Question: It's all one question based on the chart 1. The Los Angeles Department of Water and Power has issued an interesting bond which carries a

It's all one question based on the chart

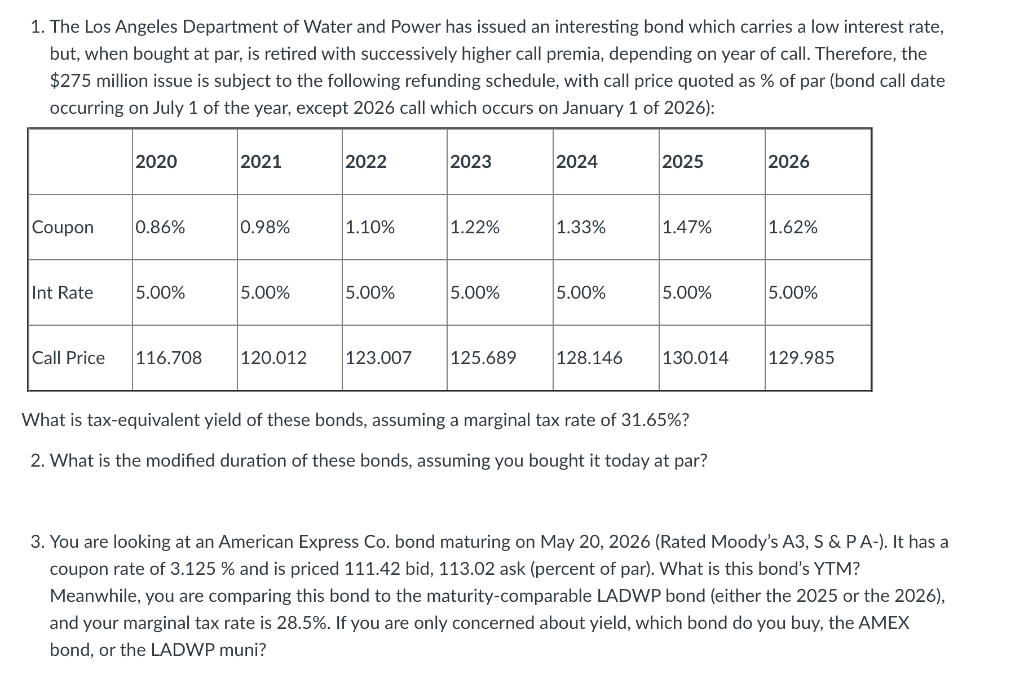

1. The Los Angeles Department of Water and Power has issued an interesting bond which carries a low interest rate, but, when bought at par, is retired with successively higher call premia, depending on year of call. Therefore, the $275 million issue is subject to the following refunding schedule, with call price quoted as % of par (bond call date occurring on July 1 of the year, except 2026 call which occurs on January 1 of 2026): 2020 2021 2022 2023 2024 2025 2026 Coupon 0.86% 0.98% 1.10% 1.22% 1.33% 1.47% 1.62% Int Rate 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% Call Price 116.708 120.012 123.007 125.689 128.146 130.014 129.985 What is tax-equivalent yield of these bonds, assuming a marginal tax rate of 31.65%? 2. What is the modified duration of these bonds, assuming you bought it today at par? 3. You are looking at an American Express Co. bond maturing on May 20, 2026 (Rated Moody's A3, S & PA-). It has a coupon rate of 3.125 % and is priced 111.42 bid, 113.02 ask (percent of par). What is this bond's YTM? Meanwhile, you are comparing this bond to the maturity-comparable LADWP bond (either the 2025 or the 2026), and your marginal tax rate is 28.5%. If you are only concerned about yield, which bond do you buy, the AMEX bond, or the LADWP muni? 1. The Los Angeles Department of Water and Power has issued an interesting bond which carries a low interest rate, but, when bought at par, is retired with successively higher call premia, depending on year of call. Therefore, the $275 million issue is subject to the following refunding schedule, with call price quoted as % of par (bond call date occurring on July 1 of the year, except 2026 call which occurs on January 1 of 2026): 2020 2021 2022 2023 2024 2025 2026 Coupon 0.86% 0.98% 1.10% 1.22% 1.33% 1.47% 1.62% Int Rate 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% Call Price 116.708 120.012 123.007 125.689 128.146 130.014 129.985 What is tax-equivalent yield of these bonds, assuming a marginal tax rate of 31.65%? 2. What is the modified duration of these bonds, assuming you bought it today at par? 3. You are looking at an American Express Co. bond maturing on May 20, 2026 (Rated Moody's A3, S & PA-). It has a coupon rate of 3.125 % and is priced 111.42 bid, 113.02 ask (percent of par). What is this bond's YTM? Meanwhile, you are comparing this bond to the maturity-comparable LADWP bond (either the 2025 or the 2026), and your marginal tax rate is 28.5%. If you are only concerned about yield, which bond do you buy, the AMEX bond, or the LADWP muni

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts