ITG Pte Ltd (ITG) is a company specialising in air-conditioner maintenance and servicing. It makes adjusting...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

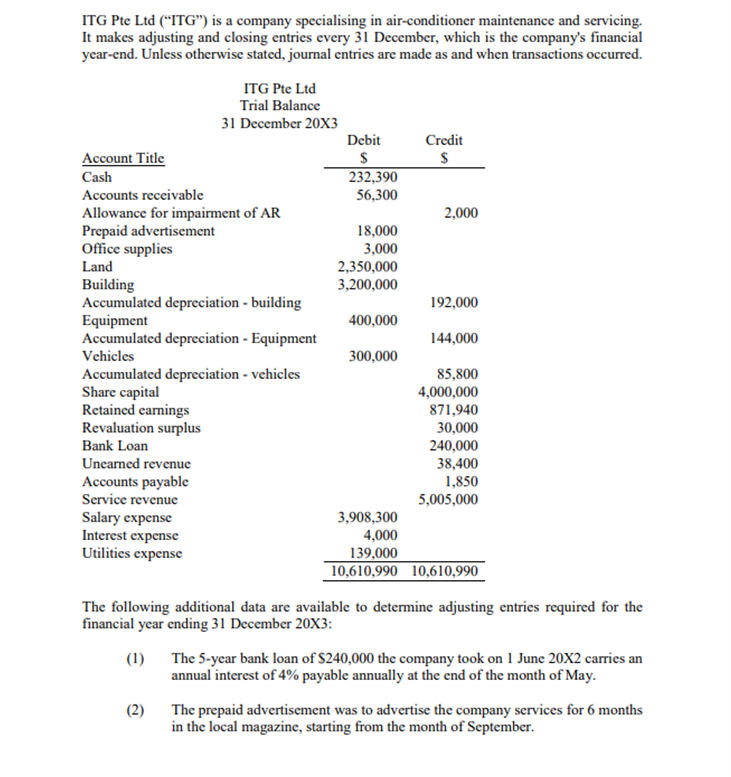

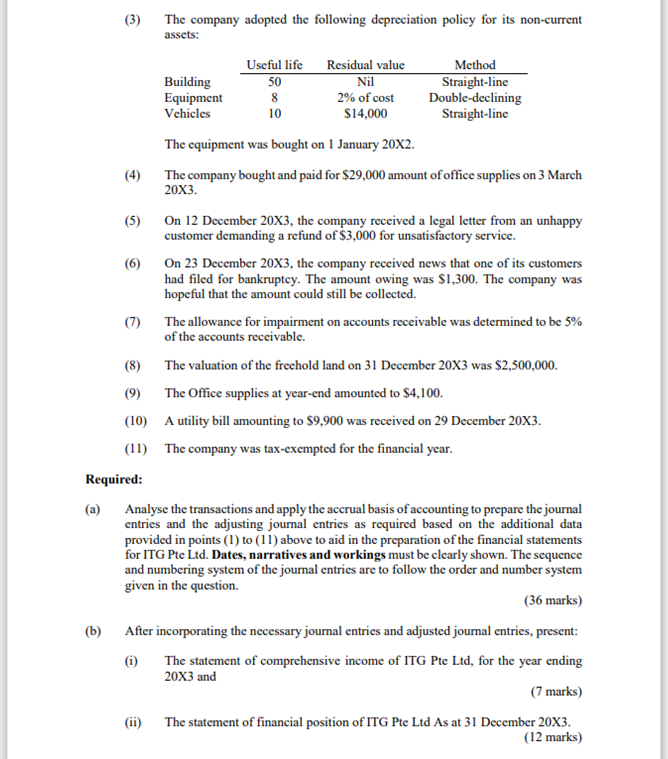

ITG Pte Ltd ("ITG") is a company specialising in air-conditioner maintenance and servicing. It makes adjusting and closing entries every 31 December, which is the company's financial year-end. Unless otherwise stated, journal entries are made as and when transactions occurred. ITG Pte Ltd Trial Balance 31 December 20X3 Debit Credit Account Title $ $ Cash 232,390 Accounts receivable 56,300 Allowance for impairment of AR 2,000 Prepaid advertisement 18,000 Office supplies 3,000 Land 2,350,000 Building 3,200,000 Accumulated depreciation - building 192,000 Equipment 400,000 Accumulated depreciation - Equipment 144,000 Vehicles 300,000 Accumulated depreciation - vehicles 85,800 Share capital 4,000,000 Retained earnings 871,940 Revaluation surplus Bank Loan Unearned revenue 30,000 240,000 38,400 Accounts payable Service revenue Salary expense Interest expense Utilities expense 1,850 5,005,000 3,908,300 4,000 139,000 10,610,990 10,610,990 The following additional data are available to determine adjusting entries required for the financial year ending 31 December 20X3: (1) The 5-year bank loan of $240,000 the company took on 1 June 20X2 carries an annual interest of 4% payable annually at the end of the month of May. (2) The prepaid advertisement was to advertise the company services for 6 months in the local magazine, starting from the month of September. (3) The company adopted the following depreciation policy for its non-current assets: Useful life Building Equipment Vehicles 50 8 10 Residual value Nil 2% of cost $14,000 Method Straight-line Double-declining Straight-line (4) (5) (6) (7) The equipment was bought on 1 January 20X2. The company bought and paid for $29,000 amount of office supplies on 3 March 20X3. On 12 December 20X3, the company received a legal letter from an unhappy customer demanding a refund of $3,000 for unsatisfactory service. On 23 December 20X3, the company received news that one of its customers had filed for bankruptcy. The amount owing was $1,300. The company was hopeful that the amount could still be collected. The allowance for impairment on accounts receivable was determined to be 5% of the accounts receivable. (8) The valuation of the freehold land on 31 December 20X3 was $2,500,000. (9) (10) The Office supplies at year-end amounted to $4,100. A utility bill amounting to $9,900 was received on 29 December 20X3. (11) The company was tax-exempted for the financial year. Required: (a) (b) Analyse the transactions and apply the accrual basis of accounting to prepare the journal entries and the adjusting journal entries as required based on the additional data provided in points (1) to (11) above to aid in the preparation of the financial statements for ITG Pte Ltd. Dates, narratives and workings must be clearly shown. The sequence and numbering system of the journal entries are to follow the order and number system given in the question. (36 marks) After incorporating the necessary journal entries and adjusted journal entries, present: (i) The statement of comprehensive income of ITG Pte Ltd, for the year ending 20X3 and (ii) (7 marks) The statement of financial position of ITG Pte Ltd As at 31 December 20X3. (12 marks) ITG Pte Ltd ("ITG") is a company specialising in air-conditioner maintenance and servicing. It makes adjusting and closing entries every 31 December, which is the company's financial year-end. Unless otherwise stated, journal entries are made as and when transactions occurred. ITG Pte Ltd Trial Balance 31 December 20X3 Debit Credit Account Title $ $ Cash 232,390 Accounts receivable 56,300 Allowance for impairment of AR 2,000 Prepaid advertisement 18,000 Office supplies 3,000 Land 2,350,000 Building 3,200,000 Accumulated depreciation - building 192,000 Equipment 400,000 Accumulated depreciation - Equipment 144,000 Vehicles 300,000 Accumulated depreciation - vehicles 85,800 Share capital 4,000,000 Retained earnings 871,940 Revaluation surplus Bank Loan Unearned revenue 30,000 240,000 38,400 Accounts payable Service revenue Salary expense Interest expense Utilities expense 1,850 5,005,000 3,908,300 4,000 139,000 10,610,990 10,610,990 The following additional data are available to determine adjusting entries required for the financial year ending 31 December 20X3: (1) The 5-year bank loan of $240,000 the company took on 1 June 20X2 carries an annual interest of 4% payable annually at the end of the month of May. (2) The prepaid advertisement was to advertise the company services for 6 months in the local magazine, starting from the month of September. (3) The company adopted the following depreciation policy for its non-current assets: Useful life Building Equipment Vehicles 50 8 10 Residual value Nil 2% of cost $14,000 Method Straight-line Double-declining Straight-line (4) (5) (6) (7) The equipment was bought on 1 January 20X2. The company bought and paid for $29,000 amount of office supplies on 3 March 20X3. On 12 December 20X3, the company received a legal letter from an unhappy customer demanding a refund of $3,000 for unsatisfactory service. On 23 December 20X3, the company received news that one of its customers had filed for bankruptcy. The amount owing was $1,300. The company was hopeful that the amount could still be collected. The allowance for impairment on accounts receivable was determined to be 5% of the accounts receivable. (8) The valuation of the freehold land on 31 December 20X3 was $2,500,000. (9) (10) The Office supplies at year-end amounted to $4,100. A utility bill amounting to $9,900 was received on 29 December 20X3. (11) The company was tax-exempted for the financial year. Required: (a) (b) Analyse the transactions and apply the accrual basis of accounting to prepare the journal entries and the adjusting journal entries as required based on the additional data provided in points (1) to (11) above to aid in the preparation of the financial statements for ITG Pte Ltd. Dates, narratives and workings must be clearly shown. The sequence and numbering system of the journal entries are to follow the order and number system given in the question. (36 marks) After incorporating the necessary journal entries and adjusted journal entries, present: (i) The statement of comprehensive income of ITG Pte Ltd, for the year ending 20X3 and (ii) (7 marks) The statement of financial position of ITG Pte Ltd As at 31 December 20X3. (12 marks)

Expert Answer:

Related Book For

Frank Woods Business Accounting Volume 1

ISBN: 9781292084664

13th Edition

Authors: Alan Sangster, Frank Wood

Posted Date:

Students also viewed these finance questions

-

Strategies used to hedge against the foreign exchange between the currencies of different countries and the commodity prices' volatility. Assess how derivatives can be used in such a situation and...

-

The arc length of a segment of a parabola ABC is given by: Determine if and. B h A \C a a

-

Have you ever had to cope with the loss of a loved one? If so, what concepts described in this section provide context that may help you understand your experience and process of grieving?

-

Apartments in New York City are often hard to find. One of the major reasons is rent control. (Difficult) a. Demonstrate graphically how rent controls could make apartments hard to find. b. Often one...

-

Sandy Bond, a recent business school graduate who had recently been employed by Huron Automotive Company, was asked by Huron's president to review the company's present cost accounting procedures. In...

-

An auditor is conducting an examination of the financial statements of a wholesale appliance distributor. The distributor supplies appliances to hundreds of individual customirs in th: metropolitan...

-

Overall, Steve Edwards, vice president of Marketing at Ditten hoefer's Fine China, is very pleased with the success of his new line of Gem-Surface china plates. Gem-Surface plates are different from...

-

Once you have completed the Excel template, review the Excel data results and written analysis of the following ratios for 2018: Working Capital Current Ratio Quick Ratio Gross Profit % Net Profit %...

-

Summer Sports, Inc. sells two types of tracksuits, the Casual model and the Professional model. The following segmented contribution margin statement shows the results of the most recent period....

-

Jerry is the owner of a local market. He sells a variety of food items, hardware, and liquor. He has four full time employees, Jerry is a very friendly guy. He is always joking with his employees,...

-

Design a project of your own choice and show the following contents thereof 1. Name or identity of your project (1 Marks) 2. Support your project by clearly defining the concepts 'project' and...

-

If there is a serious mishap at a worksite, who in particular must be notified under the federal or state requirements? 1. What do we do about OSHA reporting requirements in a state with a federally...

-

"Municipalities in South Africa are faced with a serious challenge of service delivery. It is argued that in some instances this emanates from poor talent management strategies that fail to retain...

-

Brothers Flooring Two brothers, Ali and Abbas Hamdouni have started a flooring business installing tiles, laminate and hardwood floors in residential units. From their start they have been very keen...

-

Rhetorical analysis, according to professionals, in a scholarly or trade publication. (an article from a general interest or news publication will not work, because it will be written for everyone,...

-

What did Lennox gain by integrating their WMS, TMS, and labor management systems?

-

A dynamic absorber is to be designed to eliminate the vibration at coordinate \(x_{1}\) for the system shown in Fig. P5.6, where the excitation frequency is \(400 \mathrm{rad} / \mathrm{s}\) and the...

-

After installation, it was found that a particular machine exhibited excessive vibration due to a harmonic excitation force with a frequency of \(100 \mathrm{~Hz}\). A dynamic absorber was designed...

-

Given the eigenvalues and eigenvectors for the two degree of freedom system shown in Fig. P5.9, complete the following. \[\begin{array}{ll} s_{1}^{2}=-1 \times 10^{6} \mathrm{rad} / \mathrm{s}^{2} &...

Study smarter with the SolutionInn App