Question: It is important to take into account the historical developments on the US market where the share of passive investment has increased dramatically - passive

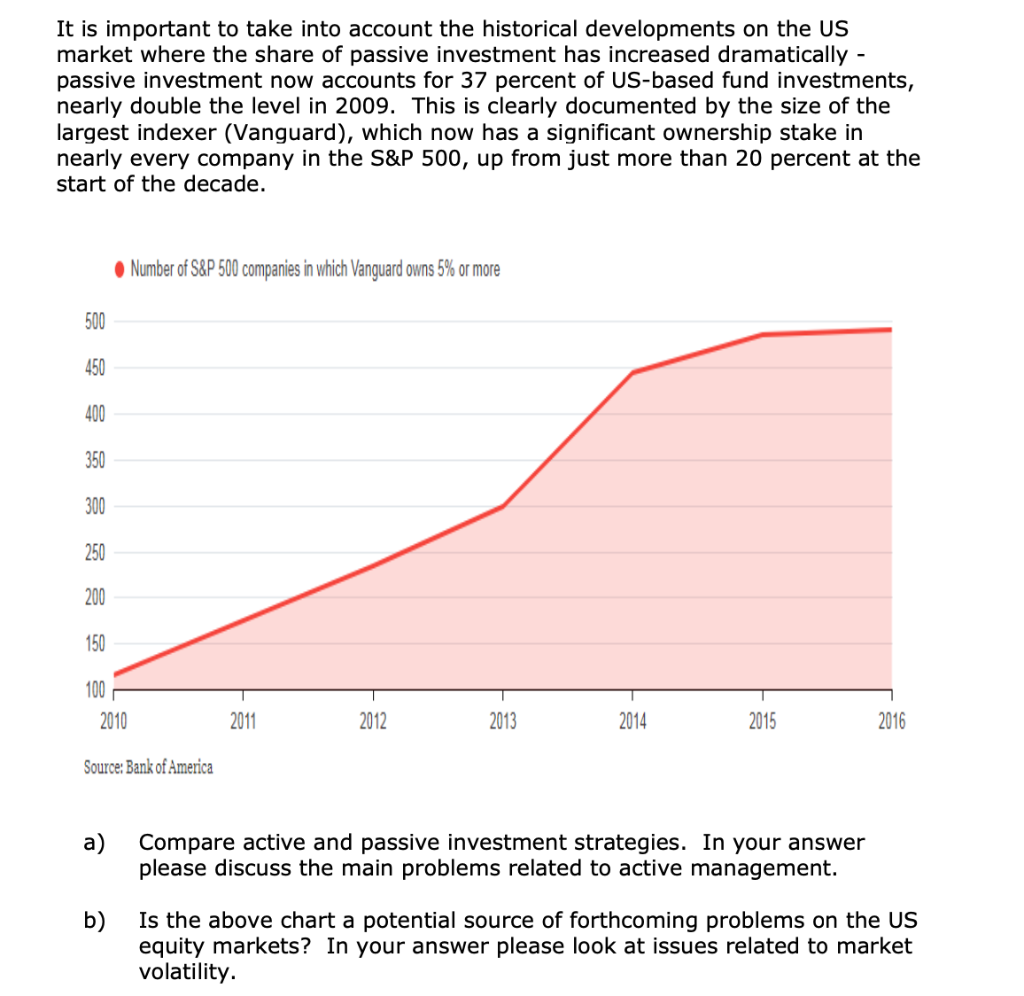

It is important to take into account the historical developments on the US market where the share of passive investment has increased dramatically - passive investment now accounts for 37 percent of US-based fund investments, nearly double the level in 2009. This is clearly documented by the size of the largest indexer (Vanguard), which now has a significant ownership stake in nearly every company in the S&P 500, up from just more than 20 percent at the start of the decade. Number of S&P 500 companies in which Vanguard owns 5% or more 500 450 400 350 300 250 200 150 1 100 2010 2011 1 2012 2013 2014 2015 2016 Source: Bank of America a) Compare active and passive investment strategies. In your answer please discuss the main problems related to active management. b) Is the above chart a potential source of forthcoming problems on the US equity markets? In your answer please look at issues related to market volatility

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts