Question: It is a very basic accounting MCQ, please solve this Team Chegg its urgent 13. Prior to the financial year end of 31 July 2020,

It is a very basic accounting MCQ, please solve this Team Chegg its urgent

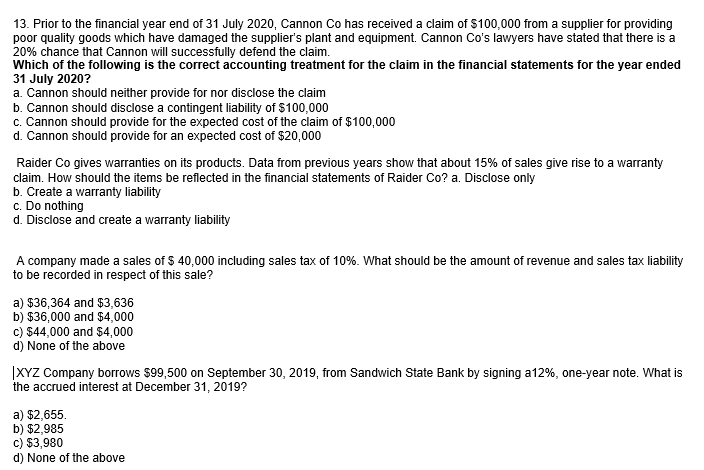

13. Prior to the financial year end of 31 July 2020, Cannon Co has received a claim of $100,000 from a supplier for providing poor quality goods which have damaged the supplier's plant and equipment. Cannon Co's lawyers have stated that there is a 20% chance that Cannon will successfully defend the claim. Which of the following is the correct accounting treatment for the claim in the financial statements for the year ended 31 July 2020? a. Cannon should neither provide for nor disclose the claim b. Cannon should disclose a contingent liability of $100,000 c. Cannon should provide for the expected cost of the claim of $100,000 d. Cannon should provide for an expected cost of $20,000 Raider Co gives warranties on its products. Data from previous years show that about 15% of sales give rise to a warranty claim. How should the items be reflected in the financial statements of Raider Co? a. Disclose only b. Create a warranty liability c. Do nothing d. Disclose and create a warranty liability A company made a sales of $ 40,000 including sales tax of 10%. What should be the amount of revenue and sales tax liability to be recorded in respect of this sale? a) $36,364 and $3,636 b) $36,000 and $4,000 c) $44,000 and $4,000 d) None of the above |XYZ Company borrows $99,500 on September 30, 2019, from Sandwich State Bank by signing a12%, one-year note. What is the accrued interest at December 31, 2019? a) $2,655. b) $2,985 c) $3,980 d) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts