Question: It is a financial modeling questionplease write whole process. = = 2. (30 points) The representative investor's utility function is given as follows: u(W) =

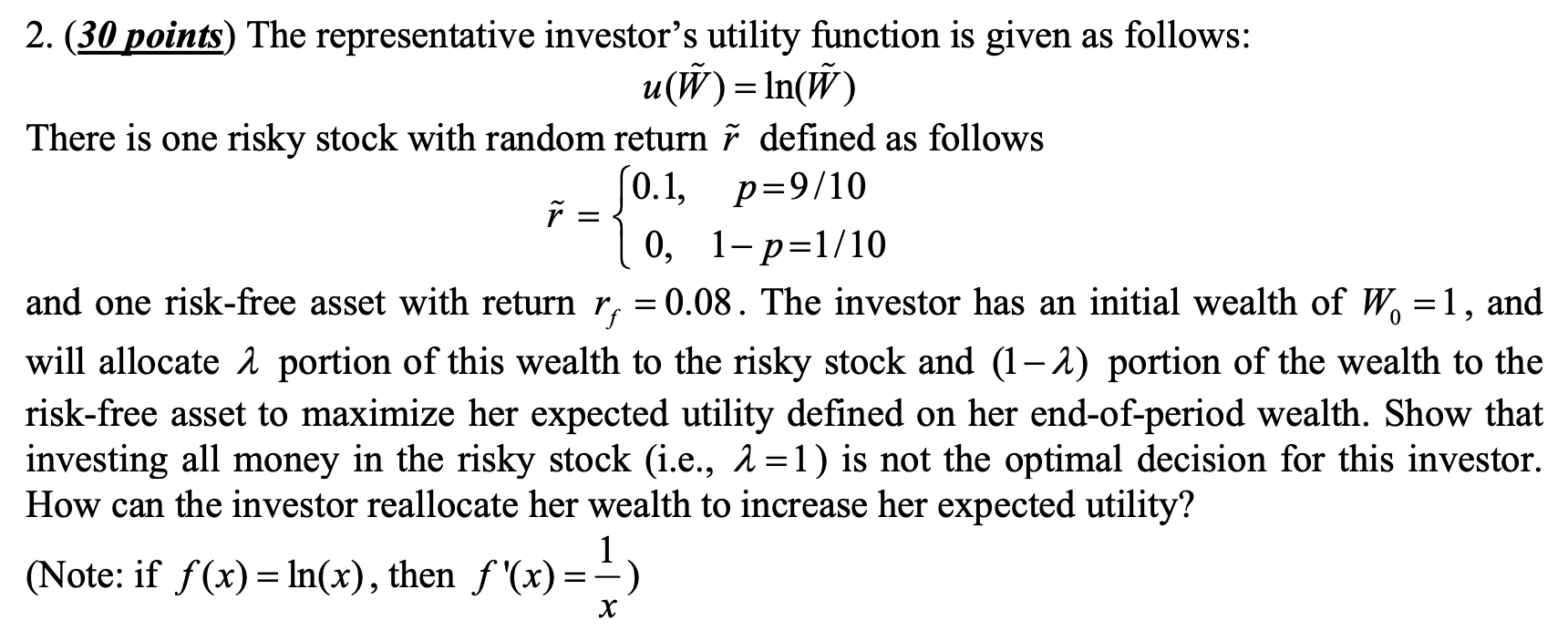

= = 2. (30 points) The representative investor's utility function is given as follows: u(W) = ln() There is one risky stock with random return defined as follows (0.1, p=9/10 0, 1-p=1/10 and one risk-free asset with return r; = 0.08. The investor has an initial wealth of W, =1, and will allocate a portion of this wealth to the risky stock and (1-2) portion of the wealth to the risk-free asset to maximize her expected utility defined on her end-of-period wealth. Show that investing all money in the risky stock (i.e., 1=1) is not the optimal decision for this investor. How can the investor reallocate her wealth to increase her expected utility? (Note: if f(x) = ln(x), then f '(x) - 0 = x)= ) = = 2. (30 points) The representative investor's utility function is given as follows: u(W) = ln() There is one risky stock with random return defined as follows (0.1, p=9/10 0, 1-p=1/10 and one risk-free asset with return r; = 0.08. The investor has an initial wealth of W, =1, and will allocate a portion of this wealth to the risky stock and (1-2) portion of the wealth to the risk-free asset to maximize her expected utility defined on her end-of-period wealth. Show that investing all money in the risky stock (i.e., 1=1) is not the optimal decision for this investor. How can the investor reallocate her wealth to increase her expected utility? (Note: if f(x) = ln(x), then f '(x) - 0 = x)= )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts