Question: It is one question but multiple parts Problem 1 & 30-32 when the risk free rate is 0.4%, and the return on the market is

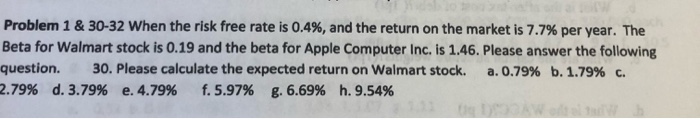

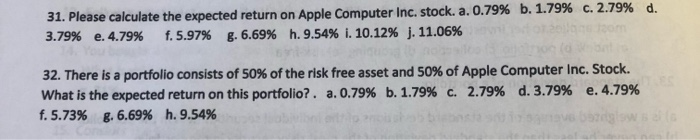

Problem 1 & 30-32 when the risk free rate is 0.4%, and the return on the market is 7.7% per year. The Beta for Walmart stock is 0.19 and the beta for Apple Computer Inc. is 1.46. Please answer the following question. 30. Please calculate the expected return on walmart stock. a. 0.79% b. 1.79% c. 2.79% d. 3.79% e. 4.79% f. 5.97% g. 6.69% h. 9.54% 31. Please calculate the expected return on Apple Computer Inc. stock. a. 0.79% b. 1.79% 3.79% e. 4.79% f. 5.97% g. 6.69% h. 9.54% i. 10.12% j. 11.06% c. 2 .79% d. 32 There is a portfolio consists of 50% of the risk free asset and 50% of Apple Computer Inc. Stock. What is the expected return on this portfolio? . a. 0.79% b. 1.79% c. 2.79% d. 3.79% e. 4.79% f. 5.73% g, 6.69% h. 9.54%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts