Question: Question 4 (15 points). A manager is trying to evaluate the economics of purchasing or leasing a mineral processing plant. It may be purchased and

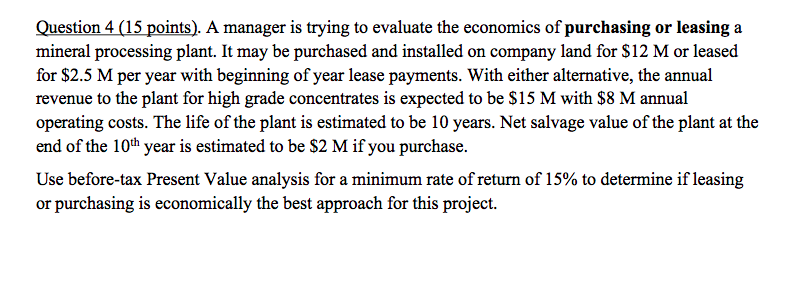

Question 4 (15 points). A manager is trying to evaluate the economics of purchasing or leasing a mineral processing plant. It may be purchased and installed on company land for $12 M or leased for $2.5 M per year with beginning of year lease payments. With either alternative, the annual revenue to the plant for high grade concentrates is expected to be $15 M with $8 M annual operating costs. The life of the plant is estimated to be 10 years. Net salvage value of the plant at the end of the 10th year is estimated to be $2 M if you purchase. Use before-tax Present Value analysis for a minimum rate of return of 15% to determine if leasing or purchasing is economically the best approach for this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts