Question: QUESTION 9 Market based forward looking estimates of future expected returns are obtained using which of the following? Earning-price ratio and dividend price ratio Estimation

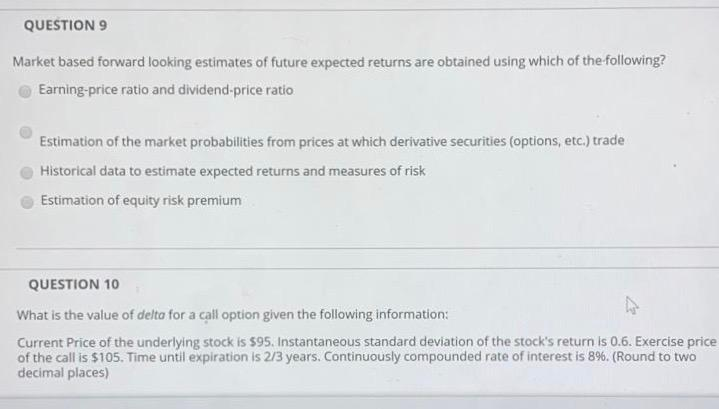

QUESTION 9 Market based forward looking estimates of future expected returns are obtained using which of the following? Earning-price ratio and dividend price ratio Estimation of the market probabilities from prices at which derivative securities (options, etc.) trade Historical data to estimate expected returns and measures of risk Estimation of equity risk premium QUESTION 10 What is the value of delta for a call option given the following information: Current Price of the underlying stock is $95. Instantaneous standard deviation of the stock's return is 0.6. Exercise price of the call is $105. Time until expiration is 2/3 years. Continuously compounded rate of interest is 896. (Round to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts