Question: Item 1 3 7 . 7 2 points Return to question Item 1 3 Palermo Incorporated purchased 8 0 percent of the outstanding stock of

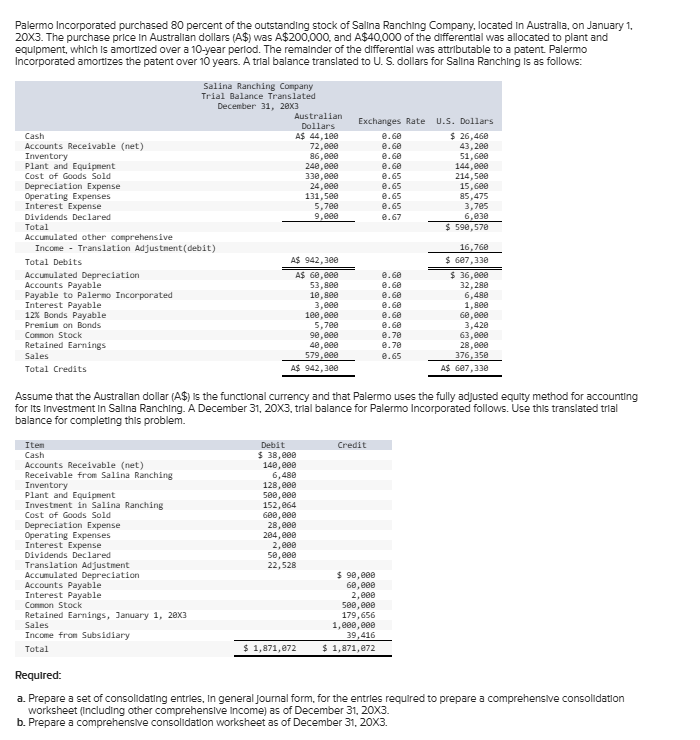

Itempoints Return to question Item Palermo Incorporated purchased percent of the outstanding stock of Salina Ranching Company, located in Australia, on January X The purchase price in Australian dollars A$ was A$ and A$ of the differential was allocated to plant and equipment, which is amortized over a year period. The remainder of the differential was attributable to a patent. Palermo Incorporated amortizes the patent over years. A trial balance translated to U S dollars for Salina Ranching is as follows: Salina Ranching CompanyTrial Balance TranslatedDecember XAustralian DollarsExchanges RateU.S DollarsCashA$ $ Accounts Receivable netInventoryPlant and EquipmentCost of Goods SoldDepreciation ExpenseOperating ExpensesInterest ExpenseDividends DeclaredTotal$ Accumulated other comprehensiveIncome Translation AdjustmentdebitTotal DebitsA$ $ Accumulated DepreciationA$ $ Accounts PayablePayable to Palermo IncorporatedInterest Payable Bonds PayablePremium on BondsCommon StockRetained EarningsSalesTotal CreditsA$ A$ Assume that the Australian dollar A$ is the functional currency and that Palermo uses the fully adjusted equity method for accounting for its investment in Salina Ranching. A December X trial balance for Palermo Incorporated follows. Use this translated trial balance for completing this problem. ItemDebitCreditCash$ Accounts Receivable netReceivable from Salina RanchingInventoryPlant and EquipmentInvestment in Salina RanchingCost of Goods SoldDepreciation ExpenseOperating ExpensesInterest ExpenseDividends DeclaredTranslation AdjustmentAccumulated Depreciation$ Accounts PayableInterest PayableCommon StockRetained Earnings, January XSalesIncome from SubsidiaryTotal$ $ Required: Prepare a set of consolidating entries, in general journal form, for the entries required to prepare a comprehensive consolidation worksheet including other comprehensive income as of December X Prepare a comprehensive consolidation worksheet as of December Xrepare a set of consolidating entries, in general journal form, for the entries required to prepare a comprehensive zonsolidation worksheet including other comprehensive income as of December times

vote: If no entry is required for a transactionevent select No journal entry required" in the first account field.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock