of service as the big consulting firms, but their low overhead allows them to provide these services at a cost that small organisations can afford. SBFC grew through mergers and acquisitions of other small companies in those markets where their clients intended to expand. Most of the companies they acquired usually employed fewer than 10 employees and often only two or three. Typically, the owners of those acquired firms become partners in SBFC. Currently clients are invoiced by the local office that has the contract with the client. That local office coordinates all the resources assigned to the project and reports the accumulated time and expenses to the client in the client's chosen currency. Accurate time and expense reporting and timely invoicing are essential to 58FC 's profitability. The fact that each SBFC office generally follows the format that the acquired company had been successfully. using prior to joining SBFC is becoming quite a problem. Every office uses a different spreadsheet, and often contracted consultants have their own too. As SBFC's clients and offices have grown so have the inconsistencies in time and expense reporting practices by the SPFC offices. The number of different languages and currencies in which SPFC operates has also led to confusion, inconsistencies, and. inaccuracies. The partners at SBFC have decided to implement a new system for time and expense reporting that will and other financial applications. Current Business: AS-IS Model Currently employees and contractual consultants record their time and report their expenses in the local currency and language of the local office dealing directly with the client. Each SBFC office is responsible for keying in expense costs, time, and invoicing data into the ERP system that SBFC's headquarters in New York uses to track overall corporate financial data. Each office converts its accounts into U.S. dollars before reporting to the ERP system. However, because most local offices joined as SBFC through acquisition, the local SPFC offices generally follow the processes for expenses and invoicing that the acquired company had been successfully using Prior to joining SPFC. Individual project managers are required to approve invoices before they are generated by the ERP system. However, because many projects span multiple countries and different systems are used for expense reporting, project managers currently do not have the capability of approving time and expenses before employees are reimbursed. Also, project managers must rely on the ERP system to track project time, which means there are often reporting delays because some local offices are not only timely or accurate when keying project data into the system. 1. Business Case (Project package): Create a business case using the PRINCE2 Business Case template provided. Call the project "TE Reporting System" project. TE stands for Time and Expense. 2. BCR, PP, NPV (Assignment package) a. Which project would you choose between: - Project A with a benefit of $200,000 and cost of $100,000 - Project B with a benefit of $300,000 and cost of $200,000 Please show all the calculation steps. b. What is the Payback Period when: - Initial investment =$300 - Year 1 cash inflow =$100 - Year 2 cash inflow =$130 - Year 3 cash inflow =5200 - Year 4 cash inflow = \$50 BCR, PP, NPV (Assignment package) a. Which project would you choose between: Project A with a benefit of $200,000 and cost of $100,000 - Project B with a benefit of $300,000 and cost of $200,000 Please show all the calculation steps. b. What is the Payback Period when: - Initial investment =$300 - Year 1 cash inflow =$100 - Year 2 cash inflow =$130 - Year 3 cash inflow =$200 - Year 4 cash inflow =$50 - Year 5 cash inflow =$340 Please show all the calculation steps. C. What is the Payback Period when the project cost is $500,000 and the annual net cash inflow is $50,000 ? Please show all the calculation steps. d. When the investment is $200,000 with a net inflow of $50,000 per year for a period of 8 years and the required rate of return is 15%, what is the NPV? Please show all the calculation steps

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts