Question: One question with multiple parts Problem 12-7 in the concise 5th edition, or problem 12-8 in the concise 6th or concise 7th edition. If you

One question with multiple parts

One question with multiple parts

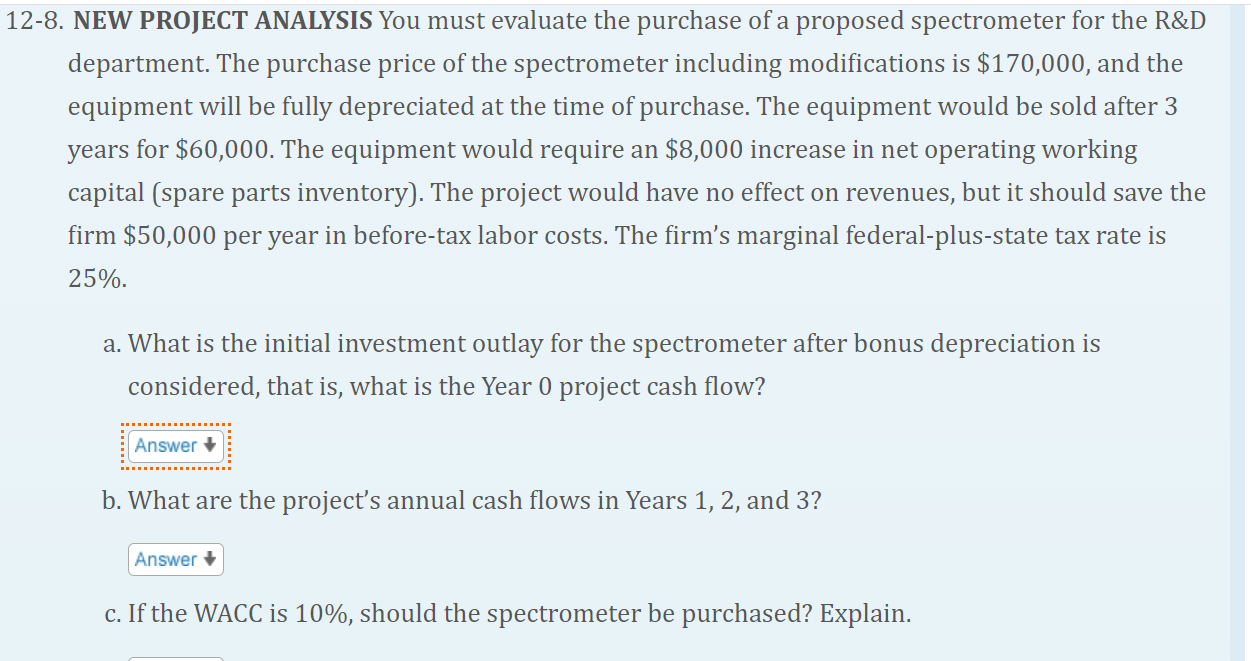

Problem 12-7 in the concise 5th edition, or problem 12-8 in the concise 6th or concise 7th edition. If you use an eBook edition other than one of the editions mentioned, request the problem from the professor via email. In the concise 5th edition, omit part d of the problem and provide the total annual cash flows for each year as your answer to part c. If you use the concise 6th or concise 7th edition, complete all parts of the problem. Feel free to use Excel. Attach a screenshot or digital printout of your work. 12-8. NEW PROJECT ANALYSIS You must evaluate the purchase of a proposed spectrometer for the R&D department. The purchase price of the spectrometer including modifications is $170,000, and the equipment will be fully depreciated at the time of purchase. The equipment would be sold after 3 years for $60,000. The equipment would require an $8,000 increase in net operating working capital (spare parts inventory). The project would have no effect on revenues, but it should save the firm $50,000 per year in before-tax labor costs. The firm's marginal federal-plus-state tax rate is 25%. a. What is the initial investment outlay for the spectrometer after bonus depreciation is considered, that is, what is the Year 0 project cash flow? Answer b. What are the project's annual cash flows in Years 1, 2, and 3? Answer + c. If the WACC is 10%, should the spectrometer be purchased? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts