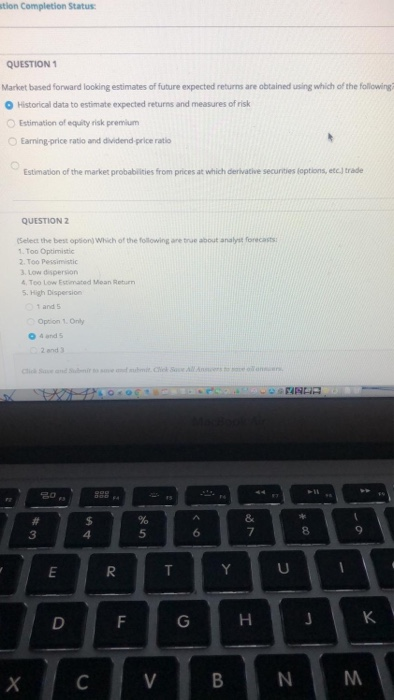

Question: ition Completion Status: QUESTION 1 Mart based forward looking estimates of future expected returns are obtained using which of the followi Historical data to estimate

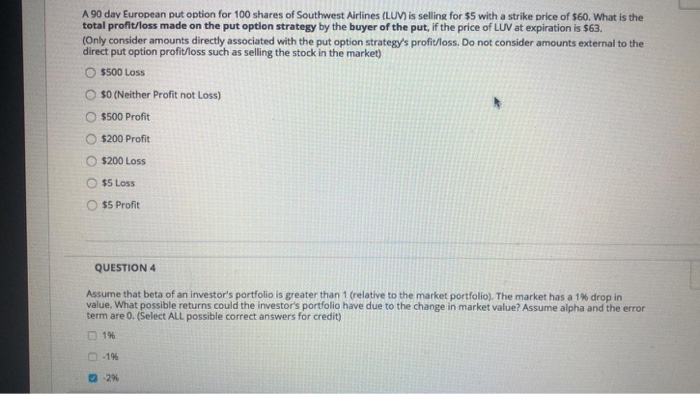

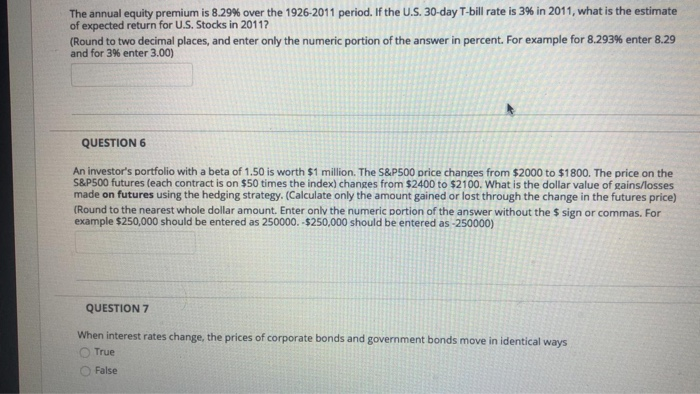

ition Completion Status: QUESTION 1 Mart based forward looking estimates of future expected returns are obtained using which of the followi Historical data to estimate expected returns and measures of risk Estimation of equity risk premium Earning price rate and dividend price ratio Estimation of the market probabilities from prices at which derivative securities options, tetrade QUESTION 2 (Select the best opson) Which of the following are true about analyst forecasts 1. Too Optime 2. Too Pessimistic 3. Low dipersion Tooted Vanem 5. High Dispersion Oy A 90 day European put option for 100 shares of Southwest Airlines (LUM is selling for $5 with a strike price of $60. What is the total profit/loss made on the put option strategy by the buyer of the put, if the price of LUV at expiration is 563. (Only consider amounts directly associated with the put option strategy's profit/loss. Do not consider amounts external to the direct put option profit/loss such as selling the stock in the market) $500 Loss $0 (Neither Profit not Loss) $500 Profit $200 Profit $200 Loss $5 Loss $5 Profit QUESTION 4 Assume that beta of an investor's portfolio is greater than 1 (relative to the market portfolio). The market has a 1% drop in value. What possible returns could the investor's portfolio have due to the change in market value? Assume alpha and the error term are 0. (Select ALL possible correct answers for credit) 1% -1% 2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts