Question: its a case study where a SOA has to generated by creating a recommendation Case study James and Gina are married and have no kids

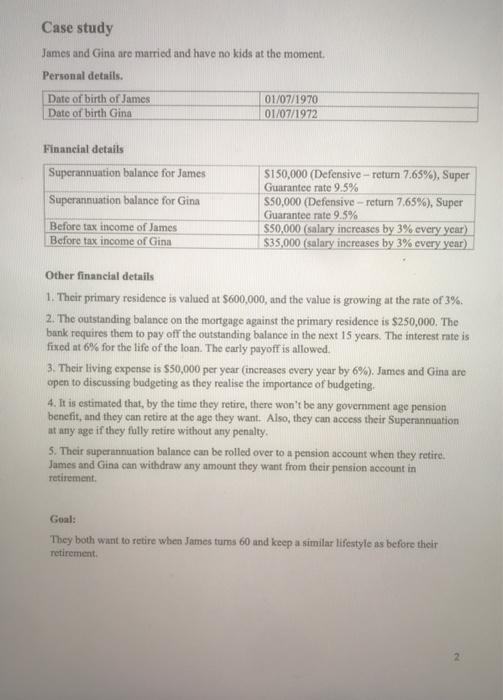

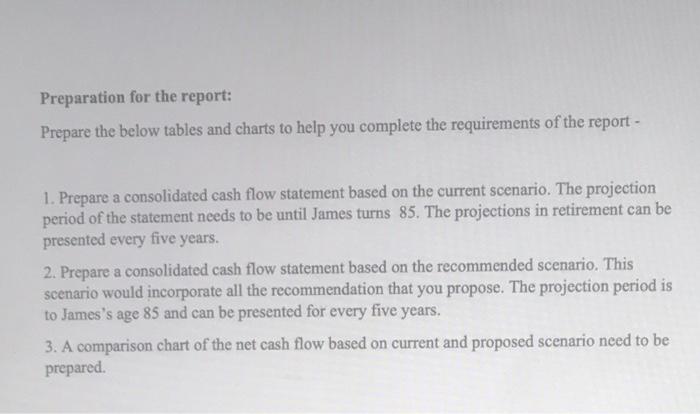

Case study James and Gina are married and have no kids at the moment, Personal details. Date of birth of James Date of birth Gina 01/07/1970 01/07/1972 Financial details Superannuation balance for James Superannuation balance for Gina $150,000 (Defensive -retum 7.65%), Super Guarantee rate 9.5% 550,000 (Defensive -retum 7.65%), Super Guarantee rate 9.5% $50,000 (salary increases by 3% every year) $35,000 (salary increases by 3% every year) Before tax income of James Before tax income of Gina Other financial details 1. Their primary residence is valued at $600,000, and the value is growing at the rate of 3%. 2. The outstanding balance on the mortgage against the primary residence is $250,000. The bank requires them to pay off the outstanding balance in the next 15 years. The interest rate is fixed at 6% for the life of the loan. The early payoff is allowed. 3. Their living expense is $50,000 per year (increases every year by 6%). James and Gina are open to discussing budgeting as they realise the importance of budgeting. 4. It is estimated that, by the time they retire, there won't be any government age pension benefit, and they can retire at the age they want. Also, they can access their Superannuation at any age if they fully retire without any penalty 5. Their superannuation balance can be rolled over to a pension account when they retire. James and Gina can withdraw any amount they want from their pension account in retirement Goal: They both want to retire when James tums 60 und keep a similar lifestyle as before their retirement Preparation for the report: Prepare the below tables and charts to help you complete the requirements of the report - 1. Prepare a consolidated cash flow statement based on the current scenario. The projection period of the statement needs to be until James turns 85. The projections in retirement can be presented every five years. 2. Prepare a consolidated cash flow statement based on the recommended scenario. This scenario would incorporate all the recommendation that you propose. The projection period is to James's age 85 and can be presented for every five years. 3. A comparison chart of the net cash flow based on current and proposed scenario need to be prepared Case study James and Gina are married and have no kids at the moment, Personal details. Date of birth of James Date of birth Gina 01/07/1970 01/07/1972 Financial details Superannuation balance for James Superannuation balance for Gina $150,000 (Defensive -retum 7.65%), Super Guarantee rate 9.5% 550,000 (Defensive -retum 7.65%), Super Guarantee rate 9.5% $50,000 (salary increases by 3% every year) $35,000 (salary increases by 3% every year) Before tax income of James Before tax income of Gina Other financial details 1. Their primary residence is valued at $600,000, and the value is growing at the rate of 3%. 2. The outstanding balance on the mortgage against the primary residence is $250,000. The bank requires them to pay off the outstanding balance in the next 15 years. The interest rate is fixed at 6% for the life of the loan. The early payoff is allowed. 3. Their living expense is $50,000 per year (increases every year by 6%). James and Gina are open to discussing budgeting as they realise the importance of budgeting. 4. It is estimated that, by the time they retire, there won't be any government age pension benefit, and they can retire at the age they want. Also, they can access their Superannuation at any age if they fully retire without any penalty 5. Their superannuation balance can be rolled over to a pension account when they retire. James and Gina can withdraw any amount they want from their pension account in retirement Goal: They both want to retire when James tums 60 und keep a similar lifestyle as before their retirement Preparation for the report: Prepare the below tables and charts to help you complete the requirements of the report - 1. Prepare a consolidated cash flow statement based on the current scenario. The projection period of the statement needs to be until James turns 85. The projections in retirement can be presented every five years. 2. Prepare a consolidated cash flow statement based on the recommended scenario. This scenario would incorporate all the recommendation that you propose. The projection period is to James's age 85 and can be presented for every five years. 3. A comparison chart of the net cash flow based on current and proposed scenario need to be prepared

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts