Question: its a multipart thing so please do all 10! i think its easy for someone who knows the material. also doing the required adjustments PLEASE

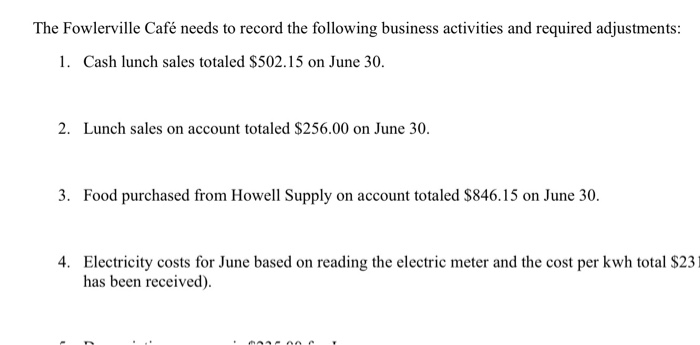

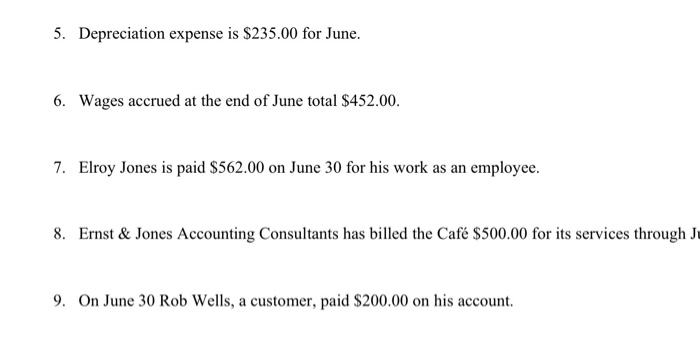

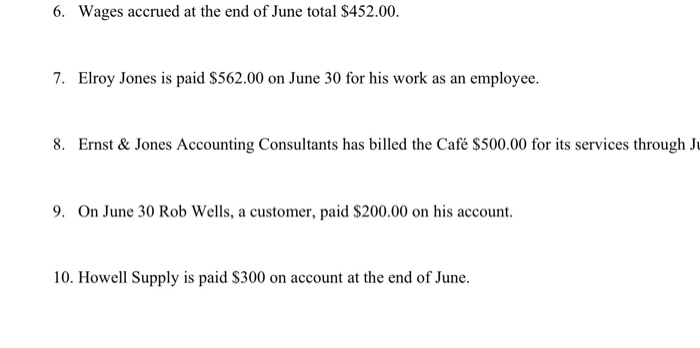

The Fowlerville Caf needs to record the following business activities and required adjustments: 1. Cash lunch sales totaled $502.15 on June 30. 2. Lunch sales on account totaled $256.00 on June 30. 3. Food purchased from Howell Supply on account totaled $846.15 on June 30. 4. Electricity costs for June based on reading the electric meter and the cost per kwh total $231 has been received). 5. Depreciation expense is $235.00 for June. 6. Wages accrued at the end of June total $452.00. 7. Elroy Jones is paid $562.00 on June 30 for his work as an employee. 8. Ernst & Jones Accounting Consultants has billed the Caf $500.00 for its services through Ju 9. On June 30 Rob Wells, a customer, paid $200.00 on his account. 6. Wages accrued at the end of June total $452.00. 7. Elroy Jones is paid $562.00 on June 30 for his work as an employee. 8. Ernst & Jones Accounting Consultants has billed the Caf $500.00 for its services through Ju 9. On June 30 Rob Wells, a customer, paid $200.00 on his account. 10. Howell Supply is paid $300 on account at the end of June

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts