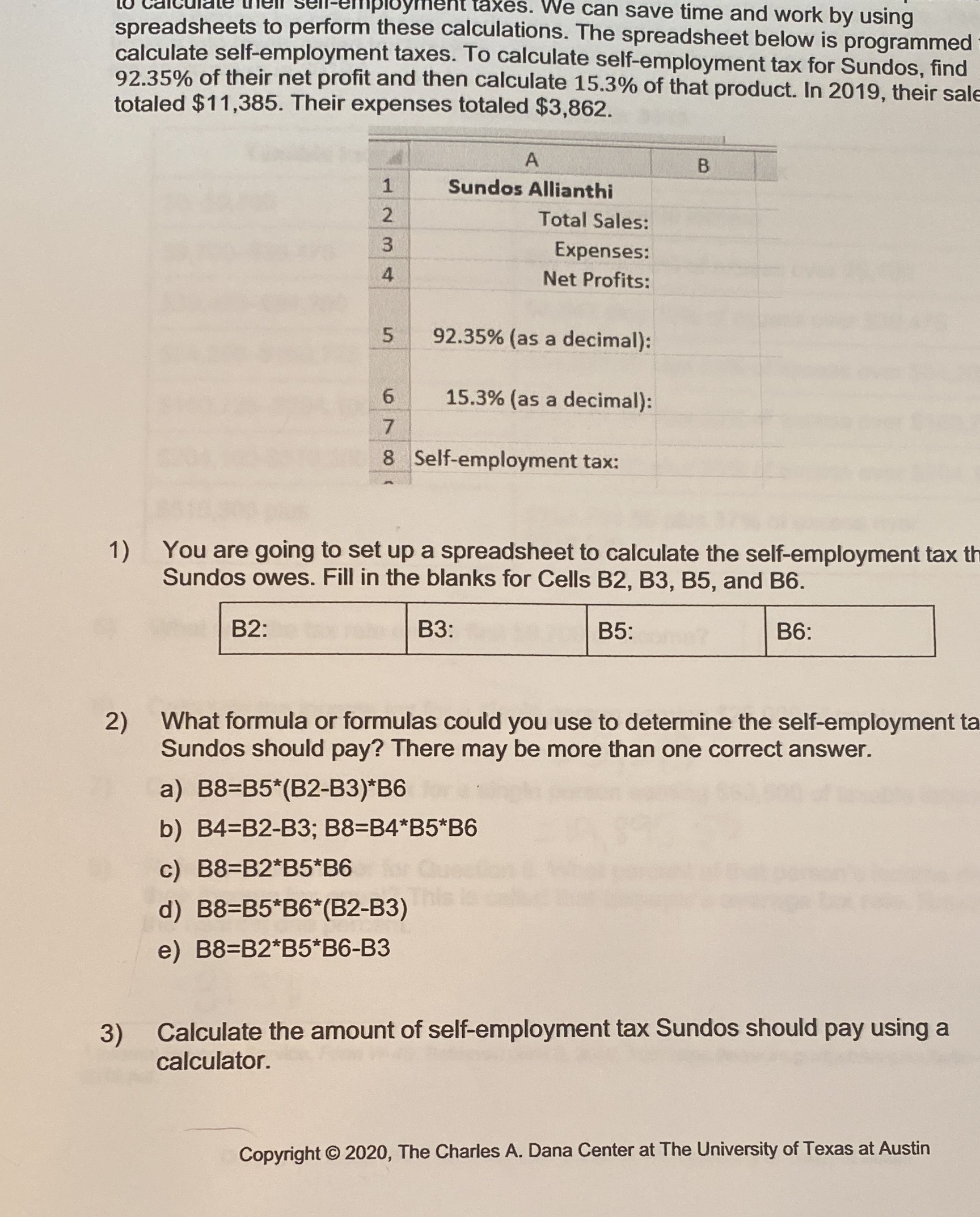

Question: it taxes. We can save time and work by using spreadsheets to perform these calculations. The spreadsheet below is programmed calculate self-employment taxes. To calculate

it taxes. We can save time and work by using spreadsheets to perform these calculations. The spreadsheet below is programmed calculate self-employment taxes. To calculate self-employment tax for Sundos, find 92.35% of their net profit and then calculate 15.3% of that product. In 2019, their sale totaled $11,385. Their expenses totaled $3,862. A B Sundos Allianthi 2 Total Sales: 3 Expenses: Net Profits: 5 92.35% (as a decimal): 6 15.3% (as a decimal): 7 8 Self-employment tax: 1) You are going to set up a spreadsheet to calculate the self-employment tax th Sundos owes. Fill in the blanks for Cells B2, B3, B5, and B6. B2: B3: B5: B6: 2) What formula or formulas could you use to determine the self-employment ta Sundos should pay? There may be more than one correct answer. a) B8=B5*(B2-B3)*B6 b) B4=B2-B3; B8=B4*B5*B6 C) B8=B2*B5*B6 d) B8=B5*B6*(B2-B3) e) B8=B2*B5*B6-B3 3) Calculate the amount of self-employment tax Sundos should pay using a calculator. Copyright @ 2020, The Charles A. Dana Center at The University of Texas at Austin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts