Question: it is financed with 37.75 debt not 40 please consider Concord Corporation has an equity cost of capital of 15.4% and a debt cost of

it is financed with 37.75 debt not 40 please consider

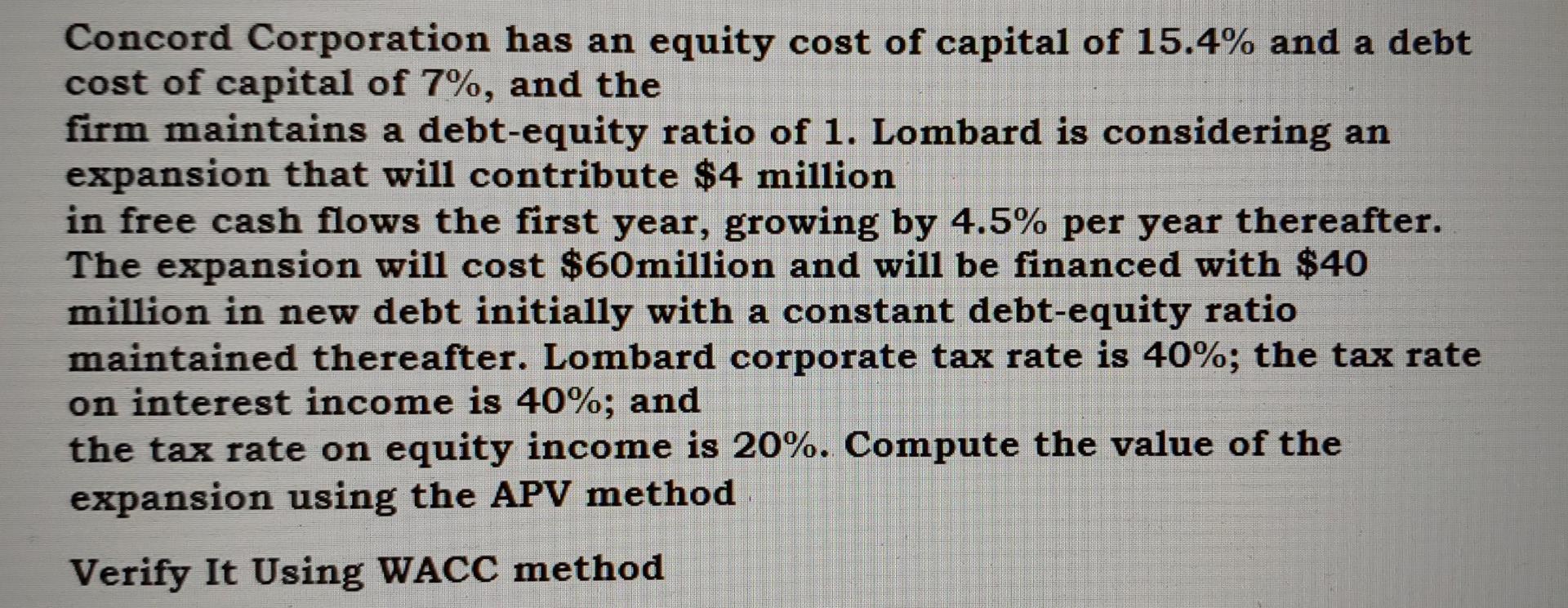

Concord Corporation has an equity cost of capital of 15.4% and a debt cost of capital of 7%, and the firm maintains a debt-equity ratio of 1. Lombard is considering an expansion that will contribute $4 million in free cash flows the first year, growing by 4.5% per year thereafter. The expansion will cost $60million and will be financed with $40 million in new debt initially with a constant debt-equity ratio maintained thereafter. Lombard corporate tax rate is 40%; the tax rate on interest income is 40%; and the tax rate on equity income is 20%. Compute the value of the expansion using the APV method Verify It Using WACC method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts