Question: It says, Answer is not complete. What am I not doing? What steps have I skipped? Can you show me what must I do next

It says, "Answer is not complete." What am I not doing? What steps have I skipped? Can you show me what must I do next to complete the answers above? Can you show me the step by step work as what I must do next, please? Thank you very much!

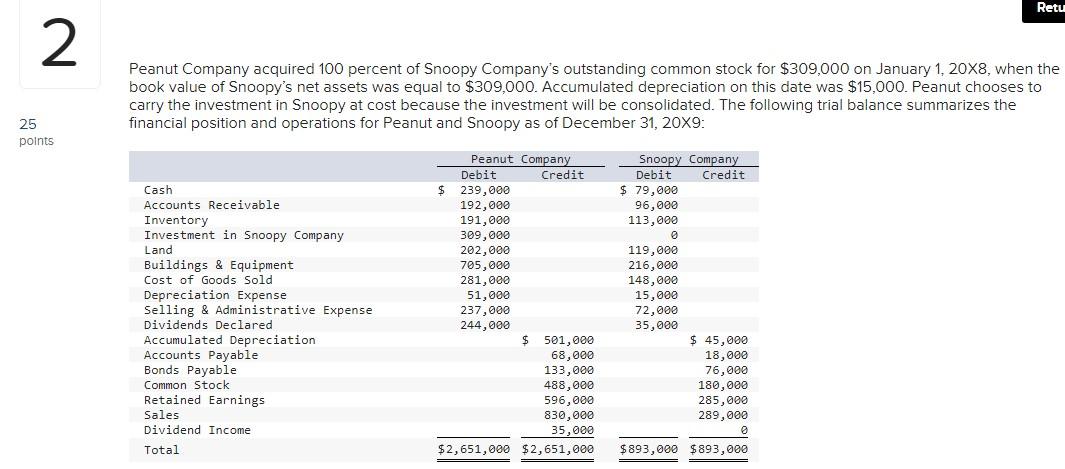

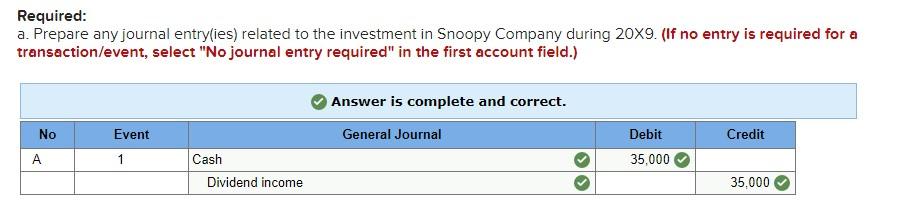

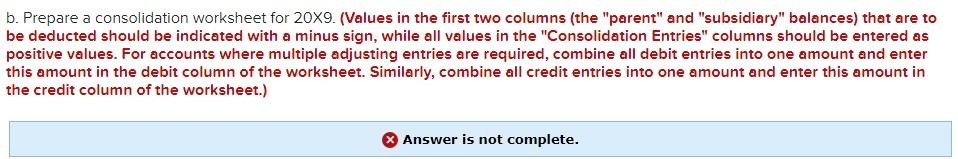

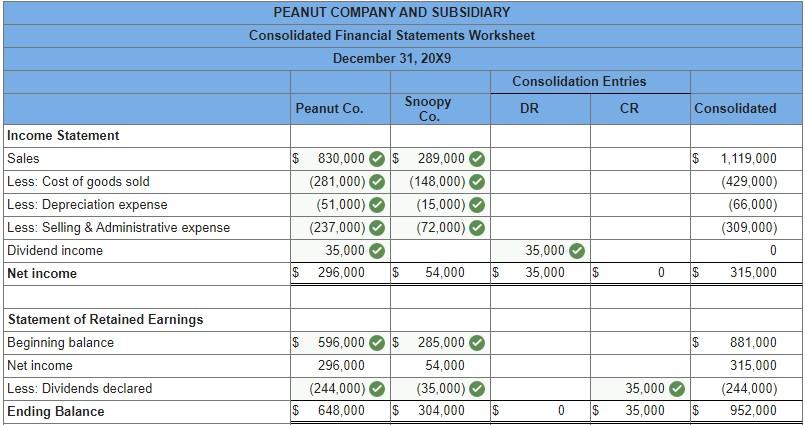

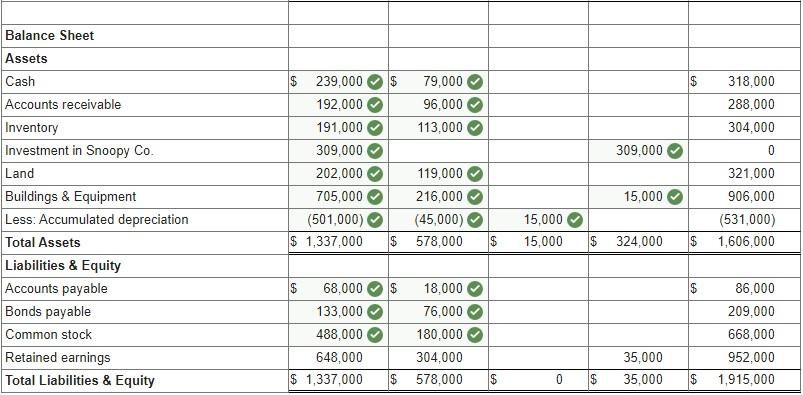

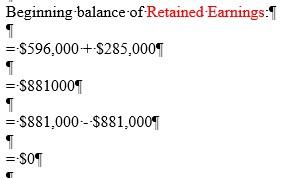

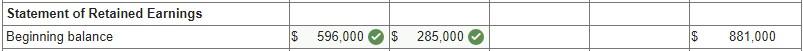

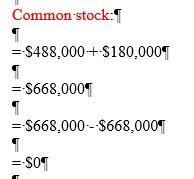

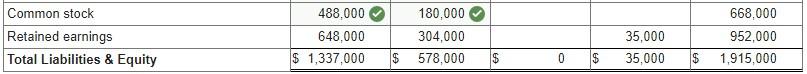

Retu 2 Peanut Company acquired 100 percent of Snoopy Company's outstanding common stock for $309,000 on January 1, 20X8, when the book value of Snoopy's net assets was equal to $309,000. Accumulated depreciation on this date was $15,000. Peanut chooses to carry the investment in Snoopy at cost because the investment will be consolidated. The following trial balance summarizes the financial position and operations for Peanut and Snoopy as of December 31, 20X9: 25 points Cash Accounts Receivable Inventory Investment in Snoopy Company Land Buildings & Equipment Cost of Goods Sold Depreciation Expense Selling & Administrative Expense Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Common Stock Retained Earnings Sales Dividend Income Total Peanut Company Debit Credit $ 239,000 192,000 191,000 309,000 202,000 705,000 281,000 51,000 237,000 244,000 $ 501,000 68,000 133,000 488,000 596,000 830,000 35,000 $2,651,000 $2,651,000 Snoopy Company Debit Credit $ 79,000 96,000 113,000 0 119,000 216,000 148,000 15,000 72,000 35,000 $ 45,000 18,000 76,000 180,000 285,000 289,000 $893,000 $893,000 Required: a. Prepare any journal entry(ies) related to the investment in Snoopy Company during 20X9. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is complete and correct. No Event General Journal Credit Debit 35,000 A 1 Cash Dividend income 35.000 b. Prepare a consolidation worksheet for 20X9. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.) Answer is not complete. PEANUT COMPANY AND SUBSIDIARY Consolidated Financial Statements Worksheet December 31, 20x9 Consolidation Entries Snoopy Peanut Co. DR CR Co. Consolidated $ Income Statement Sales Less: Cost of goods sold Less: Depreciation expense Less: Selling & Administrative expense Dividend income Net income $ 830,000 (281,000) (51,000) (237,000) 35,000 $ 296,000 $ 289,000 (148,000) (15,000) (72,000) 1,119,000 (429,000) (66,000) (309,000) 0 315.000 35,000 35,000 $ 54,000 $ 0 $ $ Statement of Retained Earnings Beginning balance Net income Less: Dividends declared Ending Balance $ 596,000 296,000 (244,000) $ 648,000 $ 285.000 54,000 (35,000) $ 304,000 881,000 315,000 (244,000) 952,000 35,000 35,000 0 $ $ 79,000 96,000 113,000 309,000 Balance Sheet Assets Cash Accounts receivable Inventory Investment in Snoopy Co. Land Buildings & Equipment Less: Accumulated depreciation Total Assets Liabilities & Equity Accounts payable Bonds payable Common stock Retained earnings Total Liabilities & Equity $ 239,000 192,000 191,000 309,000 202,000 705,000 (501,000) $ 1,337,000 318,000 288,000 304,000 0 321,000 906,000 (531,000) 1,606,000 15,000 119,000 216,000 (45,000) $ 578,000 15,000 15,000 $ $ 324,000 $ $ $ 68,000 133,000 488,000 648,000 $ 1,337,000 18,000 76,000 180,000 304,000 578,000 86,000 209,000 668,000 952,000 1,915,000 35,000 35,000 $ $ 0 $ $ Beginning balance of Retained-Earnings: =-$596,000+ $285.000 1 =-58810001 =-$881,000-$881,000 =-SOT Statement of Retained Earnings Beginning balance $ 596,000 285,000 $ 881,000 Common stock: 1 =-$488,000+ $180,000 =-S668.0001 =-5668,000-$668,000 --SOS Common stock Retained earnings Total Liabilities & Equity 488,000 648,000 $ 1,337,000 180,000 304,000 $ 578,000 35,000 35,000 668,000 952,000 1,915,000 $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts