Question: itciation on Machine B reports the highest BCiation expense in year 1 (2017)? The highest amount in year 4 (2020) amount of dep e highest

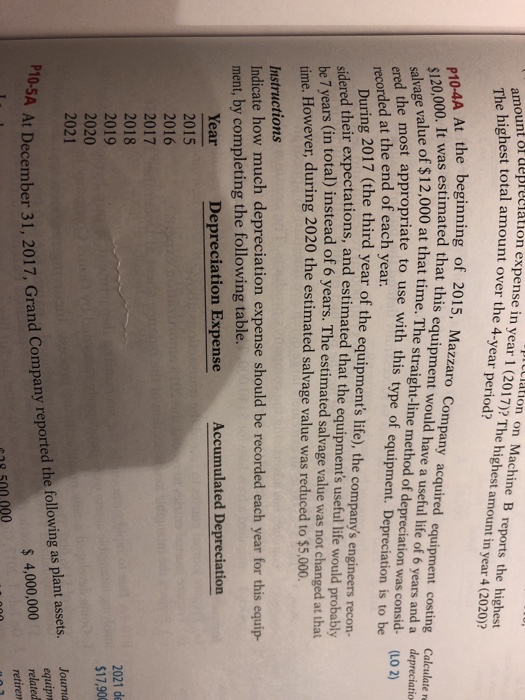

itciation on Machine B reports the highest BCiation expense in year 1 (2017)? The highest amount in year 4 (2020) amount of dep e highest total amount over the 4-year period? the beginning of 2015, Mazzaro Company acquired equipment costing Calculaten was estimated that this equipment would have a useful life of 6 years and a depreciatio $12,000 at that time. The straight-line method of depreciation was consid- (LO 2) P10-4A At most appropriate to use with this type of equipment. Depreciation is to be ered the recorded at the end of each year 2017 (the third year of the equipment's life), the company's engineers recon- their expectations, and estimated that the equipment's useful life would probably 7 years (in total) instead of 6 years. The estimated salvage value was not changed at that During er, during 2020 the estimated salvage value was reduced to $5,000. time. Howev Instructions ment, by completing the following table. Indicate how much depreciation expense should be recorded each year for this equip- Depreciation Expense Accumulated Depreciation Year 2015 2016 2017 2018 2019 2020 2021 2021 de $17,900 At December 31, 2017, Grand Company reported the following as plant assets. Jouma $4,000,000equip P1 related retiren sao 500 000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts