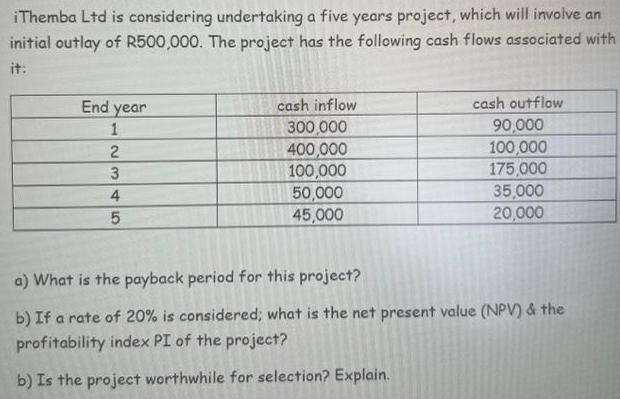

Question: iThemba Ltd is considering undertaking a five years project, which will involve an initial outlay of R500,000. The project has the following cash flows

iThemba Ltd is considering undertaking a five years project, which will involve an initial outlay of R500,000. The project has the following cash flows associated with it: End year 1 2 3 4 5 cash inflow 300,000 400,000 100,000 50,000 45,000 cash outflow 90,000 100,000 175,000 35,000 20,000 a) What is the payback period for this project? b) If a rate of 20% is considered; what is the net present value (NPV) & the profitability index PI of the project? b) Is the project worthwhile for selection? Explain.

Step by Step Solution

There are 3 Steps involved in it

Lets calculate the payback period net present value NPV profitability index PI and determine whether the project is worthwhile for selection based on ... View full answer

Get step-by-step solutions from verified subject matter experts